VietCredit’s Spectacular Turnaround with the Digitization of Financial Products

VietCredit (UPCoM: TIN) has made a remarkable comeback, achieving the highest profit in its history in Q2 2025, after suffering a record loss in Q2 2024. According to the latest financial report, the company’s net interest income reached VND 641 billion, a 3.8-fold increase compared to the same period last year.

As of the end of Q2, the loan balance reached nearly VND 5,000 billion, generating approximately VND 800 billion in net interest income, demonstrating the company’s ability to adapt and stay ahead of the curve in Vietnam’s digital finance landscape.

This remarkable result reflects the effectiveness of VietCredit’s comprehensive business model restructuring, with a focus on developing digital lending products.

Diversifying Lending Solutions for Individuals, Household Businesses, and SMEs

For individual customers, VietCredit’s personal consumer loan brand, Tin Vay, has gained wide acceptance in the market, especially for its speedy disbursement. Tin Vay offers a range of loans from VND 5 million to VND 100 million, accessible on popular platforms such as MoMo, Zalo, Viettel Money, VNPT Money, TOPI, Grab Driver, and most recently, MISA and KiotViet. These loans cater to individuals with income from business and production activities.

Tin Vay ensures a quick turnaround time of 3-5 minutes from loan application to disbursement. It also offers flexible interest rate adjustments, increased credit limits, and the option to borrow again after full repayment. The team constantly optimizes eKYC technology, big data-driven credit scoring algorithms, and AI to enhance the customer experience.

For household businesses and SMEs, VietCredit introduces Tin Vay Biz, in collaboration with KiotViet and MISA platforms (including Misa MeInvoice, CukCuk, AMIS Accounting, AMIS Executive, SME 2023, and MISA ASP). Tin Vay Biz provides easy access to capital without collateral, with same-day disbursement.

By expanding its presence on the MISA and KiotViet platforms, VietCredit demonstrates its commitment to supporting a diverse range of customers, including SMEs, household businesses, and individuals.

VietCredit’s loan products for household businesses

Developing a Diverse Range of Financial Products within a Comprehensive Ecosystem

As one of the leading domestic credit card issuers, VietCredit continues to focus on stimulating card spending among its existing customers. The recently launched Loyalty Credit Card offers higher limits, lower interest rates, and more benefits than previous card products. VietCredit plans to introduce digital card products soon to leverage its technological strengths.

Another notable development is VietCredit’s strategic collaboration with VinFast in the secured loan segment. When purchasing VinFast electric vehicles, customers can receive financing of up to 100% of the value of the VF 3 and 80% of the VF 5, with a limit of VND 1 billion, using the car as collateral without needing to surrender the vehicle registration certificate. This partnership promotes sustainable consumption and makes electric cars more accessible to Vietnamese citizens.

VietCredit’s VF 3 and VF 5 Electric Car Purchase Loan Program in collaboration with VinFast

Additionally, as a financial company licensed and regulated by the State Bank of Vietnam, VietCredit is preparing to launch a profitable investment product for institutional and corporate customers through online term deposit contracts. This product offers attractive interest rates of up to 7.5% per annum and can be managed anytime, anywhere, providing a modern, convenient, and profitable investment option for businesses to optimize their idle capital.

With its strategy of product diversification, technology application, and strategic partnership expansion, VietCredit is building a comprehensive financial ecosystem. The company aims to become a trusted financial partner for Vietnamese individuals, small businesses, and SMEs seeking flexible and efficient capital solutions.

For more information, please visit https://www.vietcredit.vn/ and https://tinvay.com.vn/

The King of Consumer Finance: Reigning Supreme for Over a Decade

With an unwavering dedication to its mission of leading consumer credit, FE CREDIT has not only weathered numerous challenges but also maintained its dominant position in the market. This is evident through the numerous accolades and awards the company has received. FE CREDIT’s resilience, adaptability, and commitment to sustainable growth in Vietnam’s consumer finance industry are testament to its success and strategic prowess.

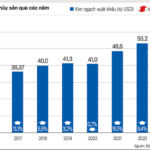

The Green Revolution: 2024 Sees a Stellar Rise in Agricultural Exports

2024 was a landmark year for Vietnam’s agricultural, forestry, and seafood exports, with a record turnover of 62.5 billion USD, an impressive 18.7% increase from 2023. This remarkable growth, the highest in two decades, was driven by strong performance across key agricultural products, including rice, coffee, fruits and vegetables, timber, cashew nuts, and seafood, all of which experienced significant increases.

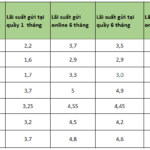

Online Savings Accounts: Earn Higher Interest with Agribank, BIDV, VPBank, TPBank, and More

Many banks offer higher interest rates for online savings accounts, ranging from 0.1% to 0.4% per annum, compared to the rates advertised at their physical branches.

Unleash the Festive Cheer and Elevate Your Business with Techcombank: Win a Share of the VND 5 Billion Prize Pool!

“As the year draws to a close, Techcombank is thrilled to announce its new program, ‘Festive Season, Business Boost’, designed to accelerate small and medium-sized enterprises’ success. With a total value of up to 5 billion VND, the program offers an array of enticing benefits. To boost businesses’ luck during this festive season, Techcombank will be awarding monthly grand prizes, including a European tour and three VinFast automobiles. The program, running until January 31, 2025, is sure to bring a boost to businesses as they close out the year.”

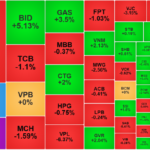

“Steady Credit Growth, VPBank’s 9-Month Profit Surges 67% Year-on-Year”

As of the third quarter of 2024, VPBank has recorded a remarkable performance with a consolidated pre-tax profit increase of over 67% year-on-year, thanks to the contributions of its comprehensive ecosystem. The bank has maintained stable credit growth, enhanced debt recovery activities, and continued to tightly control asset quality.