The Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) has recently released its Q2 2025 financial report. According to the report, as of the end of June 2025, customer deposits at BIDV officially surpassed the threshold of VND 2 quadrillion.

Specifically, as of June 30, 2025, the bank’s customer deposit balance was over VND 2,074 quadrillion, an increase of more than VND 121 trillion compared to the end of 2024, equivalent to a 6.2% increase.

BIDV’s total assets have also reached a figure of over VND 2.99 quadrillion, making it the largest bank in Vietnam. In the first six months, BIDV’s total assets increased by 8.4%.

BIDV’s outstanding loans to customers reached nearly VND 2.18 quadrillion, a 6% increase in the first two quarters of this year. Notably, BIDV’s non-performing loans increased significantly (up 48%) in the first six months to VND 43,140 billion. As a result, the non-performing loan ratio to total loans increased from 1.41% at the beginning of the year to 1.98% at the end of June.

In terms of business results, with consolidated pre-tax profit in the first six months of over VND 16 trillion, BIDV ranked third in the system, after Vietcombank and VietinBank.

BIDV’s net interest income for the first six months of 2025 increased by 2% over the same period to VND 28,937 billion. Many business areas showed impressive growth, such as net profit from investment securities trading reaching VND 793 billion, up 258% over the same period. In addition, net income from other activities (including income from handled debt) increased by 168%, reaching VND 4,114 billion.

Some less favorable business areas include net income from service activities, which decreased by 5.7% to VND 3,426 billion. Net income from foreign exchange trading decreased by 30.4%, reaching VND 2,221 billion.

Along with BIDV, another bank, the Vietnam Bank for Agriculture and Rural Development (Agribank), also recorded customer deposits surpassing VND 2 quadrillion. As of June 2025, Agribank’s customer deposits reached VND 2,043 quadrillion, second only to BIDV.

Currently, the banking system has over VND 15 quadrillion in deposits. Thus, the market share of BIDV and Agribank is both over 13%, significantly higher than that of other banks such as VietinBank (11.5%) and Vietcombank (10.3%).

“Agris Bolsters Leadership, Geared for the 2025 – 2030 Breakthrough”

On August 1st, 2025, in Ho Chi Minh City, AgriS (HOSE: SBT) – a vanguard group in innovation and sustainable development – appointed several senior personnel, fortifying and completing their existing leadership team as they gear up for their strategic acceleration phase from 2025 to 2030.

The Captivating Craft of Words:

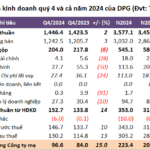

“Dat Phuong’s Profitable Prowess: A Stellar Fourth Quarter with nearly 100 Billion VND in Profit.”

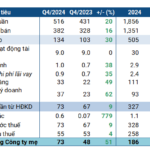

The Joint Stock Commercial Bank for Foreign Trade of Vietnam, or Vietcombank, has announced its fourth-quarter 2024 financial statements, reporting a net profit of VND 97 billion, the highest in the past seven quarters. This figure represents a 15% increase compared to the same period last year, yet Vietcombank has only achieved 88% of its annual profit plan.

The Magic Formula for Success: Unlocking the Secrets to a Booming Business

The fourth-quarter profit surge propelled the Southern Basic Chemicals Corporation (HOSE: CSV) to a successful year, surpassing the targets approved by the 2024 Annual General Meeting.

“Steady Growth and Effective Risk Management: Nam A Bank’s Path to Success in 2024”

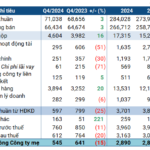

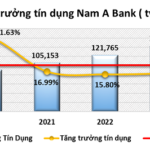

As of the end of 2024, Nam A Bank (HOSE: NAB) reported impressive growth in its business performance. The bank witnessed a significant expansion in its scale of operations, coupled with enhanced asset quality. Notably, the bank’s indicators for mobilization and credit outstanding balances demonstrated remarkable effectiveness, reflecting the bank’s strong performance and strategic success.