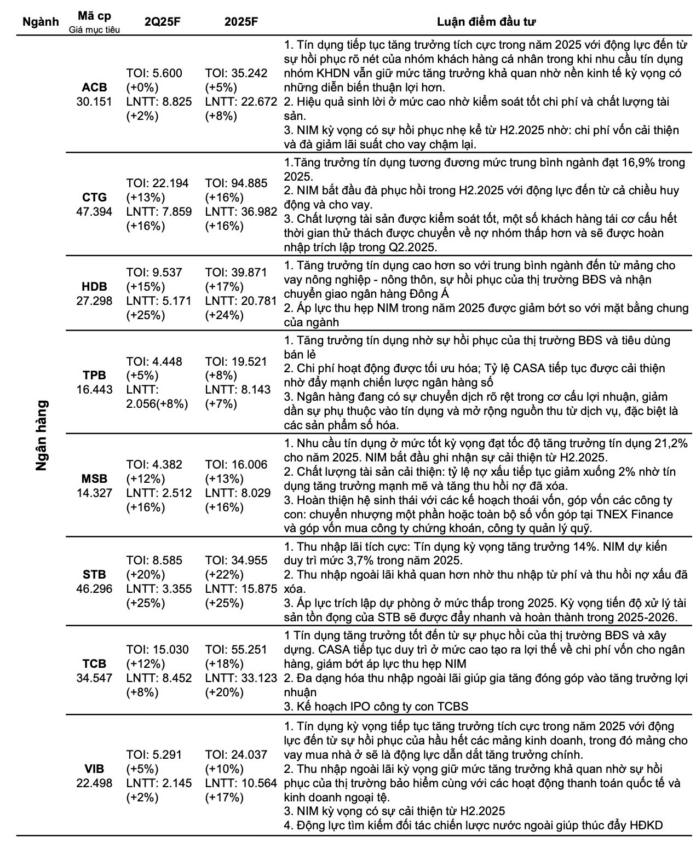

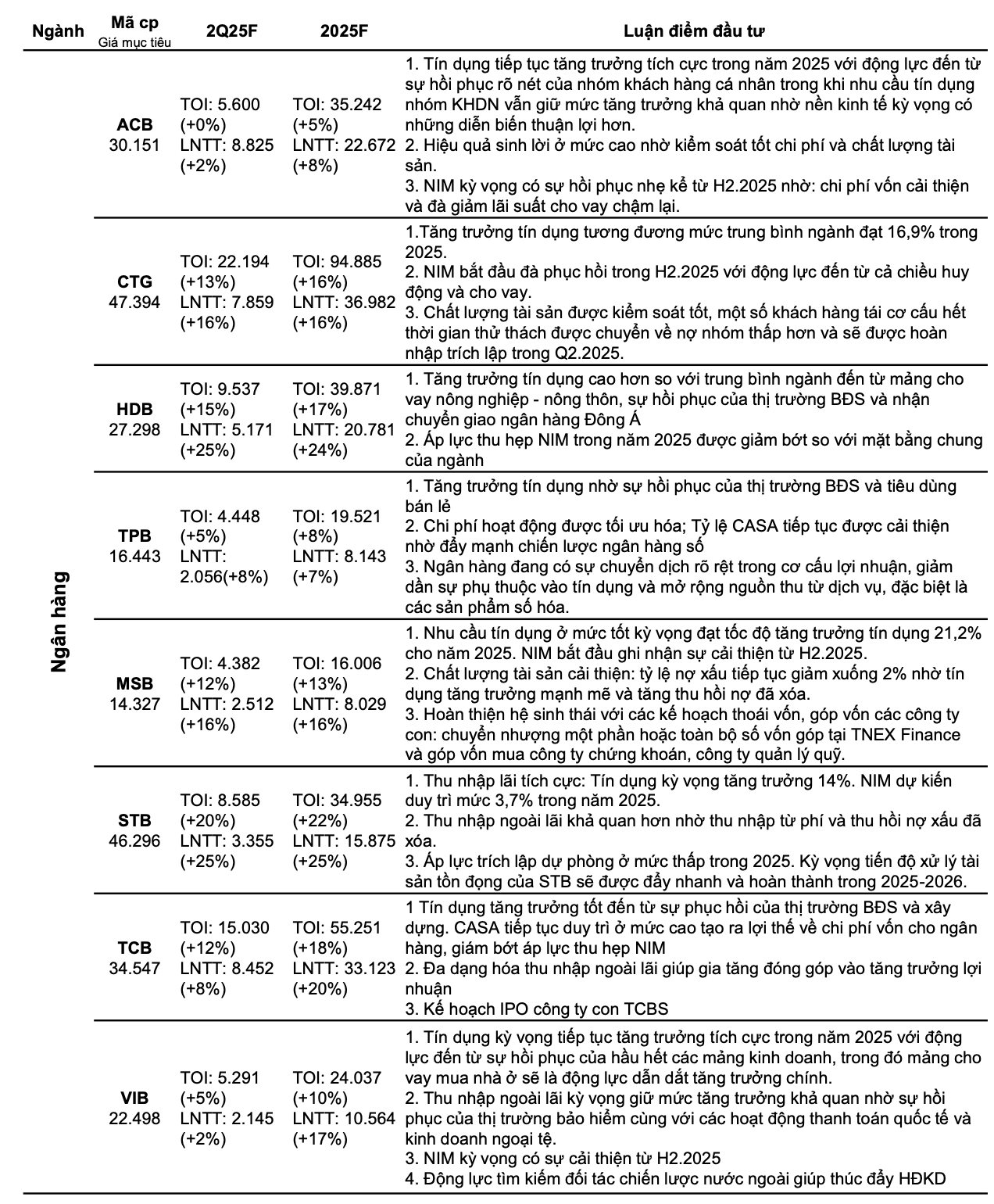

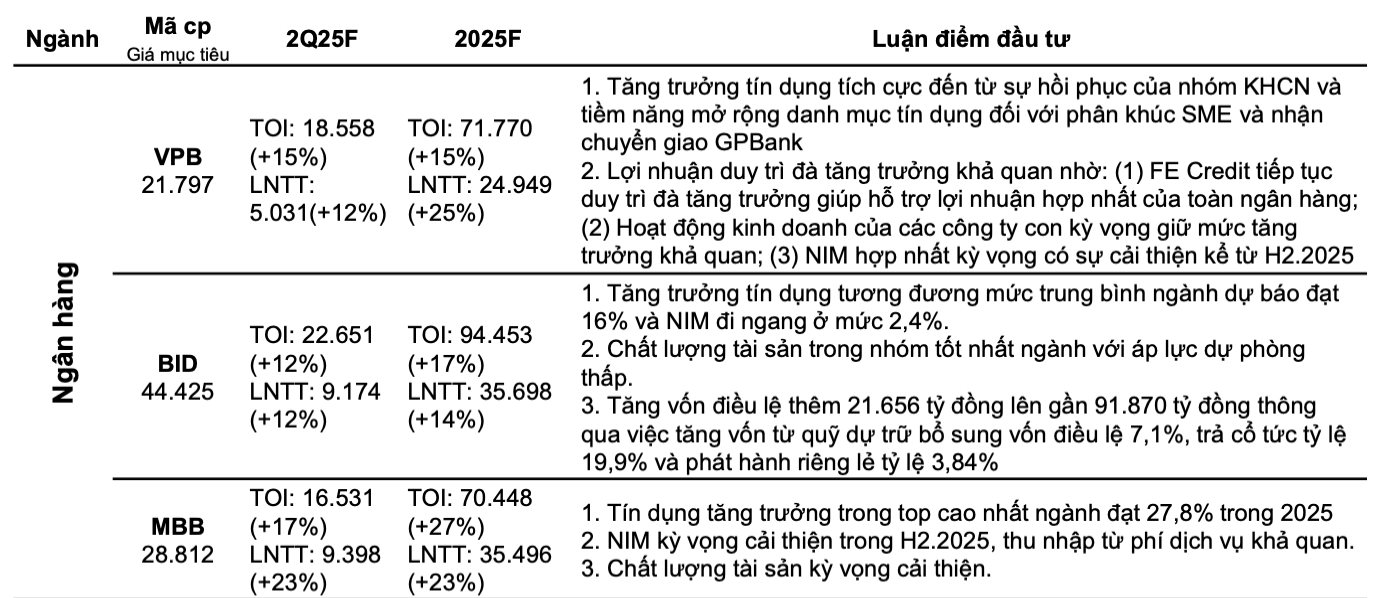

Vietcombank Securities (VCBS) has released a comprehensive report forecasting the financial performance of 11 prominent Vietnamese banks for the second quarter and full year of 2025. The banks included in this report are ACB, VietinBank (CTG), HDBank (HDB), TPBank (TPB), MSB, Sacombank (STB), Techcombank (TCB), VIB, VPBank (VPB), BIDV (BID), and MB (MBB).

According to VCBS, all the aforementioned banks are expected to witness positive growth in their pre-tax profit for both the second quarter and the full year of 2025. Notably, VietinBank, MB, BIDV, VPBank, HDBank, MSB, and Sacombank are anticipated to achieve impressive growth rates of over 10%.

VietinBank: VCBS forecasts a 16% growth in pre-tax profit for the second quarter and full year of 2025, attributed to (1) credit growth equivalent to the industry average of 16.9% in 2025, (2) recovery in NIM during H2 2025 driven by both deposit and lending dynamics, and (3) well-managed asset quality, with some restructured clients being reclassified to lower-risk categories and resulting in loan loss provision reversals in Q2 2025.

HDBank: VCBS predicts a 25% increase in pre-tax profit for the second quarter and a 24% rise for the full year of 2025. This growth is attributed to (1) higher credit growth compared to the industry average, driven by agricultural and rural lending, real estate market recovery, and the acquisition of Dong A Bank, and (2) less pressure on NIM contraction in 2025 compared to the industry norm.

MSB: VCBS expects a 16% growth in pre-tax profit for both the second quarter and the full year of 2025, due to (1) robust credit demand with an expected credit growth rate of 21.2% for 2025 and an improvement in NIM from H2 2025, (2) enhanced asset quality with a decreasing NPL ratio of 2% thanks to strong credit growth and increased recovery of written-off loans, and (3) ecosystem refinement through capital divestment and investment plans, including the partial or full transfer of capital in TNEX Finance and investment in securities and fund management companies.

Sacombank: VCBS forecasts a 25% growth in pre-tax profit for the second quarter and full year of 2025, driven by (1) positive interest income: expected credit growth of 14% and maintained NIM at 3.7% in 2025, (2) improved non-interest income from fees and recovery of written-off bad debts, and (3) low provisioning pressure in 2025, with expectations to accelerate the resolution of non-performing assets in 2025-2026.

MB: VCBS predicts a 23% growth in pre-tax profit for the second quarter and full year of 2025, attributed to (1) top-tier credit growth of 27.8% in 2025, (2) anticipated improvement in NIM during H2 2025, and positive service fee income, and (3) expected enhancement in asset quality.

VPBank: VCBS forecasts a 12% and 25% growth in pre-tax profit for the second quarter and full year of 2025, respectively, due to (1) sustained growth of FE Credit, positively contributing to the consolidated profit of the entire bank, (2) expectedly robust performance of subsidiary companies, and (3) anticipated improvement in consolidated NIM from H2 2025.

BIDV: VCBS predicts a 12% and 14% growth in pre-tax profit for the second quarter and full year of 2025, respectively. This growth is attributed to (1) credit growth equivalent to the industry average, forecast at 16%, and a stable NIM of 2.4%, (2) top-tier asset quality with low provisioning pressure, and (3) increased charter capital by VND 21,656 billion to nearly VND 91,870 billion through the use of supplementary capital reserve funds (7.1%), dividend payout ratio of 19.9%, and private placement ratio of 3.84%.

“Chairman of APG Sells 6 Million Shares”

“From May 20 to June 17, a series of transactions were made that resulted in Mr. Nguyen Ho Hung reducing his ownership in APG. The transactions, which were agreed upon beforehand, saw Mr. Hung’s holdings decrease from nearly 6.8 million shares, representing 3.03% of the company, to 783,803 shares, now accounting for 0.35% of the company’s capital. This significant shift in ownership has undoubtedly sparked interest and curiosity among investors and market observers alike.”

The Perils of Pumping Trillions into the Economy

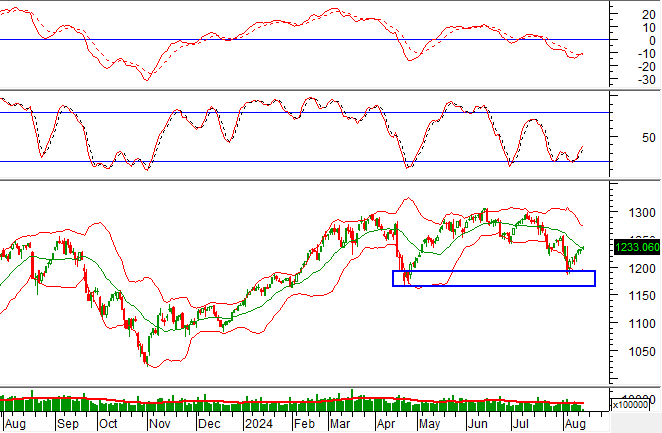

The banking sector has witnessed an impressive credit growth since the beginning of the year. Experts warn that if the large sums of money injected into the economy do not flow into the real production sector, it could lead to a resurgence of inflation, asset bubbles, and bad debt.

Unlocking Capital: Vietbank Launches a 2,000 Billion VND Interest-Free Loan Package

“Vietbank is proud to announce an exclusive promotional program, offering an incredible 0% interest rate on loans to our valued customers. With a substantial 2,000 billion VND in funding, we’re here to support your financial journey and help unlock your potential. It’s time to take advantage of this opportunity and set your plans in motion with Vietbank’s ‘Super-Charged Loan Program: 0% Interest, Unlocking Endless Possibilities’.”

VNDirect: Techcombank’s IPO of TCBS Securities: A Catalyst for Mr. Ho Hung Anh’s Vision

One of the highlights of TCB’s business performance in 2025 came from its securities arm, Techcom Securities (TCBS).