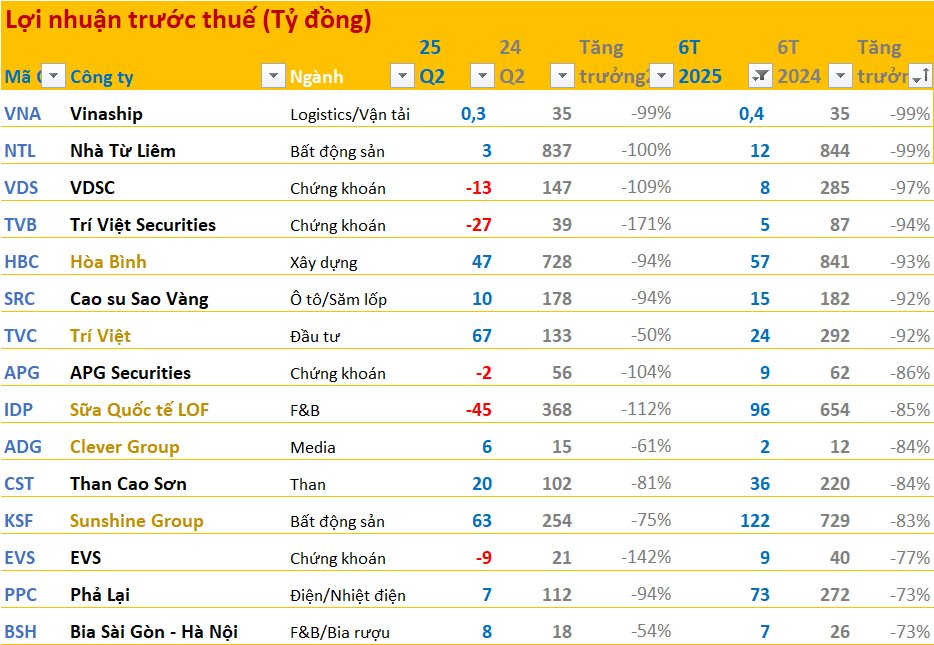

A Mixed Bag for Businesses: Profits Surge for Some, While Others See a Drastic Dip in the First Half of 2025

While some businesses thrived and witnessed impressive growth in the first half of 2025, others experienced a significant downturn in profits compared to the same period in 2024. In fact, some companies saw their profits dip by almost 100%.

Leading this unfortunate list are Vinaship (VNA) and Nha Tu Liem (NTL), with their pre-tax profits plunging by nearly 100% year-on-year. VNA’s profits dropped from VND 35 billion to VND 400 million, while NTL’s profits took a nosedive from VND 844 billion to VND 12 billion.

VNA attributed this sharp decline in post-tax profits to various challenges, including unstable cargo sources, unfavorable market conditions, and operational risks that led to unforeseen expenses.

As for NTL, a staggering 90% drop in revenue was primarily due to the lack of eligible projects this year, coupled with constantly changing legal regulations that hindered the company’s ability to pursue commercial projects.

Another industry giant, Hoa Binh Construction Group (HBC), reported a profit of VND 57 billion, reflecting a substantial decrease of 93% from the previous year’s figure of VND 841 billion.

Diving into specific industries, the securities sector had the most significant representation, with four companies making the list: VDSC (down 97%), Tri Viet Securities (down 94%), APG Securities (down 86%), and EVS (down 77%).

The top 15 companies with the most significant profit declines also included businesses from diverse sectors, such as Cao Su Sao Vang in tire manufacturing, Tri Viet in investment, LOF in F&B (beverages), Clever Group in media, Than Cao Son in coal, and Phả Lại in electricity.

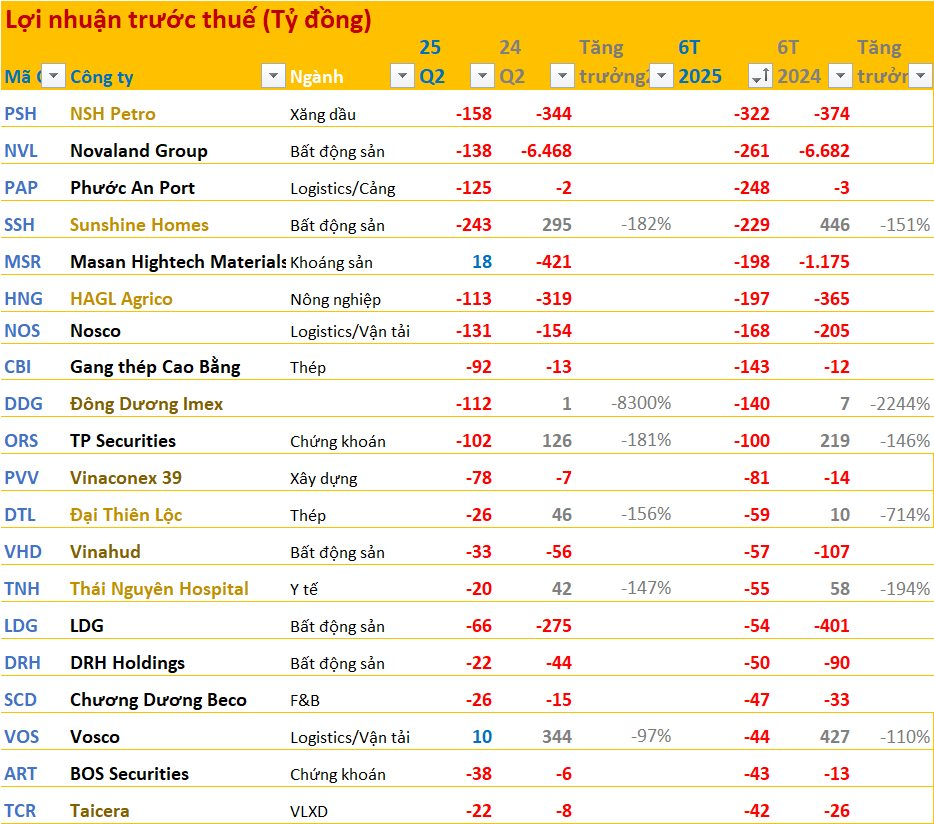

In addition to the steep profit declines, several businesses reported substantial losses for the first half of the year. The three companies with the largest losses were NSH Petro (VND 332 billion), Novaland (VND 261 billion), and Cang Phuoc An (VND 248 billion).

As we move forward into the second half of 2025, it remains to be seen whether these businesses will be able to recover and improve their financial performance.

“SHB and SHS Stocks Plummet After Do Quang Vinh’s August Address”

“SHB and SHS stocks have been the talk of the town in the stock market recently, boasting impressive liquidity and skyrocketing share prices.”

The Green Airport: CEO Group’s Profitable Venture into Industrial Park Development

“CEO Group reports a doubling of profits for the second quarter of 2025, attributed to successful cost-cutting measures. The Group’s quarterly profits soared to 39 billion VND. During this period, CEO Group also invested 50.5 billion VND in its newly established subsidiary, which has a charter capital of 450 billion VND.”