At the investor conference on the afternoon of August 4, 2025, representatives from Vietnam Prosperity Joint-Stock Commercial Bank (VPBank, HOSE: VPB) shared its business results for the first half of 2025 and business plans for the Group and its subsidiaries within the ecosystem.

VPBank successfully syndicates a $1.56 billion loan

Ms. Luu Thi Thao – Deputy CEO and Senior Executive Director shared that VPBank has officially surpassed VND 1.05 million billion in consolidated total assets, becoming the largest private commercial bank in Vietnam.

“This is a significant milestone, proving VPBank’s ability to execute an exceptional growth strategy, based on a prudent risk management foundation and a spirit of innovation”, emphasized Ms. Thao. This success stems from the synergistic strength of the entire ecosystem, including the parent bank, FE Credit, and the new member, GPBank.

Another notable achievement is the successful syndication of a $1.56 billion loan from international financial institutions, a record high for a private organization in Vietnam. This not only affirms VPBank’s reputation but also brings in affordable capital to finance green projects, SMEs, and women-owned businesses.

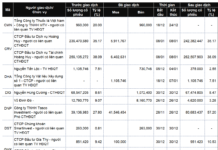

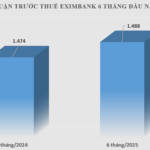

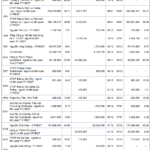

On a consolidated basis, total credit outstanding reached VND 842,000 billion, up 18.6% from the beginning of the year. Pre-tax profit exceeded VND 11,200 billion, completing 44% of the yearly plan.

FE Credit recorded a positive recovery with a 19% increase in disbursement, a 5.5% rise in core loan balance, and continued to contribute positive profits to the overall results. VPBank Securities grew margin lending by 87%, bringing its market share to 2.6% (Top 4 in the market).

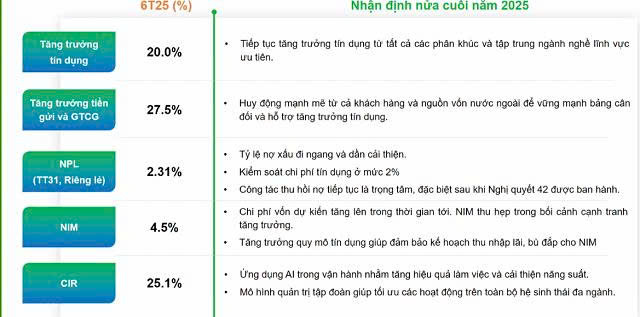

Regarding the parent bank’s results, credit growth reached 20%, led by secured loans and the SME segment. Deposit growth exceeded 27%, strengthening the bank’s balance sheet sustainability. The CASA ratio improved to 15.8% thanks to innovative products such as “Super Cash”. Total operating income (TOI) reached nearly VND 23,500 billion. Pre-tax profit stood at VND 10,700 billion, achieving 48% of the yearly plan. The NPL ratio showed a decreasing trend. The cost-to-income ratio (CIR) was maintained at a low level of approximately 25%.

FE Credit’s noticeable recovery and digital transformation strategy

Answering questions about the prospects of the consumer finance industry, Ms. Luu Thi Thao shared that FE Credit is showing positive recovery signs, in tandem with the warming up of the economy.

“The first six months witnessed a 19% year-on-year growth in FE Credit’s disbursement, and a 5.5% increase in core loan balance. These are positive signals for a breakthrough in the second half of the year”, Ms. Thao shared.

To realize this goal, FE Credit is focusing on key programs of action. Firstly, there is a strong emphasis on digital transformation, as evidenced by the recent launch of the FE Online 2.0 app and the ongoing integration of AI models to optimize the loan approval process and enhance customer experience at a more reasonable cost. Secondly, FE Credit is developing its partner ecosystem by strengthening linkages with large retail chains (such as The Gioi Di Dong) and e-commerce platforms, while also leveraging the strengths of VPBank’s ecosystem and strategic partner SMBC.

Ms. Thao expressed her confidence that FE Credit will make a strong and solid comeback, contributing significantly to the Group’s overall results.

GPBank’s rapid transformation and profitability goal

Providing an update on the progress of the new member GPBank’s restructuring, Ms. Luu Thi Thao shared that despite starting later than other pairs of banks in the mandatory transfer scheme, VPBank is making rapid progress.

Immediately after the takeover in January, VPBank focused on comprehensively restructuring its operating model, clearly separating the sales force from the management blocks (credit approval, technology, human resources, etc.).

The initial results are very encouraging, with June 2025 being the first month that GPBank recorded a profit after a long time. In just five months, the bank achieved a 20% growth in deposit mobilization. The pre-tax profit goal for 2025 is set modestly at VND 500 billion.

“Our goal is not just financial, but to transform GPBank into a modern and reputable bank. We have completed the strategy formulation and plan to announce the new brand image in the third quarter”, revealed Ms. Thao.

One of the most concerning topics is debt collection. Mr. Phung Duy Khuong – Deputy CEO in charge of the South – Director of Retail Banking Division and Director of Debt Recovery and Handling Division emphasized that the government’s legalization of Resolution 42 is a significant step forward, providing a solid and clear legal framework.

“The legalization of the right to seize secured assets empowers banks to be more proactive, reducing complex litigation and legal risks. This will expedite the debt recovery process and release capital”, analyzed Mr. Khuong.

VPBank’s debt recovery strategy focuses on specialization, such as establishing an independent debt recovery division with strategies tailored to each customer segment and product. The bank also utilizes tools like Callbot and Chatbot to automate the recovery of small-value or long-overdue loans, optimizing resources. Additionally, VPBank takes advantage of the warming up of the real estate market to expedite the handling of mortgaged assets that are real estate properties.

VPBank is confident in accomplishing its 2025 plan

Ms. Luu Thi Thao affirmed the management’s confidence in achieving the business targets approved by the AGM for 2025. This confidence is based on the solid results of the first six months and a clear action strategy for the next phase, closely following the opportunities presented by the favorable macro context.

Ms. Thao assessed that with the government’s aggressive growth orientation, the 8% GDP target, and strong credit growth impetus, the economic landscape presents challenges but also opens up significant opportunities for banks that can find breakthrough growth. VPBank recognizes this as a chance to consolidate its position. Accordingly, the bank’s strategy for the last six months will focus on four key priorities.

First, scale growth is the top priority. VPBank will continue its strong credit growth momentum across all customer segments. The bank commits to prioritizing capital for strategic sectors with large spillover effects on the economy, such as infrastructure, renewable energy, information technology, and green finance. The growth momentum will come from the entire ecosystem, including not only the parent bank but also the positive contributions of subsidiaries like VPBank Securities and FE Credit.

Second, VPBank aims to build a sustainable capital foundation. Amidst the industry-wide challenge of the gap between credit growth and mobilization, VPBank targets to construct a “sustainable balance sheet”. “We are one of the banks with the fastest growth rate in customer deposit mobilization in the first six months”, shared Ms. Thao. In addition to efficient domestic mobilization, VPBank will continue to be a pioneer in diversifying capital sources from international markets, ensuring a solid capital foundation ready for all growth scenarios.

Third, the bank will closely manage asset quality. Building on the new legal foundations, such as the legalization of Resolution 42, and the decisive actions of the debt recovery division, VPBank sets a specific goal for the next six months to maintain the NPL ratio at a stable level and control credit costs at below 2%. This is a core prerequisite to safeguarding the bank’s asset quality and profit targets.

Finally, VPBank will optimize operational efficiency. To counter the competitive pressure on net interest margin (NIM), VPBank will continue implementing solutions to minimize funding costs. Simultaneously, the bank will selectively invest in technology, data, and AI applications in its operations. The dual objective is to improve productivity and maintain the cost-to-income ratio (CIR) at a market-leading competitive level.

“With the consolidated pre-tax profit of over VND 11,200 billion achieved in the first half, equivalent to nearly 45% of the plan, we have a solid basis to strive to achieve and exceed the targets committed to shareholders for the full year 2025”, affirmed Ms. Thao.

Cat Lam

– 20:37 04/08/2025

“VPBank Secures a Monumental $350 Million Agreement for Sustainable Growth.”

“VPBank joins forces with renowned global development institutions, SMBC, BII, EFA, FinDev Canada, and JICA, in a groundbreaking partnership. Together, they have secured a landmark loan, a pivotal step towards financing Vietnam’s sustainable and eco-friendly future. This collaboration marks a significant milestone in the country’s journey towards a greener tomorrow.”

The Unexpected Twist in Mortgage Interest Rates

Amidst the upward trajectory of deposit interest rates, a surprising move by several banks has been to announce a further reduction in home loan interest rates.

“VPBank Secures $350 Million Loan to Boost Sustainability Efforts”

On July 29, 2025, VPBank (HOSE: VPB), one of the leading joint-stock commercial banks in Vietnam, announced the successful signing of a syndicated loan worth USD 350 million. This loan was made possible through a collaboration with Sumitomo Mitsui Banking Corporation (SMBC) and prominent development finance institutions (DFIs), including British International Investment (BII), Export Finance Australia (EFA), FinDev Canada, and the Japan International Cooperation Agency (JICA). SMBC acted as the coordinator and authorized co-lead arranger for this significant financing endeavor.