According to a recent announcement by the Hanoi Stock Exchange (HNX), F88 Joint Stock Business Company has disclosed the results of its bond issuance.

On June 12, F88 issued 500 bonds with the code F8812503 and a face value of VND 100 million per bond, raising a total of VND 50 billion. The bonds have a term of 18 months and are expected to mature on December 12, 2026, with a fixed interest rate of 10.5%.

HNX statistics reveal that since the beginning of the year, F88 has issued three batches of bonds. In addition to the aforementioned F8812503, the two previous batches were coded F8812502 worth VND 50 billion, issued on May 7 with a 12-month term, and F8812501 worth VND 150 billion, issued on April 4 with the same 12-month term.

Illustrative image

In a separate development, on May 19, 2025, F88 made a payment of over VND 51.3 billion in principal and interest for the F88CH2425003 bond batch, comprising VND 50 billion in principal and over VND 1.3 billion in bond interest.

It is worth noting that the aforementioned bond batch consisted of 500 bonds with a face value of VND 100 million each, totaling VND 50 billion in issuance value. Issued on May 17, 2024, the bonds had a 12-month term and were scheduled to mature on May 17, 2025.

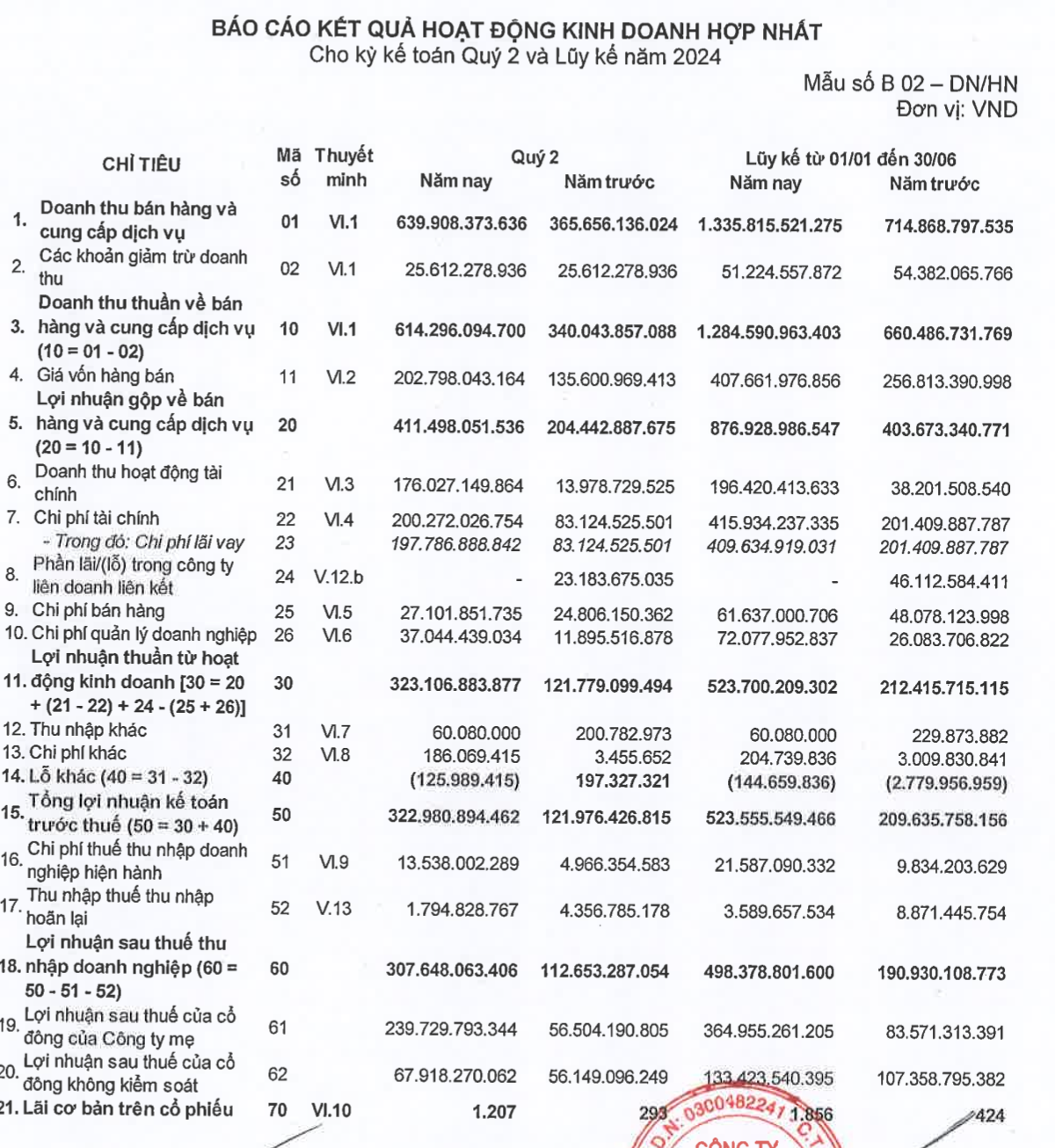

In terms of business performance, F88 recorded a post-tax profit of nearly VND 362 billion in 2024, a significant improvement from the net loss of nearly VND 530 billion in 2023. As a result of the 2024 profit, the company turned around its accumulated loss into accumulated earnings of over VND 119 billion.

As of the end of 2024, the company’s owner’s equity stood at VND 1,792.3 billion, up 25% from the beginning of the year. Total liabilities amounted to VND 3,307.3 billion, an increase of 28% compared to the start of the year. Notably, there were no bank debts, and bond debt accounted for only VND 665 billion, with the remaining VND 2,241 billion borrowed from other sources.

“Fish Mogul in Deep Waters: Over $1.7 Billion in Accumulated Losses, Ex-Chairman Indicted for Embezzling $1 Billion from Major Banks”

As per the 2024 audited financial statements, the company still owes VND 440 billion to banks. Despite this, the management emphasizes that they “cannot assess the ability to pay” due to accumulated losses and negative equity.

“Vingroup Plans to Issue $43 Million in Bonds to Restructure Debt”

The Vingroup Board of Directors has approved the issuance of 1,000 billion VND in bonds with a maximum term of 36 months. The purpose of this bond issuance is to restructure the organization’s debt, providing a strategic opportunity to optimize its capital structure and ensure long-term financial stability.