Despite the domestic real estate market facing ongoing challenges, the mid-year 2025 financial reports of several industry giants reveal a contrasting reality: while business performance showed little improvement, executive compensation remained high and, in some cases, even increased significantly.

Novaland Records Significant Losses, Yet Executive Compensation Remains High

Novaland, a leading real estate group, continued to experience losses in the first half of 2025, amounting to VND 666.2 billion. However, this figure is a substantial improvement from the previous year’s record loss of VND 7,327 billion, mainly due to better performance in the second quarter of 2025. During this period, Novaland’s loss stood at VND 189 billion, a notable reduction from the VND 6,726 billion loss in the same period last year. The company attributed this improvement to increased sales revenue and significantly reduced financial expenses.

Additionally, cost of goods sold and other expenses were trimmed by over VND 4,370 billion. This reduction was due to the company’s decision to make provisions related to financial obligations at the Nam Rạch Chiếc project in Ho Chi Minh City, as per the auditor’s requirements, in the previous year.

AI-illustrated image of real estate company executives with high incomes in the first half of 2025.

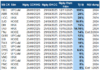

Despite the company’s ongoing losses, the compensation for Novaland’s leadership remained substantial. In the first six months of 2025, Mr. Bui Thanh Nhon, Chairman of the Board of Directors, received VND 600 million in remuneration, unchanged from the previous year. Two other Board members, Mr. Pham Tien Van and Mr. Hoang Duc Hung, maintained their compensation at VND 300 million each.

Notably, Mr. Duong Van Bac, who took on the role of CEO in November 2024, received a salary of VND 2.4 billion in the first half of 2025, equivalent to approximately VND 400 million per month, representing a 71% increase compared to the same period last year when he served as the company’s CFO.

The vice-CEOs, Ms. Tran Thi Thanh Van and Mr. Cao Tran Duy Nam, also earned considerable salaries of VND 1.4 billion and VND 1.34 billion, respectively, in the first six months, translating to approximately VND 220-230 million per month.

An Gia’s Profit Declines, But Executive Compensation Rises

At An Gia Investment and Development Joint Stock Company, profit after tax in the first half reached VND 90.3 billion, a 58% decrease compared to the previous year. However, the compensation for the company’s leadership showed an opposite trend, with significant increases.

Specifically, Mr. Nguyen Ba Sang, Chairman of the Board of Directors, earned VND 1.24 billion, a 66% increase compared to the first half of the previous year. Other leaders also saw considerable rises in their compensation, including Ms. Nguyen Mai Giang, Vice President, who earned VND 680.6 million (a 35% increase), and Mr. Nguyen Thanh Chau, Chief Accountant, who received a 16% raise.

Phat Dat Reports Modest Profit, Executive Compensation Remains Stable

In contrast, Phat Dat Real Estate Development Corporation recorded positive results, with a 12% increase in profit after tax to VND 115 billion in the first six months. However, the compensation for the company’s leadership remained unchanged from the previous year.

Mr. Nguyen Phat Dat, Chairman, received a total income of nearly VND 970 million, while Mr. Bui Quang Anh Vu, CEO, earned over VND 2.8 billion. Mr. Nguyen Tan Danh, Vice Chairman, received VND 300 million. The two independent Board members, Mr. Tran Trong Gia Vinh and Mr. Duong Hao Ton, each earned VND 240 million in the first half of the year.

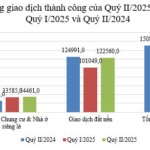

The Real Estate Renaissance: A Booming Market Unveiled

According to the Ministry of Construction’s report on the real estate market in Q2 2025, real estate transactions (apartments, individual houses, and land plots) continued an upward trend, recording 157,021 transactions, a significant 2.2-fold increase compared to the first quarter.

“TV Holdings Enters Strategic Partnership with Altara Hospitality Group”

On Tuesday, August 3rd, 2025, TV Holdings, a prominent real estate company, and Altara Hospitality Group, a member of the Eco Business System managed by Altara Singapore, solidified their strategic partnership. This momentous occasion took place at the Sales Gallery of the captivating Fresia Riverside project in Bien Hoa, Dong Nai.

The Rise of the Southern Metropolis: Satellite Cities and Infrastructure Take Off

As urban decentralization gains momentum and central land resources deplete, the southern region of Ho Chi Minh City is emerging as a “golden destination” for real estate investors. Benefiting from the infrastructure boost and integrated urban planning, this once-peripheral area is now transforming into a thriving satellite city, offering both residential and investment opportunities ahead of its upcoming breakthrough in the new development cycle.

“DXS Profits Soar: First-Half Earnings Quadruple with 46% Increase in Down Payments for Condos and Land”

Recognizing an extraordinary performance in Q2, the net profit of the Real Estate Service Joint Stock Company (HOSE: DXS) for the first half of 2025 tripled that of the same period last year, reaching an impressive VND 258 billion.