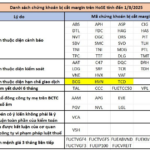

The Ho Chi Minh City Stock Exchange (HOSE) announces a supplementary list of securities ineligible for margin trading.

Accordingly, HOSE has recently added TAL, the ticker symbol for Taseco Real Estate Investment Joint Stock Company, to the list of securities ineligible for margin trading. This is due to the company’s listing period being less than six months.

On August 1, 2025, HOSE organized a listing ceremony for Taseco Real Estate Investment Joint Stock Company (TAL) and officially traded 311.85 million TAL shares, with a total listing value of over 3,118 billion VND based on par value. TAL’s reference price on its first trading day was 25,500 VND per share, with a price fluctuation limit of ±20%.

According to the Consolidated Financial Statements, TAL’s net revenue in 2023 and 2024 was over 3,237 billion VND and 1,684 billion VND, respectively, with corresponding after-tax profits of over 472 billion VND and 685 billion VND. In the first quarter of 2025, TAL’s net revenue reached over 375 billion VND, with an after-tax profit of 22 billion VND.

On August 6, the share price rose to 30,850 VND per share, an increase of nearly 21%, with a market capitalization of over 9,600 billion VND.

Previously, in late July, HOSE removed BSR shares of Binh Son Refinery and Petrochemical Joint Stock Company from the list of securities ineligible for margin trading as the company resolved its margin trading eligibility issues.

As of August 1, 2025, there were 62 ticker symbols on the HoSE that were restricted from margin trading, including notable names such as BCG, HAG, HVN, NVL, TDH, LDG, VPL, VSH, and ORS.

HOSE Updates August Margin Cuts: 62 Tickers Including HAG, NVL, LDG, BCG, and HVN Make the No-Margin List.

“As per the new regulations, investors will no longer be able to utilize the margin credit facility provided by brokerage firms to purchase these 62 specific stocks. This means that investors will have to rely on their own funds or other sources of financing if they wish to invest in these particular securities.”

The Purple BSR Ceiling: A New Peak for the VN-Index Era

“The VN-Index soared to a record high of 1,573.71 points on August 6, 2025, marking a significant surge of 26.56 points or 1.72% from the previous trading session. This remarkable performance highlights the resilience and growth of Vietnam’s stock market. Among the few stocks that reached the maximum upward limit on the HOSE was Binh Son Refining and Petrochemical Joint Stock Company (HOSE: BSR), a standout performer and the sole representative of Petrovietnam on the exchange.”

The Leader’s Insider Trading: A Bold Move for LHC Shares at All-Time Highs

Amidst LHC’s record-breaking second-quarter profits and near-completion of its annual plan within just six months, the move to increase ownership among the leader’s family is a notable development.

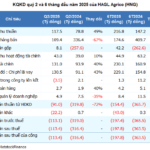

HAGL Agrico: Overburdened by Financial Debt of 10.2 Trillion VND, Gross Profit Falls Short of Covering Interest Expenses

HAGL Agrico has turned a corner with two consecutive quarters of positive gross profits, marking a significant shift from its historical trend of operating below cost. However, the weight of substantial financial debts, totaling over VND 10,200 billion, primarily owed to its largest shareholder, Thaco Agri, continues to burden the company with interest expenses that erase these hard-earned profits.