Illustrative Image

According to preliminary statistics from the General Department of Customs, the import of plastics and raw materials (polymers/plastics) into Vietnam in June reached over 817,000 tons, valued at over $1.05 billion. This represents a 2.1% increase in volume and a 1.2% decrease in value compared to May. In the first half of 2025, Vietnam imported over 4.7 million tons, worth over $6.2 billion, a significant increase of 19.1% in volume and 12.8% in value compared to the same period in 2024.

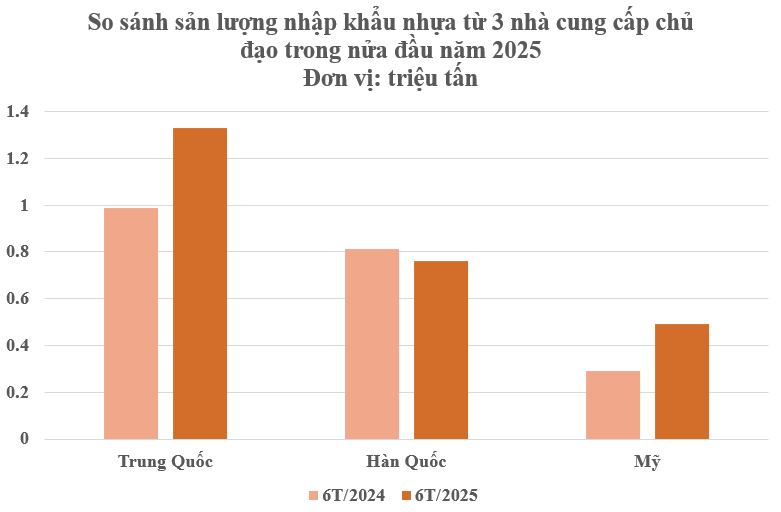

In terms of market sources, China is currently the largest supplier of raw plastic materials to Vietnam, with over 1.3 million tons, valued at over $1.8 billion, an increase of 35% in volume and 26% in value compared to the same period in 2024. The average import price reached $1,402 per ton, a decrease of 6%.

South Korea is the second-largest supplier of plastics to Vietnam, with over 763,000 tons, valued at over $1.07 billion. However, this represents a 6% decrease in volume and a 4% decrease in value compared to 2024. The average price increased by 2% to $1,406 per ton.

The United States is the third-largest supplier, with over 494,000 tons, worth over $556 million, a significant increase of 70% in volume and 48% in value compared to the first six months of 2024. The average price decreased by 13% to $1,127 per ton.

Vietnam can produce raw materials such as PVC, PP, PET, PS, and PE, with a total capacity of almost 3 million tons per year. Domestic raw materials can meet 30% of the domestic market demand, while the remaining 70% is imported from countries such as Saudi Arabia, South Korea, Thailand, Japan, the United States, China, Taiwan, Malaysia, and Singapore.

In terms of import taxes, raw plastic materials such as PE and PP resin imported from China into Vietnam are exempt from import taxes (0%) if they have a certificate of origin (C/O form E) according to the ACFTA Agreement. In the absence of a C/O, the MFN tax rate of around 3-5% applies. Additionally, these resins are still subject to a 10% VAT upon importation.

As for the United States, one of Vietnam’s important sources of plastic raw materials, the two countries have not yet established a bilateral free trade agreement. Therefore, goods imported from the US are typically subject to preferential import tax rates. The import tax rate for plastics such as Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), and Polyvinyl Chloride (PVC) is approximately 5% for products originating from the United States.

From 2011 to 2023, the export value of raw plastics (raw plastic) increased significantly from $163 million to $1.53 billion, with a focus on PE, PP, and PVC resin. The Vietnamese plastics market is projected to reach approximately 10.9 million tons by 2024 and further grow to 16.4 million tons by 2029, with a CAGR of about 8.44%.

Vietnamese plastic products are currently exported to over 160 countries worldwide, including demanding markets such as the US, Japan, Australia, and European countries like Germany, France, the UK, Italy, the Netherlands, and Spain. The Vietnamese plastics industry comprises nearly 4,000 enterprises, 90% of which are small and medium-sized enterprises, mainly located in the southern region of the country.

The Youngest Municipality in Vietnam: Unveiling the Country’s First Dual Heritage Site in Southeast Asia

Hoa Lu is an extraordinary city, boasting the Trang An Landscape Complex – a UNESCO World Heritage Site and a unique ‘double’ heritage site in Vietnam and Southeast Asia.

The Critical Bottleneck: Indochina Capital Chairman’s Emphatic Message on Unlocking Vietnam’s Real Estate Market Potential

Peter Ryder, Executive Chairman of Indochina Capital and Board Member of Indochina Kajima, firmly believes that infrastructure is the foundation for Vietnam’s future growth, both in the real estate sector and the economy as a whole. He emphasizes that infrastructure is also the most critical bottleneck currently restraining the industry’s development.

Bac Giang Approved for Six New Industrial Parks in 2024

In 2024, Bac Giang province witnessed the expansion and establishment of six new industrial parks (IPs), the highest number ever.