The Ministry of Finance is drafting a Law on Tax Administration (replacing the current one). In this draft, the Ministry of Finance has reported on the operation and tax administration of households and business individuals.

A household business selling fresh seafood with a turnover of nearly VND 560 billion in 2024. Photo: Ngoc Anh

As of December 2024, the total number of business households and individuals was 3.6 million, an increase of 6% compared to 2023.

The number of stable business households (those on a quota or declaration) was 2.2 million, an increase of 4% compared to 2023. Among them, 1.3 million households (59%) were subject to tax, i.e., those with a turnover of over VND 100 million/year.

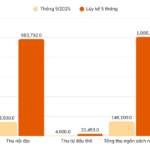

According to the Ministry of Finance, the tax revenue from business households and individuals in 2024 was VND 25,953 billion, an increase of 20% compared to the same period in 2023 (VND 21,638 billion).

The number of quota-paying households was 2.15 million (including 1.22 million households paying an average quota of VND 686 thousand/month/household across the country). The number of declaration-paying households was 84,499, with an average tax payment of VND 3.29 million/month/household across the country.

According to the Ministry of Finance’s report, in 2025, there were 1,829,920 business households with a turnover of less than VND 500 million/year. The tax liability for the year was VND 5,551 billion.

For high-turnover business households, the Ministry of Finance stated that in 2024, there were 860 business households with a turnover of VND 30 billion or more (including 121 quota households and 739 declaration households), mainly in Region I (226 households), Region II (140 households), Region IV (77 households), Region XV (46 households), Region XVIII (50 households), and Region XVI (46 households).

Among them, five declaration households had a turnover of over VND 200 billion/year: N.T.M.T., a household selling fresh seafood, located in the area of the XI Tax Department (Ha Tinh, Quang Binh, Quang Tri), with a turnover of nearly VND 560 billion in 2024; and D.T.O., a household selling wholesale food, located in the area of the III Tax Department (Hai Phong, Quang Ninh), with a turnover of nearly VND 360 billion in 2024. Three other households also had a turnover of over VND 200 billion in 2024.

According to the Ministry of Finance, from June 1, 2025, business households with a turnover of VND 1 billion/year or more will have to switch to tax declaration and use e-invoices. At the same time, from January 1, 2026, the quota tax method will be officially abolished and replaced by the declaration method to ensure transparency in business activities and improve tax administration.

“Eliminating the quota tax method and switching all business households to the self-declaration and self-tax payment regime based on actual turnover is necessary to ensure accurate and sufficient tax collection and reduce budget leakage, especially for high-turnover households that previously paid low taxes due to the fixed quota,” the Ministry of Finance stated.

Business households will have to comply with the tax declaration regime, use e-invoices in goods and service transactions, and apply simple bookkeeping for revenue and expenses for tax calculation.

According to the drafting agency, eliminating the quota tax method will not only increase transparency but also create opportunities for business households to grow into enterprises. When they are required to use the declaration method, business households will gradually become familiar with formal financial management, which is an important prerequisite for developing into small and micro-enterprises and accessing business support policies under Resolution 198/2025/QH15.

By completely eliminating the quota tax method, the Ministry of Finance said that this solution would end the serious injustice where the tax of declaration households is seven times higher than that of quota households, thereby effectively preventing budget leakage from large business households.

Why Are So Many Businesses Closing Down?

“A curious coincidence occurred as multiple businesses abruptly ceased trading, coinciding with a swift and comprehensive crackdown on illicit activities by enforcement agencies, targeting contraband, commercial fraud, and other violations.”

“A Relief for Small Businesses: The Truth About Electronic Invoice Costs”

“Misinterpretations of the new tax regulations have led to inappropriate reactions that could potentially harm the very businesses they affect.”

The New Tax Declaration for 2.2 Million Business Households: A Comprehensive Guide to Navigating the Changes.

By the end of 2024, Vietnam is expected to have approximately 2.2 million stable business households, with a total tax revenue of nearly VND 26 trillion from this sector. With the planned abolition of the lump-sum tax from January 1, 2026, the Ministry of Finance has proposed a new regulation. This proposal suggests that individuals and business households will be required to self-declare and pay taxes according to a direct tax calculation method (a percentage of revenue), with a roadmap for the implementation of electronic invoices based on revenue.