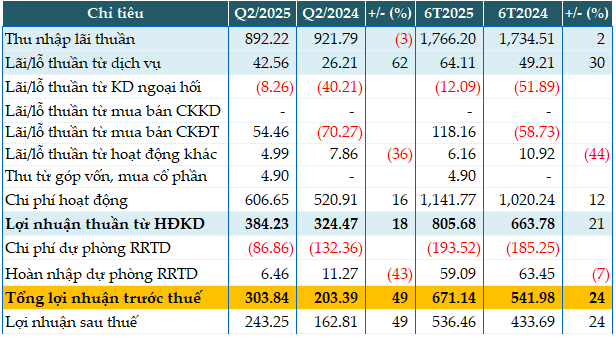

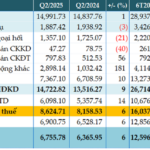

In Q2, the Bank’s net interest income decreased by 3% compared to the same period last year, amounting to just over 892 billion VND.

Meanwhile, service income increased significantly by 62% to nearly 4.3 billion VND, and investment securities trading activities turned profitable with a gain of 5.4 billion VND.

Foreign exchange operations continued to incur losses, while other business activities generated a profit of nearly 500 million VND.

Additionally, the Bank’s operating expenses increased by 16% to nearly 60.7 billion VND, resulting in a 18% rise in net profit from business operations, totaling 38.4 billion VND.

During this period, the Bank reduced its risk provision expenses by 53%, allocating nearly 8.7 billion VND, along with a reversal of over 600 million VND. Consequently, pre-tax profit increased significantly by 49%, reaching nearly 30.4 billion VND.

For the first six months of the year, the Bank’s cumulative pre-tax profit exceeded 67.1 billion VND, a 24% increase compared to the same period last year. With a target of 1,300 billion VND in pre-tax profit for the full year, Bac A Bank has achieved nearly 52% of its goal in the first half.

|

Q2 and 6-month business results of BAB in 2025. Unit: Billion VND

Source: VietstockFinance

|

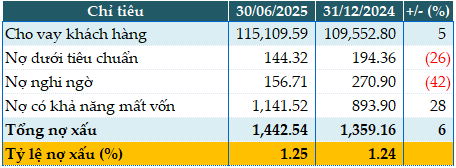

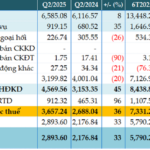

Total assets as of the end of Q2 increased by 7% from the beginning of the year, reaching 131,084 billion VND. Within this, customer loans increased by 5% to 115,109 billion VND, and customer deposits rose by 7% to the same amount of 131,084 billion VND.

As of June 30, 2025, the total non-performing loans amounted to 1,442 billion VND, a 6% increase from the beginning of the year. There was a gradual shift towards the group of loans with potential losses, causing the NPL ratio to inch up from 1.24% at the start of the year to 1.25%.

|

Loan quality of BAB as of June 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 4:28 PM, July 31, 2025

Profiting from Services: OCB Records an 11% Rise in Q2 Profit

The recently released consolidated financial statements for the second quarter of 2025 reveal that Orient Commercial Joint Stock Bank (HOSE: OCB) has achieved remarkable financial performance. The bank reported a remarkable pre-tax profit of over VND 999 billion, reflecting an 11% increase compared to the same period last year. This impressive growth is attributed to the bank’s strategic focus on core income growth and a robust performance in its services division.

Vietcombank Reports 9% Rise in Q2 Pre-Tax Profit, Attributed to Reduced Provisions

The recently released consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Foreign Trade of Vietnam, commonly known as Vietcombank (HOSE: VCB). The bank reported a remarkable pre-tax profit of over VND 11,034 billion, reflecting a 9% increase compared to the same period last year. This outstanding performance is attributed to a significant reduction in risk provisions.

BIDV Posts 6% Pre-Tax Profit Increase in Q2, Total Assets Near VND 3 Quadrillion

The consolidated financial statements for the second quarter of 2025 reveal impressive results for the Joint Stock Commercial Bank for Investment and Development of Vietnam, better known as BIDV (HOSE: BID). The bank posted a remarkable pre-tax profit of nearly VND 8,625 billion, reflecting a 6% increase compared to the same period last year. As of the end of the second quarter, BIDV’s total assets stood at over VND 2.99 million billion.

“Sacombank’s Strategic Cost Management Pays Off: A 36% Jump in Pretax Profit for Q2”

The consolidated financial statements for the second quarter of 2025 revealed impressive results for the Saigon Thuong Tin Commercial Joint Stock Bank, more commonly known as Sacombank (HOSE: STB). The bank demonstrated its resilience and strong performance by recording a remarkable pre-tax profit of over VND 3,657 billion, reflecting a significant 36% increase compared to the same period last year, despite substantially bolstering its risk provisions.

“VietinBank’s Impressive Performance: A 80% Surge in Pre-Tax Profit for Q2”

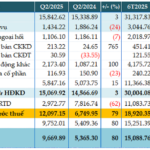

“VietinBank’s recently released consolidated financial statements for Q2 2025 reveal impressive results. The bank, listed as CTG on the Ho Chi Minh Stock Exchange (HOSE), reported a remarkable 79% year-over-year increase in pre-tax profits, totaling over VND 12,097 billion. This outstanding performance is largely attributed to a significant reduction in risk provisions.”