In the latest report on the foreign exchange market for August 2025, Mr. Dinh Duc Quang, Director of Currency Trading at UOB Vietnam, predicts that USD interest rates are likely to remain high, averaging above 4% throughout the remaining months of 2025. In the most optimistic scenario, UOB forecasts a stronger VND interest rate reduction of 0.5%-0.75% by year-end.

USD INTEREST RATES REMAIN HIGH

The UOB report indicates that during the July 30 meeting, the US Federal Reserve (Fed) decided to keep the policy rate unchanged at 4.5%. Speaking after the meeting, the Fed Chair attributed this decision to positive economic data.

Specifically, the US economy grew steadily at 3% in Q2 2025, despite tariff-related headwinds. Meanwhile, the unemployment rate remained low, while inflation slightly exceeded the 2% target.

“We believe that the SBV will continue to monitor domestic macroeconomic developments, follow USD interest rate trends, and assess the impacts of the new tariff policies that took effect on August 1. Based on these factors, they will make a decision regarding VND interest rates.”

As a result, the Fed expressed confidence in its current interest rate policy and stated that it would need additional data in the coming months to consider any changes by the end of 2025. Notably, the Fed Chair did not provide a definite forecast for the policy direction in the upcoming September meeting.

This development immediately impacted global financial markets. The US dollar strengthened significantly against other major currencies, pushing the USD Index back to the 100-point mark, its highest level in three months. Markets have also reflected this new development, with the probability of a Fed rate cut in September now calculated to be less than 50%.

According to Mr. Dinh Duc Quang, Director of Currency Trading at UOB Vietnam, this indicates a high likelihood that USD interest rates could remain high, averaging above 4%, throughout the remaining months of 2025.

However, UOB maintains its view that the Fed will cut rates two to three times in the final quarters of the year, with a total reduction of approximately 0.5%-0.75%.

POTENTIAL FOR STRONGER VND INTEREST RATE REDUCTION IN AN OPTIMISTIC SCENARIO

In the domestic market, the Fed’s decision to maintain high USD interest rates continues to put pressure on expectations for VND interest rate cuts. Reducing interest rates is considered an important tool to support production and business activities and boost economic growth towards the government’s target of over 8% GDP growth in 2025.

Additionally, the high level of USD interest rates will continue to attract holdings of USD and USD-denominated assets in the US and worldwide. This presents challenges for the State Bank of Vietnam (SBV) in implementing monetary policies to ensure USD/VND exchange rate stability and expand foreign reserve assets.

Experts at UOB maintain the view that the SBV will temporarily refrain from adjusting VND policy rates in the short term.

However, UOB experts lean towards the scenario that the SBV will quickly reduce VND interest rates by approximately 0.5% if the Fed cuts USD rates in the September meeting and the downward trend in USD interest rates becomes more apparent in Q4 2025 and Q1 2026.

UOB forecasts credit growth for the full year of 2025 to reach 18%-20%, strongly supporting economic growth.

Regarding exchange rates, UOB maintains its view that the USD/VND exchange rate will continue to trade at high levels, around 26,400-26,500 VND/USD in Q3 2025. Subsequently, the rate is expected to ease slightly to around 26,000 VND/USD by the end of 2025 and early 2026. At this rate, the VND could depreciate by about 2%-3% against the USD for the full year of 2025.

Given the above, the Director of Currency Trading at UOB Vietnam believes that commercial banks are unlikely to significantly reduce VND deposit and lending rates in the remaining months of the year.

Currently, VND deposit rates in August 2025 are about 0.2%-0.4% lower than the same period last year, depending on the term. These rates are considered appropriate in the overall context of international USD interest rates and USD/VND exchange rate fluctuations in recent months.

At these interest rate levels, the market still records high credit growth for the whole system, reaching 10% in the first six months. Additionally, UOB forecasts credit growth for the full year of 2025 to reach 18%-20%, strongly supporting economic growth.

“In the most optimistic scenario, if USD interest rates decrease by the end of the year, the impact of tariff policies remains minor, and the stock market is upgraded, attracting strong foreign capital inflows again. In that case, UOB believes that VND interest rates could see a more substantial reduction of 0.5%-0.75%. This would be an important factor in transmitting positive impacts on the economic growth plan of 8%-9% in 2026,” predicted Mr. Dinh Duc Quang.

The Exchange Rate Conundrum: Why It Remains a Challenge in 2025

Although there have been signs of cooling off since the beginning of the year, the USD/VND exchange rate remains one of the most unpredictable factors of 2025. What key elements could influence the foreign exchange market this year?

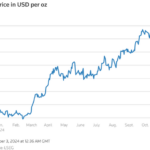

The Curious Case of Gold’s Global Price Movement

The gold price hovers tentatively, awaiting a new catalyst to spark action. Investors are cautious ahead of impending U.S. economic data and the Federal Reserve’s interest rate trajectory. With markets holding their breath, all eyes are on the Fed’s next move, as they delicately balance inflation concerns with economic growth. This delicate dance has investors poised, ready to pounce or retreat, depending on the Fed’s forthcoming steps.