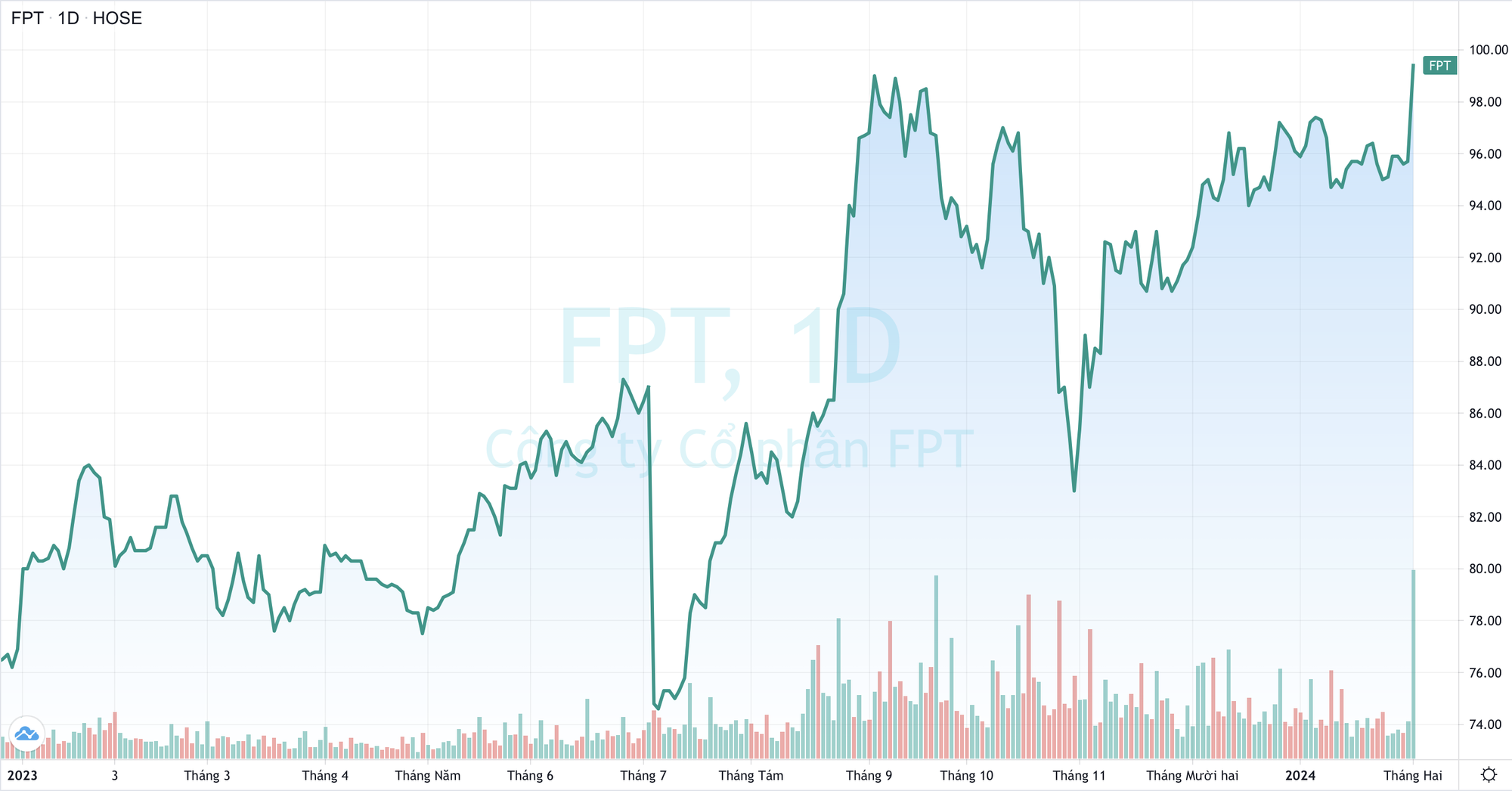

After a period of consolidation, FPT shares unexpectedly accelerated on the first day of February. The leading technology stock increased by 4.39% to VND 99,900 per share, setting a new all-time high (adjusted price). The market capitalization correspondingly reached nearly VND 127 trillion (~USD 5.3 billion), up 50% compared to the same time last year.

Notably, FPT shares broke through the peak and had a very active trading session. The trading volume was nearly 7.8 million shares, the highest in 22 months since the end of March 2022. The corresponding trading value reached nearly VND 770 billion, the highest on the HoSE exchange on February 1. This rare occurrence partly demonstrates the strong attraction of Vietnam’s leading technology stock, even when it is no longer undervalued.

FPT shares surged, pulling up the stock market value of the company’s board of directors, especially Chairman Truong Gia Binh. Estimated, the stock market value of the 68-year-old businessman is nearly VND 7,800 billion (including 77.2 million FPT shares and 2.74 million TPB shares).

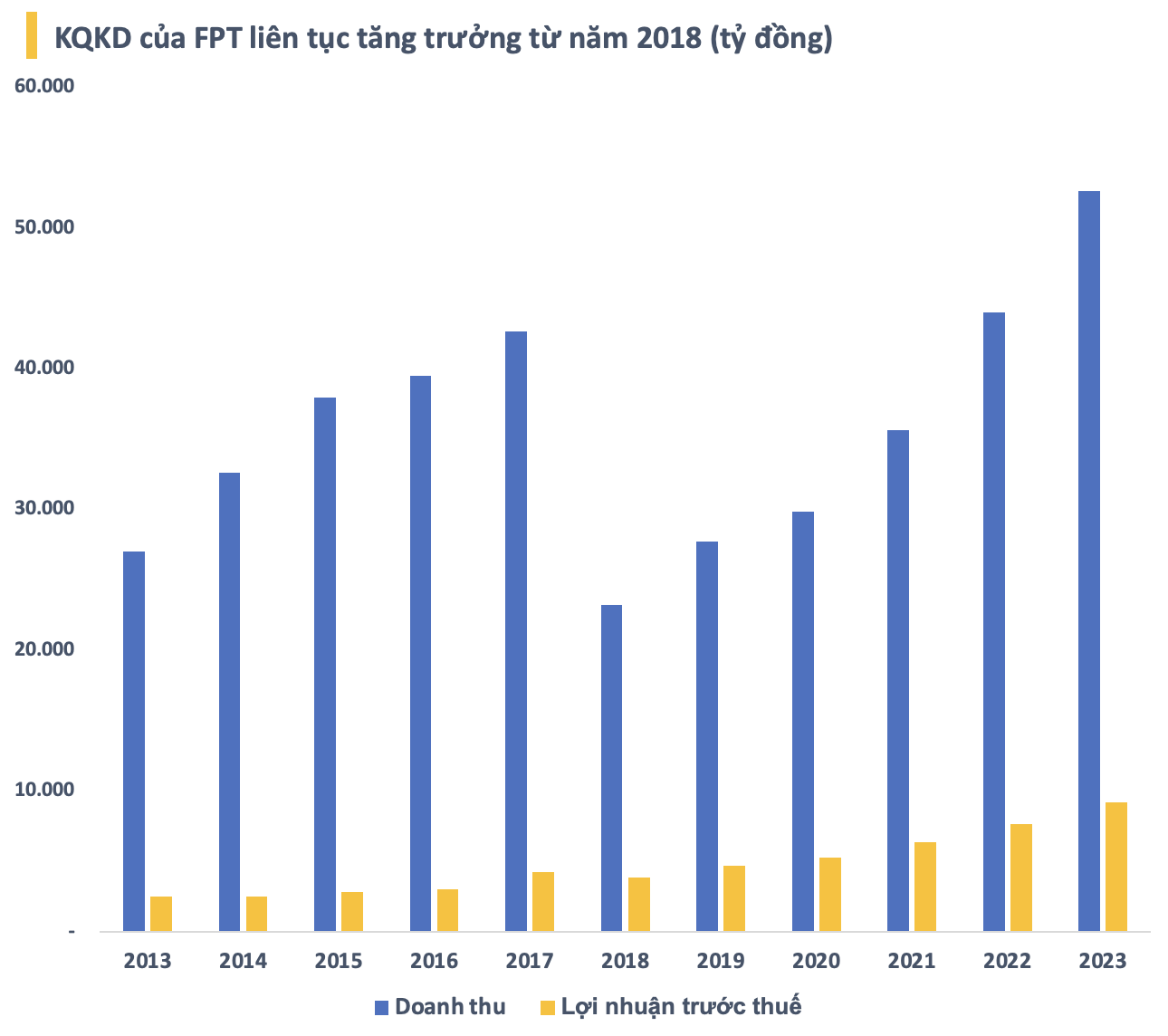

FPT’s upward trend was positively supported by excellent business results with continuous revenue and profit growth over the years. In 2023, FPT recorded a revenue of VND 52,618 billion and a pre-tax profit of VND 9,203 billion, respectively increasing by 19.6% and 20.1% compared to the same period last year. This is the company’s record revenue and profit since its inception.

In 2023, the revenue of the overseas IT service sector reached VND 24,288 billion (~USD 1 billion), a growth of 28.4% year-on-year, thanks to strong growth in the Japanese market (+43.4%) and the Asia-Pacific region (APAC) (+37.7%). The new revenue of the overseas IT service sector reached VND 29,777 billion (+37.6% year-on-year), including 37 projects (+19.4% year-on-year) with a scale of over USD 5 million. FPT aims to achieve a revenue of USD 5 billion from the overseas IT service sector by 2030 (equivalent to a compound annual growth rate of 26% in the 2024-2030 period).

In 2023, FPT also aggressively expanded its market through M&A in order to drive growth in the future. FPT expanded its geographic scope by acquiring 3 US companies and 1 EU company in 2023, thereby significantly enhancing its technology and sales capabilities. Specifically, FPT announced the acquisition of Intertec in February, Landing AI (US) in October, Cardinal Peak (US) in November, and Aosis (France) in December.

Technology and education are two growth drivers

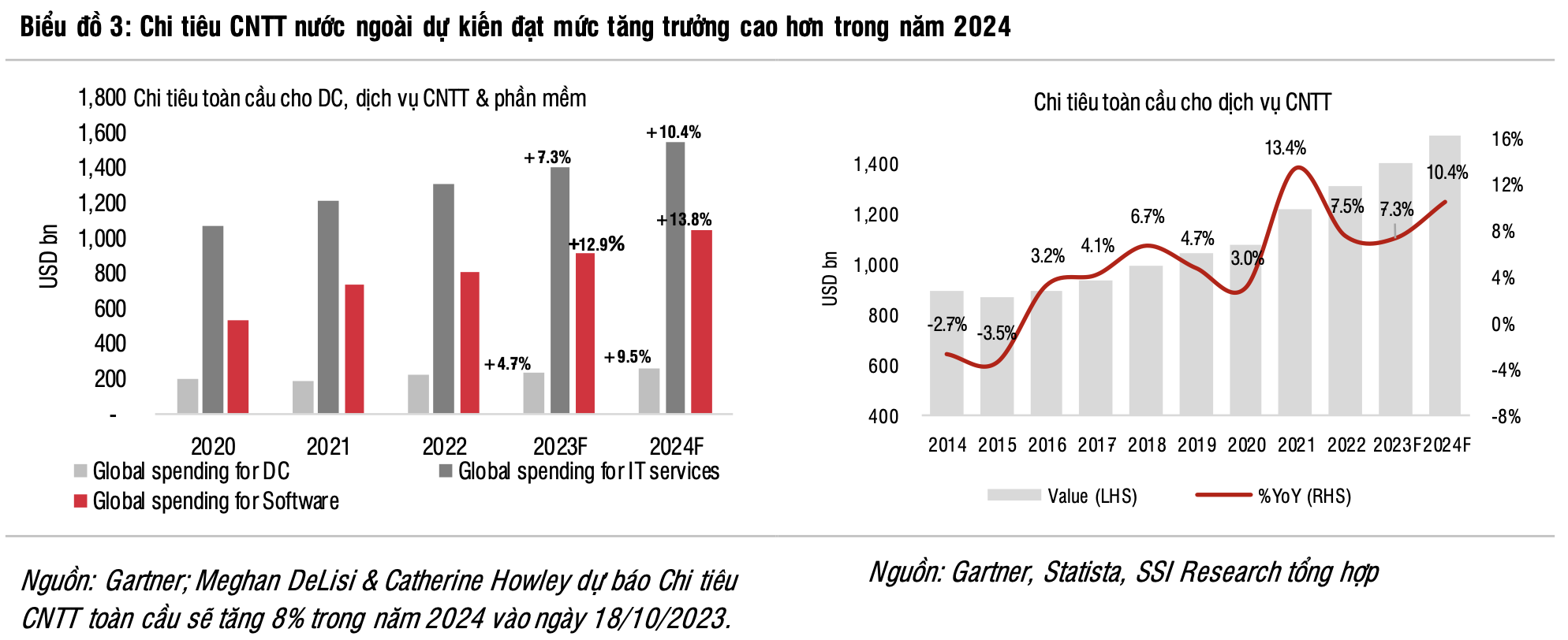

In a recent report, SSI Research noted that global IT spending is expected to achieve high growth in 2024. According to Gartner, the slowdown in IT spending in 2023 indicates that IT spending will rebound in 2024. For FPT’s foreign IT service sector, SSI Research expects the highest revenue growth in 2024 to come from Japan and APAC (30% and 31% year-on-year growth, respectively), followed by Europe (14% year-on-year growth) and the US (12% year-on-year growth).

Gartner believes that cloud computing and AI spending are the two main drivers of global IT spending growth in 2023 and will continue to sustain until 2024, which will support FPT’s growth, as these two segments account for over 40% of the company’s digital transformation revenue.

For the AI segment, which has relatively higher profit margins, FPT expects to increase its AI revenue in 2024 (which is currently relatively small compared to total revenue) to improve overall business performance. According to FPT, the company plans to collaborate with Microsoft to further develop generative AI use cases for customers, and the company is also promoting cooperation with NVIDIA in relation to AI.

SSI Research believes that the demand for automation in the automotive industry will continue to be stable in 2024, especially the demand for electric self-driving cars, an area that FPT is expanding into. In the next 10 years, Precedence Research forecasts a double-digit compound annual growth rate (CAGR) for software in automobiles, global cloud computing services, and AI.

For the domestic semiconductor industry, the Government aims to train about 30,000-50,000 engineers and semiconductor specialists by 2030, of which FPT will train about 10,000-15,000 experts for this industry. To pursue this goal, in Q3 2023, the FPT School of Semiconductor Electronics was established by FPT University with the aim of training the first batch of students in 2024.

SSI Research assumes that the education sector’s revenue will grow by 25% year-on-year in 2024 because 1) FPT’s current education sector continues to benefit from the fact that public schools in the country have not fully met the demand for education, and 2) FPT will benefit from the first batch of students in the field of semiconductor electronics.

In the long run, it takes time to evaluate the effectiveness of this segment, which largely depends on the actual number of Vietnamese people interested/willing to participate in the semiconductor industry.

For FPT Semiconductor, FPT has recorded chip revenue (although very small) since 2022 and expects to sell 67 million chips to customers in Taiwan, South Korea, and Japan by 2025. However, SSI Research believes that the profit contribution from this segment is still insignificant because FPT Semiconductor is only responsible for chip design, which does not require a large investment capital.