Vietnamese companies announce generous dividend plans, with some offering rates as high as 159%

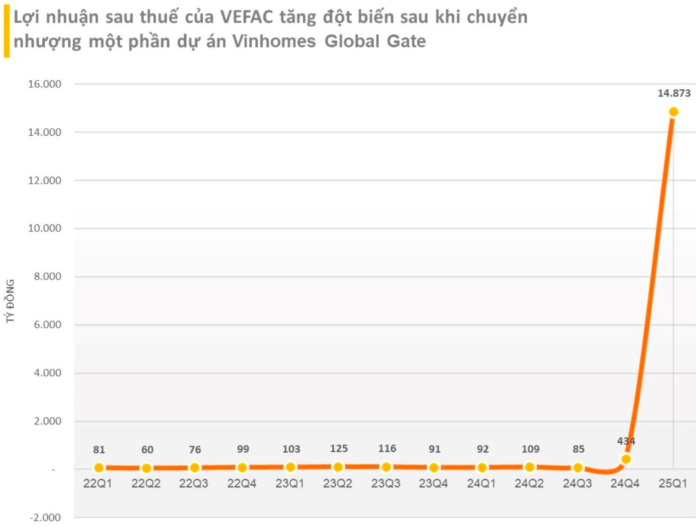

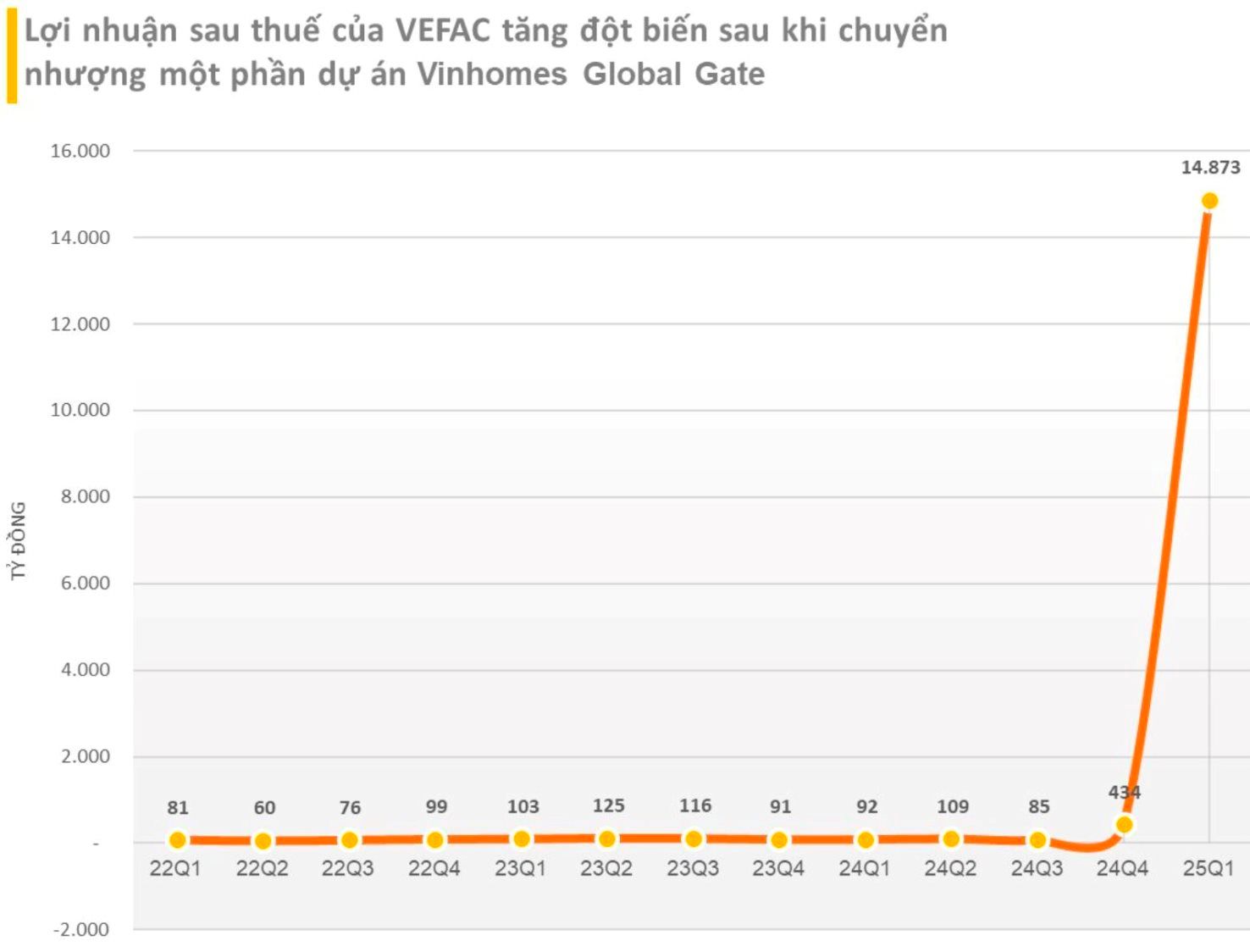

Vietnamese companies have been announcing generous dividend plans, with some offering rates as high as 159%. Recently, Vietnam Exhibition Fair Center JSC (VEFAC, stock code VEF) revealed a dividend plan with a rate of 435%, meaning each share will receive VND 43,500. VEF will use the first-quarter after-tax profit (VND 17,220 billion) to fund this payout. With over 166 million shares in circulation, the total amount the company needs to pay out for this dividend is estimated at VND 7,247 billion.

In other news, SJ Group JSC (stock code SJS) has attracted attention with its plan to distribute dividends and bonuses at a total rate of 159%. Specifically, the company will issue over 86.25 million shares to pay dividends for the years 2018, 2019, 2020, 2021, and 2024, equivalent to a rate of 75.1%. At the same time, SJ Group plans to issue an additional 96.36 million bonus shares to increase its charter capital, with a performance ratio of 83.9%. Thus, the total ratio of issued shares reaches 159%.

Another notable example is Industrial Urban Development Corporation No. 2 (stock code D2D), which announced a cash dividend plan with a rate of 84%, equivalent to VND 8,400 per share. The record date to finalize the list of shareholders is May 23, 2025, and the dividends will be paid out on June 10, 2025. With more than 30 million shares in circulation, D2D is expected to distribute a total of over VND 254 billion.

Vinaconex JSC (stock code VCG) has also approved a 2025 dividend plan with a rate of 16%. Meanwhile, Thang Long Investment Group (stock code TIG) plans to distribute a 10% dividend and issue more than 240 million shares this year. Of these, 193.6 million shares will be offered to existing shareholders, and 50 million shares will be privately placed with professional investors.

Khang Dien House Trading and Investment JSC (stock code KDH) is about to pay 2024 dividends in shares, with a rate of 10%. Specifically, the company will issue over 101 million new shares to shareholders. Notably, the expected dividend rate for 2025 is also maintained at 10%.

Last June, Dat Phuong Group JSC (stock code DPG) finalized the list of shareholders to receive 2024 dividends in cash and bonus shares. In particular, Dat Phuong will pay 2024 dividends in cash at a rate of 10% (VND 1,000 per share). The expected payment date is July 4, 2025.

In addition to the dividend policy, this real estate company will issue nearly 37.8 million new shares to increase its charter capital, equivalent to a performance ratio of 60% (shareholders owning 100 shares will receive 60 new shares). After this issuance, DPG’s charter capital will exceed VND 1,000 billion…

Overall, the high dividend rates are not only a “gift” from real estate companies to shareholders after challenging years but also a strategy to raise capital in preparation for the upcoming recovery phase. The Vietnam Real Estate Brokers Association (VARS) recently forecasted a widespread recovery in real estate supply, especially in housing, in 2025, with an expected increase of about 10% compared to 2024. This positive outlook is driven by the resolution of difficulties faced by real estate projects and the granting of new permits, including those for social housing developments.

The Businesses Smashing Profit Records in 2024

Vietnam Airlines, FPT, PNJ, Gelex, and Idico are among the top Vietnamese companies that have announced record-breaking profits for 2024. With impressive financial results, these businesses have showcased their resilience and growth amidst economic challenges. As they soar to new heights, they set a benchmark for success in the dynamic Vietnamese market.

The Real Estate Shark’s Profit Soars: A VN30 Enterprise’s Q4/2024 Financial Statement Revelations

After a thorough review of the financial statements, it is apparent that HNG incurred a substantial net loss of nearly VND 731 billion in the last quarter of 2024, marking a decline from the corresponding period in 2023, where the loss amounted to over VND 652 billion.