There are now loan packages on the market that allow customers to be much more proactive in how they repay their debts, from the amount, time to payment methods. International Bank ( VIB) stands out as one of the pioneers with leading flexible solutions, bringing practical policies to help borrowers feel secure in borrowing for the long term and stabilizing their lives.

Below are the clear financial benefits when choosing a loan designed to give customers control over their personal cash flow.

Retain emergency funds – No need to spend all your savings

One of the biggest concerns for first-time homebuyers is having to “wipe out” their savings to make a down payment. However, banks now typically lend up to 70-80% of the value of the secured property, so borrowers don’t have to drain their accounts.

With VIB’s loan package, homebuyers can borrow up to 85% of the value of an apartment and 80% of the value of a house. Keeping a portion of their own capital gives borrowers more flexibility with their emergency funds for medical and educational expenses or unexpected situations in life. This is a big plus, ensuring that you can own your dream home while maintaining a safe financial cushion.

Financial breathing space – Flexible repayment according to ability

Many people are reluctant to borrow because they are afraid that the monthly principal repayment will be too high, accounting for 30-50% of their income. But now, some banks allow customers to choose a repayment method that suits their financial capacity at each stage.

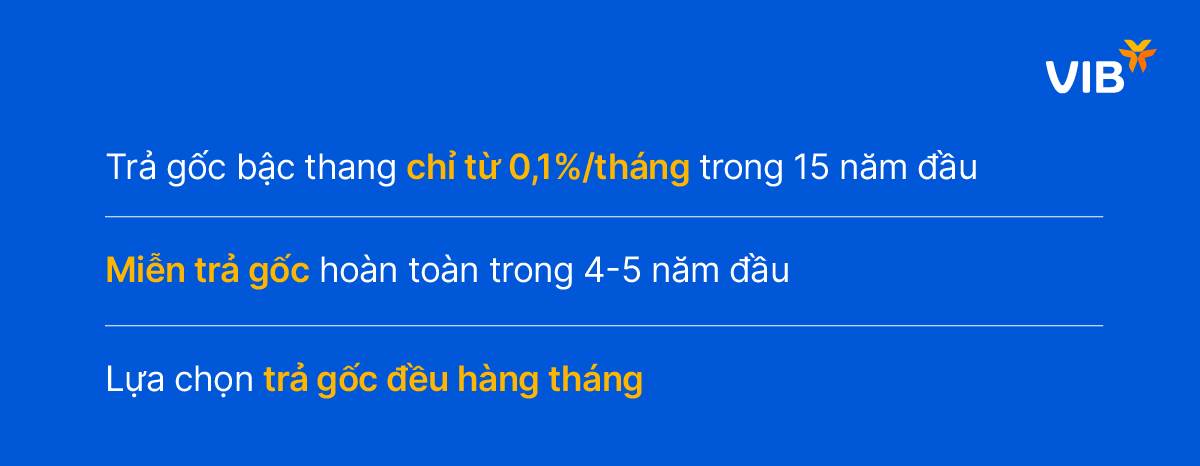

Typically, VIB’s home loan package allows customers to flexibly choose principal repayment methods:

- Repay the principal in a stepped manner, starting at only 0.1%/month for the first 15 years, equivalent to about 1 million VND/month for every billion VND borrowed – the lowest principal repayment rate in the market today.

- No principal repayment for the first 4-5 years, reducing financial pressure from the very first months of buying a house.

- Or choose to repay the principal monthly if income is stable.

This policy is especially practical for young people who have just started working, families with young children, or those who are focusing their capital on business and investment. Maintaining a low principal repayment in the initial phase ensures that you don’t have to compromise your current quality of life just to own a home.

Proactively repay the principal without penalty

Another common concern is that if you repay less principal, the interest will be higher. But the issue is not just about how much principal you repay each month, but whether you have the flexibility to repay the principal at any time.

A notable flexibility in VIB’s home loan package is that it allows customers to prepay up to 25 million VND/month (equivalent to 300 million VND/year) in the first 5 years without any prepayment penalty. After 5 years, customers will be exempt from 100% of the prepayment penalty, regardless of conditions.

The key to controlling the total borrowing cost is the borrower’s ability to proactively repay the principal at any time without penalty. When there is a bonus, unexpected profit, or additional savings, the borrower can accelerate debt repayment and immediately reduce the interest expense without worrying about contract penalties.

Transparent interest rates – Control of total borrowing costs

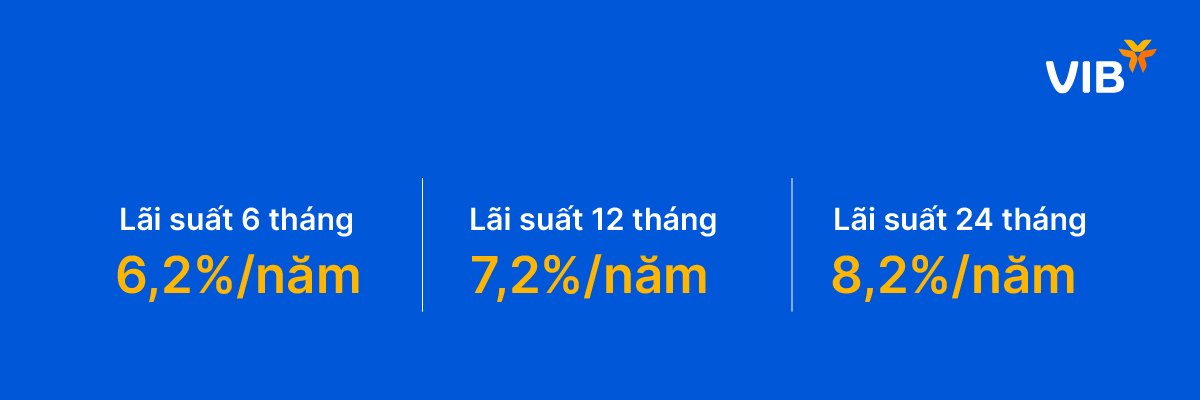

A flexible loan is only truly valuable if the borrowing cost is transparent from the start. Some loan packages on the market – typically VIB’s package – allow customers to choose a fixed interest rate for the first 6-24 months.

After the promotional period, the interest rate applied is based on a fixed formula: base rate plus a margin of 2.9%/year, publicly disclosed on the website and clearly stated in the contract. This margin is very competitive compared to the 3.5-4% commonly seen in the market.

Clearly stating the interest rate from the beginning helps borrowers plan long-term debt repayment and control total borrowing costs. Combined with the flexibility to prepay the principal, borrowers can proactively optimize borrowing costs according to their actual financial capacity.

Quick loan approval – Time savings for homebuyers

One of the biggest barriers to home loan borrowing is the long waiting time for approval and disbursement. However, with a database of over 800,000 apartments in major provinces and cities such as Hanoi, Ho Chi Minh City, Danang, and Binh Duong, VIB can appraise real estate in just 1 minute. As a result, loan approval time has been shortened to just 4-8 hours. This speed is superior to the multiple working days at other banks.

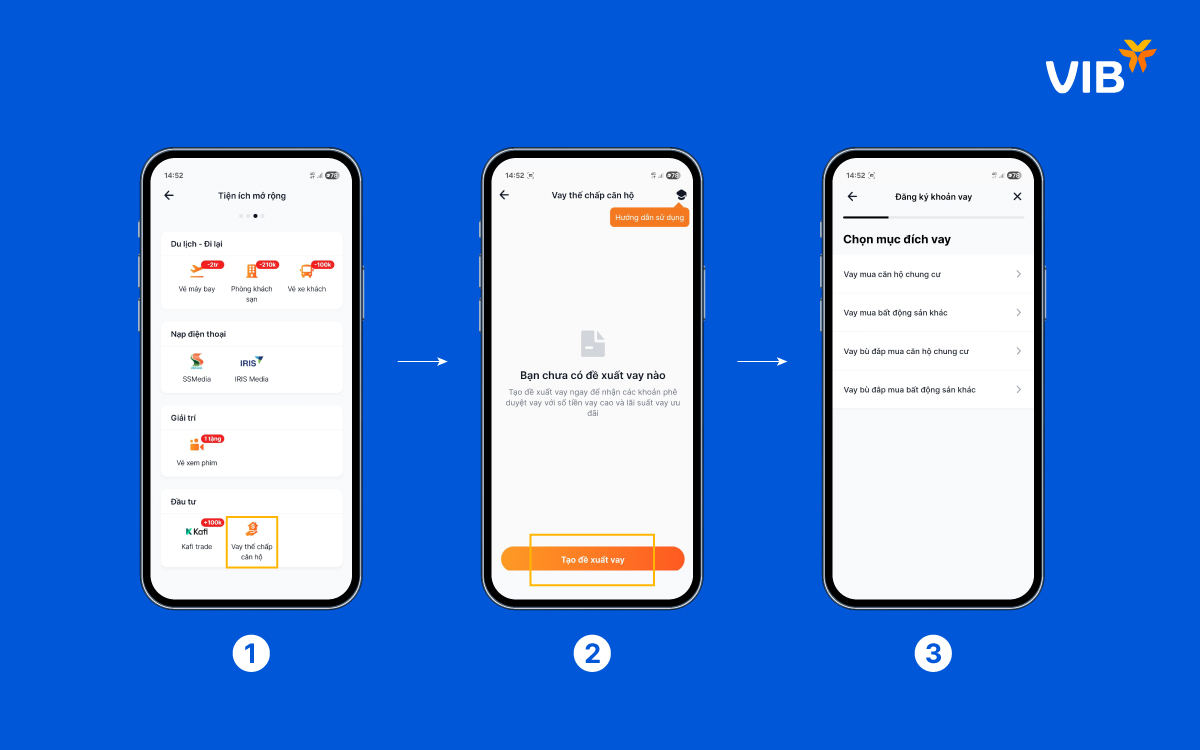

Especially, customers can now experience mortgage loans for apartments right on the MyVIB digital banking application with approval time in just a few minutes, quickly and conveniently.

A truly good loan is not just about low-interest rates but about giving borrowers control: control over the pace of repayment, cash flow, borrowing costs, and, most importantly, control over how you manage your life throughout the repayment journey.

Flexible loan packages like VIB’s offer a worthwhile consideration for those who want to own a home but don’t want to sacrifice too much to the pressure of debt repayment. Not all loans are created equal – what matters is whether the loan gives you enough autonomy.

Learn more about VIB’s flexible home loan package at VIB’s website or visit the nearest branch for direct advice. Borrowing to buy a home is not a barrier, but a way to get you closer to your important life plans.

“Van Phu Reports 56% Profit Growth in First Half of 2025”

With a boost from positive macroeconomic factors, the real estate market’s recovery has significantly impacted Van Phu – Invest Development Joint Stock Company (HOSE: VPI). The company has reported impressive financial results for the first half of 2025, with a 56% year-over-year increase in after-tax profit, totaling VND 148.8 billion.

The Flow of Capital: A Week of Healthy Adjustments

Although the VN-Index fell in 4 out of 5 trading sessions last week, experts do not consider this a cause for concern. In fact, a slowdown and a pullback are healthy signals for the market after the initial strong gains and the explosive session on December 5th.

The Ultimate Guide to Saigontel’s Ambitous Endeavor: Unlocking the $1.6 Billion Loan for Vietnam’s Industrial Revolution

On December 12th, the Board of Directors of Saigon Telecommunication Technology Corporation (Saigontel, HOSE: SGT) approved a resolution to accept a credit facility of up to VND 1,635 billion from VPBank. This financing will be utilized to invest in the second phase of the Dai Dong – Hoan Son Industrial Park project.