The Vietnamese consumer finance market is undergoing a dynamic phase, presenting both challenges and opportunities. While the industry faced headwinds during 2022-2024, the post-pandemic era, coupled with controlled credit policies and high-interest rates, shifted consumer behavior and impacted the performance of many financial companies.

This challenging period witnessed a significant decline in revenue for many businesses, with some even reporting losses. While some chose to downsize or exit the market, a few, like FE CREDIT, opted for strategic restructuring to adapt to the evolving landscape.

Despite the uncertainties, analysts remain optimistic about the sector’s long-term potential. They attribute this to the low penetration of formal consumer finance in Vietnam and the growing trend of online shopping, installment purchases, and credit card usage. These factors present a vast growth opportunity for the industry.

Vietnamese consumer finance market: Significant growth potential ahead

|

According to the State Bank of Vietnam, consumer loans account for only 20% of the country’s total outstanding debt. This highlights the untapped potential, especially for financial companies specializing in consumer credit. With a projected GDP growth of 8% and improving household incomes, the consumer finance market is poised for a strong recovery in the latter half of 2025 and beyond.

Additionally, the legal framework is being strengthened to support safer and more transparent consumer finance operations. The legalization of Resolution 42 on bad debt handling provides a clear mechanism for secured loan providers, benefiting consumer finance companies.

As the market enters a new phase, FE CREDIT, backed by its comprehensive restructuring, is well-positioned to capitalize on these opportunities. With the strategic support of VPBank and SMBC, FE CREDIT has reported five consecutive profitable quarters, with pre-tax profits of nearly VND 270 billion in the first two quarters of 2025.

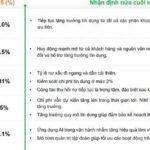

The company’s resilient performance is a result of its strategic transformation, including adopting a group management model and strengthening collaborations with VPBank and SMBC. FE CREDIT has diversified its offerings, ranging from personal consumer loans to vehicle, electronics, and home appliance loans, as well as credit cards, catering to a wider customer base and enhancing its retail and consumer ecosystem connectivity.

FE CREDIT enters a new growth cycle with five consecutive profitable quarters

|

FE CREDIT has also prioritized sustainable management practices, investing in high-quality human resources, and upgrading its IT infrastructure. The company has embraced international governance standards, focusing on transparency and long-term growth. Additionally, FE CREDIT has accelerated its digital transformation with the FE ONLINE 2.0 multi-functional financial application, offering a comprehensive digital platform for consumer finance needs.

With a solid foundation, strategic partnerships, and a well-prepared approach, FE CREDIT is poised to lead the consumer finance industry into a new cycle of growth, characterized by sustainability and resilience.

As Vietnam’s economy continues to prosper, FE CREDIT, backed by its strong performance and strategic vision, is well-equipped to navigate the challenges and seize the opportunities ahead, driving the consumer finance sector towards a brighter future.

“FE Credit Bounces Back: VPBank Confident in 2025 Plan as GPBank Turns a Profit”

In the first half of 2025, VPBank recorded a consolidated profit of over VND 11,200 billion and successfully mobilized a record loan of $1.56 billion. Based on the results of the first half and the 4-pronged strategy, the leadership affirmed their confidence in achieving the set business goals for the year.

“FE Credit Races Back, VPBank’s Annual Profit Surges by an Impressive 85%”

Seizing the positive shifts in the economy during the year-end period, VPBank accelerated its breakthrough expansion of credit in strategic segments in the fourth quarter, contributing to an outstanding 85% year-on-year profit growth. The bank has been, and continues to, strengthen its foundation, expand its ecosystem, and create a solid launchpad for its sustainable growth strategy in the medium to long term.

“Cash in Hand, a Bountiful Spring” with FE CREDIT’s Mega Livestream

“Capitalizing on the booming trend of livestreaming, FE CREDIT is excited to announce the launch of not one, but two, thrilling livestream series from now until December 2024. Get ready for an exhilarating ride with “Drive into the New Year with a New Set of Wheels” and “Fill Your Wallets for a Prosperous Spring”. With prizes including Urbox gift vouchers and Urbox e-shopping codes worth up to VND 1,000,000, it’s an opportunity not to be missed! Join us live and be a part of this exhilarating journey as we ring in the new year and spring season with a bang.”

The Power of Persuasive Writing: Unveiling the Unprecedented Phenomenon in the Financial Industry.

“The financial services industry primarily serves blue-collar workers and freelancers, a segment that is often the first to be affected by economic downturns, as Mr. Le Quoc Ninh highlights. However, when the economy bounces back, they are also usually the last to reap the benefits.”