Services

Booming business, robust finances

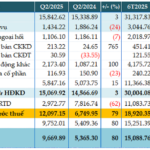

Estimated profit after tax reached VND 565 billion, an increase of VND 227 billion compared to the same period last year, resulting in a profit after tax of VND 452 billion. Along with the impressive business results of the previous quarter, the cumulative six-month period saw the bank achieve a pre-tax profit of VND 922 billion, an increase of VND 371 billion compared to the same period last year. Thus, after just two quarters of operation, KienlongBank has accomplished 66.8% of its profit plan.

Not only does KienlongBank stand out in terms of profit scale, but its income structure also showcases a positive shift, with service revenue continuing to play a dominant role. In the first half of the year, the service segment contributed VND 149 billion, an increase of VND 29 billion compared to the previous year – an encouraging figure for the bank’s multi-functional development strategy. Other business activities such as foreign exchange and securities investment also brought in VND 21 billion and VND 13 billion, respectively, diversifying income sources and enhancing overall operational efficiency.

The proportion of service-related income was elevated to 19% of total income, within the target range set by the bank at the beginning of the year (18-20%). Key business indicators, including total assets, total mobilized capital, and credit balance, reached VND 97,630 billion, VND 87,321 billion, and VND 69,547 billion, respectively, achieving 95.7%, 93.9%, and 97.9% of the annual plan. If this trend persists in the remaining six months, KienlongBank has a solid foundation to accomplish its approved profit targets.

The positive business results for this period attest to the effectiveness of the bank’s flexible and prudent management strategy. KienlongBank proactively adjusted deposit interest rates to optimize capital costs while orienting credit growth selectively, aligning with its risk management capabilities and sustainable development vision.

The application of technology has enabled KienlongBank to accurately analyze and assess the status of each customer, facilitating the provision of suitable products and services. Consequently, non-performing loan ratios remained low, below 3%, strictly adhering to SBV regulations. The bank also maintained a high bad debt coverage ratio, reflecting its proactive approach to provisioning, enabling it to proactively manage emerging risks.

Successful Extraordinary General Meeting, up to 60% dividend payout

Recently, KienlongBank successfully held its 2025 Extraordinary General Meeting of Shareholders. Confident in the bank’s reliable vision and business strategy, and encouraged by its promising profits, KienlongBank’s shareholders unanimously approved adjustments to the 2024 profit distribution plan, the plan to increase charter capital through dividend payout in shares, and amendments to the bank’s operating charter.

KienlongBank successfully held its 2025 Extraordinary General Meeting of Shareholders on July 15

|

For the first time in its 30-year history, KienlongBank will pay dividends in shares to existing shareholders at a rate of up to 60%, one of the highest rates in the industry. All shares will be listed on the stock exchange as planned.

On July 17, KienlongBank’s share price surged by 9.9%, trading at VND 21,100 per share, the highest level in the past two years.

Additionally, the bank’s charter capital will be increased from the current level of VND 3,652 billion to VND 5,822 billion upon completion of legal procedures and receipt of approval from the state management agency.

The expansion of the charter capital not only strengthens the bank’s financial foundation but also serves as a crucial driver for enhancing lending capacity, thereby supporting the economy’s capital demands. Concurrently, this additional capital will enable KienlongBank to realize its growth targets for the year, ensuring operational safety, enhancing risk resilience, and fostering sustainable development in the medium and long term.

Concluding a highly efficient and successful second quarter, KienlongBank is confident in its business plan and long-term objectives. As we enter the third quarter and celebrate the bank’s 30th anniversary (1995-2025), KienlongBank expresses its gratitude to customers and shareholders through a journey of innovation, creativity, and responsibility, accompanied by attractive promotional programs. With a clear direction, detailed action plan, and the determination of the entire system, KienlongBank is poised for significant transformations in reshaping its business network to be more familiar, convenient, and efficient.

– 10:45 29/07/2025

“Digital Transformation Pays Off: HDBank Records Impressive 6-Month Profit of VND 10,068 Billion, with ROE Climbing to 26.5%”

“HDBank (HOSE: HDB) has announced its Q2 and H1 2025 financial results, boasting impressive profits exceeding VND 10,068 billion, a remarkable 23% increase compared to the same period last year. The bank continues to lead the industry with top-tier performance and operational efficiency, solidifying its position as a powerhouse in the Vietnamese banking sector.”

Reverse Engineering Profits: Unraveling Bac A Bank’s Strategy for a 49% Surge in Pre-Tax Profits

“Bac A Bank (HNX: BAB) announced a remarkable 49% year-over-year increase in its second-quarter 2025 consolidated profit, amounting to nearly VND 304 billion. This impressive performance is attributed to the bank’s successful diversification strategy, evident in the growth of non-interest income, coupled with a prudent reduction in credit risk provisions.”

Profiting from Services: OCB Records an 11% Rise in Q2 Profit

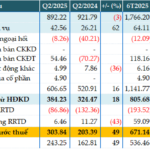

The recently released consolidated financial statements for the second quarter of 2025 reveal that Orient Commercial Joint Stock Bank (HOSE: OCB) has achieved remarkable financial performance. The bank reported a remarkable pre-tax profit of over VND 999 billion, reflecting an 11% increase compared to the same period last year. This impressive growth is attributed to the bank’s strategic focus on core income growth and a robust performance in its services division.

“Sacombank’s Strategic Cost Management Pays Off: A 36% Jump in Pretax Profit for Q2”

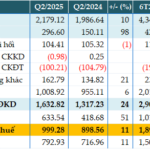

The consolidated financial statements for the second quarter of 2025 revealed impressive results for the Saigon Thuong Tin Commercial Joint Stock Bank, more commonly known as Sacombank (HOSE: STB). The bank demonstrated its resilience and strong performance by recording a remarkable pre-tax profit of over VND 3,657 billion, reflecting a significant 36% increase compared to the same period last year, despite substantially bolstering its risk provisions.

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

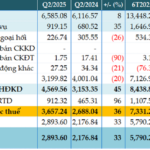

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”