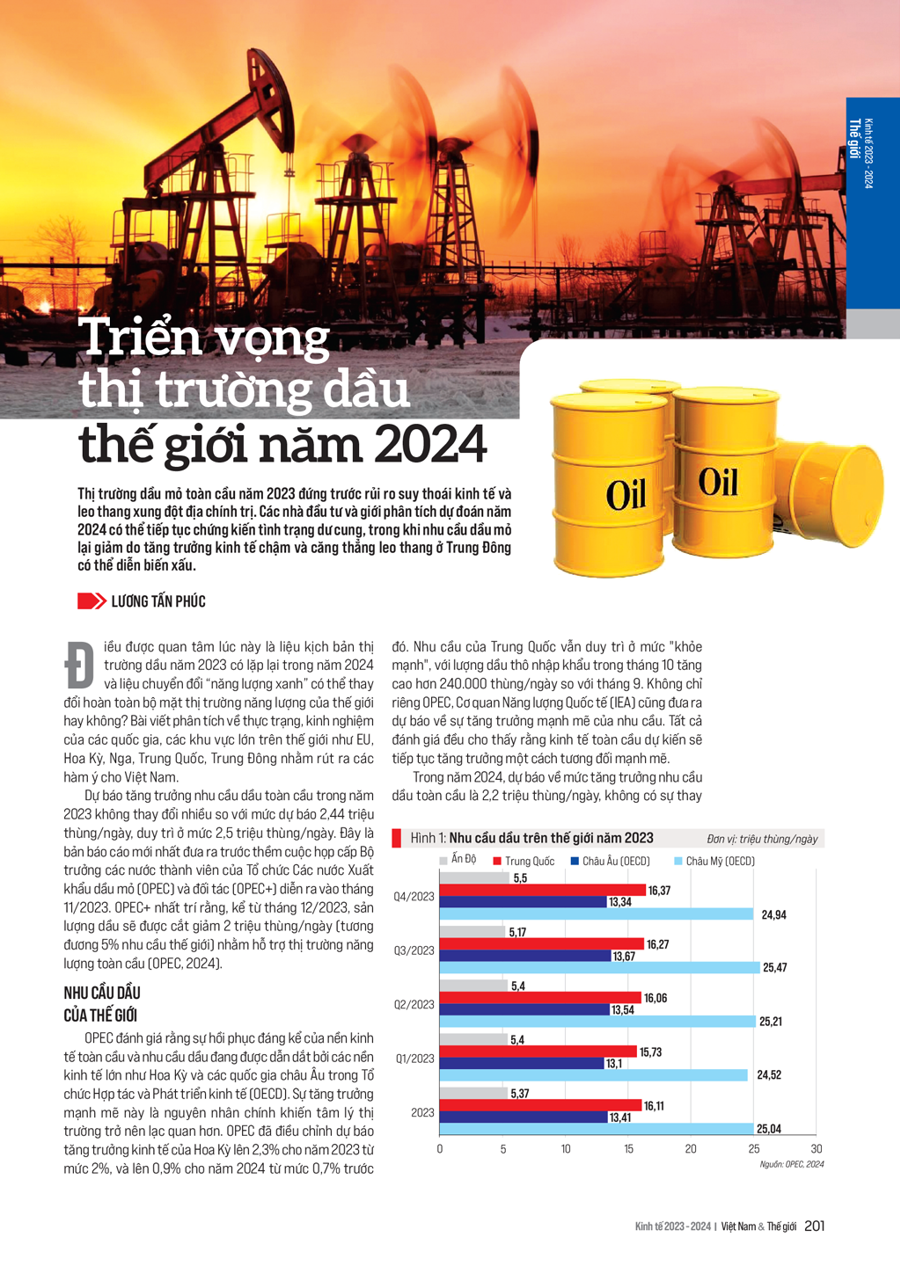

Gold prices and the Dollar index ended the session on Tuesday (13/2), with spot gold falling 1.3% to $1,993.29 an ounce, its lowest level since December 13, 2023; April gold futures also fell 1.3% to $2007.2 an ounce.

Data showed that US consumer prices in January 2024 rose more than expected amid rising housing and healthcare costs.

Following inflation data, the USD rose 0.7% to its highest level in three months against its rivals, making gold more expensive for those holding other currencies. US 10-year Treasury bond yields also rose.

Gold prices and the Dollar index

The Dollar index – a comparison of the USD against 6 major partner currencies – soared to 104.95, up 0.7% from the previous session. In particular, the USD surpassed 150 yen for the first time since November 2023.

Tai Wong, an independent metals analyst in New York, said: “This is not the report the market was expecting.” “After this report, the ‘dovish birds’ rushed to find safe havens because surprisingly stubborn inflation has reduced the chances that the Federal Reserve will cut interest rates in May to less than 50%.”

With such strong inflation data, traders bet that the Fed’s policy makers may wait until June to cut interest rates.

US consumer price index (CPI) in January 2024 increased 3.1% compared to a year ago, down from the 3.4% pace in December 2023 but higher than the expected 2.9% rate. Core inflation, which excludes energy and food prices, rose 3.9% (compared to a year ago) for the second consecutive month.

US inflation.

With the labor market still strong – a previous report showed that US employers created over 350,000 jobs in January – inflation remains high, leaving the US central bank with little reason to rush to cut interest rates.

After the inflation report on Tuesday, traders previously bet on rate cuts at the Fed’s meeting on April 30 – May 1, now pushing the predicted deadline back to June.

Last month, the Fed kept its policy interest rates steady at 5.25% to 5.5%, which has been in effect since July last year, and while Fed Chairman Jerome Powell acknowledged progress, he also said the decision at the March meeting may be the same.

Peter Cardillo, chief market economist at Spartan Capital Securities, said: “If this continues for another month or two at a high level, you can say goodbye to (the dream of rate cuts) in June and we may be heading to September.” “This is a hotter report than expected and is part of what the Fed has hinted at when it says it is too early to say that inflation has been defeated.”

Reference: Reuters