A Decade of Dominance in Consumer Finance

Established in 2010 as the consumer finance arm of Vietnam Prosperity Joint-Stock Commercial Bank (VPBank), FE CREDIT has been a pioneer in modern consumer finance in Vietnam. In 2015, the company officially operated as an independent entity, marking the beginning of its journey to build a specialized financial institution with a focus on mainstream consumer lending.

To become a leading player, FE CREDIT adopted a unique development strategy, targeting customers who lack collateral and access to traditional banks, such as blue-collar workers, small traders, and the unbanked. With a “cover early and deep” strategy, the company not only accurately targeted the niche market that other credit institutions neglected but also rapidly built a solid foundation for long-term growth.

Starting with its first product, installment loans for motorcycle purchases, FE CREDIT continuously expanded its portfolio to include cash loans, installment loans for phones and appliances, credit cards, and linked insurance. This diversity enabled the company to reach a broader customer base while effectively managing credit risk.

Following a phase of rapid development, the consumer finance market entered a rigorous screening phase due to the impact of the Covid-19 pandemic, tightening credit control policies, high-interest rates in the 2022-2023 period, and shifting consumer spending behaviors. Many businesses scaled back or withdrew from the market. However, with a comprehensive restructuring strategy backed by VPBank and the SMBC group, FE CREDIT not only maintained stability but also retained its leading position.

A testament to this journey is FE CREDIT’s consecutive rankings as the number one financial company in terms of prestige by Vietnam Report in collaboration with VietnamNet on August 1, 2025. The ranking is based on a comprehensive evaluation of financial capacity, media reputation, and trust from customers, experts, and partners.

In 2024, after two years of comprehensive restructuring, FE CREDIT achieved nearly VND 515 billion in pre-tax profits, marking a strong recovery. In the first half of 2025, FE CREDIT maintained its growth momentum with nearly VND 270 billion in pre-tax profits, recording the fifth consecutive profitable quarter.

FE CREDIT also took the lead in building a distribution system with over 13,000 sales outlets nationwide. With total assets exceeding VND 66,400 billion, the company not only solidified its leading position in terms of scale but also demonstrated the quality of its assets, operational efficiency, and strong capital foundation.

Diversification, Digitization, and Responsible Development

FE CREDIT’s success is not just about leading in market share and assets but also in continuously adapting to market demands, innovating products, adopting technology, and upholding its commitment to sustainable development. The three pillars of diversification, digitization of the customer journey, and responsible development form the foundation for the company’s current and future strength.

In a rapidly changing market, FE CREDIT has been agile in expanding its product portfolio to reduce dependence on cash loans, which are considered a high-risk segment.

The company diversified into less risky segments such as installment loans for phones, appliances, motorcycles, credit cards, and linked insurance. These products not only better meet the actual spending needs of consumers but also enable the company to effectively manage credit risk, especially as consumer behavior shifts towards convenience, flexibility, and transparency.

To serve a diverse customer base, especially the mass market, including blue-collar workers, small traders, freelancers, and people in remote areas – a segment often overlooked by traditional financial institutions, FE CREDIT has heavily invested in digitization. The FE ONLINE 2.0 app is a significant step forward, allowing customers to access a full range of financial services, from flexible loans to credit card applications and loan inquiries to repayment tracking, with just a few simple clicks on their phones.

The multi-tasking FE ONLINE 2.0 financial app brings financial services to various customer groups, making the experience more seamless and convenient. Image: FE CREDIT.

The FE ONLINE 2.0 app and the company’s robust digitization strategies are also a step towards anticipating long-term consumption trends, especially as Gen Z – a group with a propensity for spending and transacting through digital platforms – grows in numbers, purchasing power, and influence in the market.

The combination of data, technology, and market understanding has enabled FE CREDIT to personalize products for different customer segments, enhancing outreach effectiveness and fostering long-term relationships.

Alongside business development, FE CREDIT also upholds its role as a responsible financial organization. With the goal of disseminating financial knowledge and raising community awareness, the company launched the “Hieu tien bot phien” (Finance Explorer) financial education communication program. This is not just a CSR activity but also reflects FE CREDIT’s deep commitment to enhancing individuals’ financial capabilities, thereby contributing to a more transparent, comprehensive, and sustainable credit ecosystem for society.

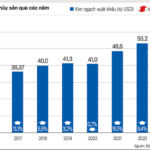

The Green Revolution: 2024 Sees a Stellar Rise in Agricultural Exports

2024 was a landmark year for Vietnam’s agricultural, forestry, and seafood exports, with a record turnover of 62.5 billion USD, an impressive 18.7% increase from 2023. This remarkable growth, the highest in two decades, was driven by strong performance across key agricultural products, including rice, coffee, fruits and vegetables, timber, cashew nuts, and seafood, all of which experienced significant increases.

“Cash in Hand, a Bountiful Spring” with FE CREDIT’s Mega Livestream

“Capitalizing on the booming trend of livestreaming, FE CREDIT is excited to announce the launch of not one, but two, thrilling livestream series from now until December 2024. Get ready for an exhilarating ride with “Drive into the New Year with a New Set of Wheels” and “Fill Your Wallets for a Prosperous Spring”. With prizes including Urbox gift vouchers and Urbox e-shopping codes worth up to VND 1,000,000, it’s an opportunity not to be missed! Join us live and be a part of this exhilarating journey as we ring in the new year and spring season with a bang.”

Unleash the Festive Cheer and Elevate Your Business with Techcombank: Win a Share of the VND 5 Billion Prize Pool!

“As the year draws to a close, Techcombank is thrilled to announce its new program, ‘Festive Season, Business Boost’, designed to accelerate small and medium-sized enterprises’ success. With a total value of up to 5 billion VND, the program offers an array of enticing benefits. To boost businesses’ luck during this festive season, Techcombank will be awarding monthly grand prizes, including a European tour and three VinFast automobiles. The program, running until January 31, 2025, is sure to bring a boost to businesses as they close out the year.”