Xanh SM Enters the Food Delivery Arena, Taking on GrabFood and ShopeeFood

Shortly after entering the ride-hailing market, Xanh SM has launched its food delivery service with over 2,000 partner restaurants and eateries in Hanoi. The company also plans to quickly expand this service nationwide.

A recent survey reveals that for every two Vietnamese people ordering food via an app, one chooses ShopeeFood out of habit. (Photo: P. Minh)

Xanh SM commits to reducing waiting times for deliveries by leveraging its technological platform and operational network inherited from its ride-hailing service. They also offer attractive promotions, such as orders from VND 50,000, co-sponsorship programs between restaurants and the system, resulting in benefits ranging from VND 20,000 to VND 90,000 for customers.

Users paying with e-wallets or linked bank cards may receive additional gifts ranging from VND 15,000 to VND 30,000. Many dishes will also be sponsored up to VND 50,000… In addition, the platform will issue discount codes based on time frames, dish categories, or user groups, with support ranging from 20-50% of the order value; delivery fees may also be directly supported, ranging from VND 5,000 to VND 10,000…

According to market research firm Mordor Intelligence, in the first quarter of 2025, Xanh SM led the motorcycle taxi market share in Vietnam.

The report “e-Conomy SEA 2024” by Google, Temasek, and Bain & Company shows that the combined size of the ride-hailing and food delivery market in Vietnam in 2024 was estimated at USD 4 billion (up 12% from 2023) and is expected to expand to USD 9 billion by 2030.

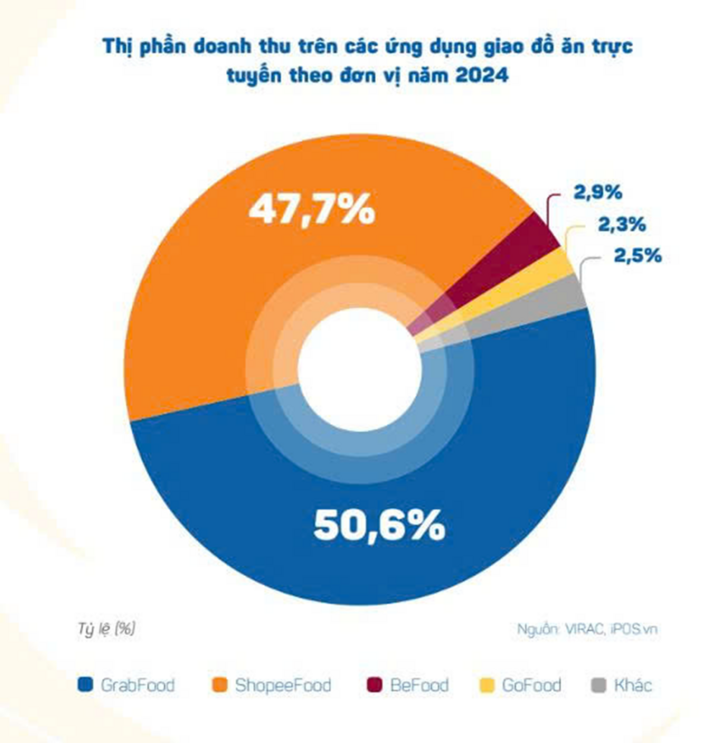

This market used to have many participating apps, but the battle was almost settled in the third quarter of 2024 when Gojek exited the game. According to the report on the foodservice market in 2024, recently published in March 2025 by iPOS.vn, most of the revenue went to GrabFood and ShopeeFood.

For every two Vietnamese people ordering food via an app, one chooses ShopeeFood out of habit. Shopee is known for its attractive pricing, and users are already familiar with its ecosystem, so this app benefits greatly from its parent company’s brand strength.

The report states that ShopeeFood is the most-used app by stores, accounting for 38.8%. This app’s revenue market share was approximately 47.7%.

2024 Revenue Market Share of Food Delivery Apps. (Source: iPOS.vn)

Meanwhile, GrabFood maintains a loyal user base and leads the food delivery app market in Vietnam, with a 50.6% revenue market share. However, the number of stores using it is only at 36.7%.

Notably, according to the iPOS.vn report, the two leading food delivery platforms have a similar transaction volume but a significant revenue gap. This is because ShopeeFood mainly focuses on low-value orders with minimized shipping costs. ShopeeFood’s strength lies in its ability to efficiently batch orders for shippers, reducing transportation costs and attracting price-sensitive users.

This strategy is challenging to compete directly with GrabFood in the high-end order segment. GrabFood’s delivery time in major cities like Hanoi and Ho Chi Minh City is usually fast and quite accurate, providing a good experience for customers. The high cost is a limitation, however, hindering the group sensitive to prices.

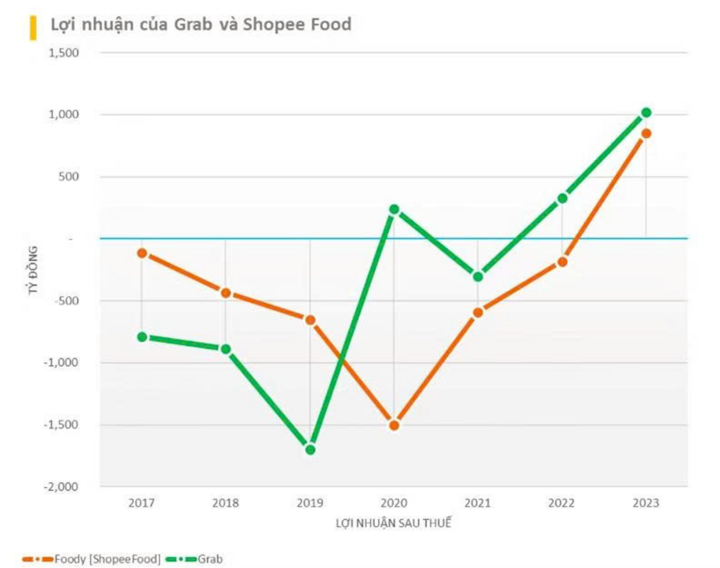

2024 was a challenging year for Grab in Vietnam as it faced intense competition from domestic rivals, while financial pressure after reaching the break-even point caused discounts for sellers and transportation costs to rise, affecting both businesses and end-users.

The Fastest-Growing Market in Southeast Asia

ShopeeFood, GrabFood, and BeFood shared a large customer base in September 2024 when Gojek suddenly withdrew from Vietnam. Earlier, at the end of 2023, Baemin, a South Korean company, also bid farewell to the food delivery market in Vietnam after only four years.

Urban eateries are always packed with shippers waiting to buy food for customers. (Photo: D. Viet)

In 2024, BeFood gained a 12.9% market share of F&B stores nationwide using the app, mainly in Hanoi and Ho Chi Minh City.

In smaller provinces, Vill Food is a notable food delivery app, currently holding a 3.5% market share in the country. This app was launched in 2020 and is now available in 29 provinces, mainly in the southern region and some provinces in the South-Central Coast and Central Highlands regions. Notably, 4% of restaurants reported that Vill Food was the platform with the highest revenue. However, the app faces high operating costs due to the market’s fragmentation.

Although the number of people ordering food via apps is increasing, the number of stores participating in online food delivery apps in 2024 is gradually decreasing. 52.8% of businesses stated that they used food delivery apps in 2024, compared to 53.1% in 2023. This decrease results from various factors, including stores ceasing operations, some online businesses stopping distribution through food delivery apps due to disagreements over discount rates.

In contrast, the report “Food Delivery Platforms in Southeast Asia” by the Singaporean venture capital firm Momentum Works, published in February 2025, estimates that the scale of Vietnam’s online food delivery market in 2024 reached USD 1.8 billion, an increase of USD 400 million from USD 1.4 billion in 2023. Vietnam is the country with the highest growth rate in the food delivery market in Southeast Asia.

ShopeeFood was the first to turn a profit after the money-burning war, earning VND 850 billion in 2023. (Source: Vietdata)

According to this report, the most-used food delivery apps in Vietnam include Grab, Foodpanda, Loship, Deliveroo, Lalamove, LINE MAN, ShopeeFood, and beFood. However, GrabFood and ShopeeFood dominate the market with 48% and 47% market share, respectively. The minuscule remainder goes to beFood with 4%, and before leaving Vietnam in September 2024, GoFood held 1%.

Despite being the fastest-growing market in the region, Vietnam’s food delivery market is the smallest in scale compared to the other six Southeast Asian countries included in the statistics: Indonesia, Thailand, the Philippines, Singapore, and Malaysia.

“Hòa Phát to Roll Out First Rail Products in February 2027”

Hòa Phát is poised to meet the demands of producing steel for high-speed rail, urban rail, and conventional rail projects. With a reputation for excellence, the company is well-equipped to tackle the challenges of manufacturing steel for these specialized industries.

“The Rise of Vietnam’s Mega City: Envisioning a Southeast Asian Metropolis Grander than Shanghai”

The consolidation of these three provinces marks a pivotal turning point in the history of Vietnamese urban development, according to the General Secretary. This move is unprecedented and signifies a significant transformation in the country’s urban landscape.