Vietnam’s stock market experienced a turbulent trading session on Friday, leaving investors feeling a bit ‘seasick’ as stock indices fluctuated between green and red. However, the VN-Index managed to close the session on August 8 with a slight gain of 3.14 points, setting a new peak at 1,584.95 points. The trading value on the HoSE exchange reached an impressive figure of over VND 49,100 billion.

In contrast, foreign transactions were a downside, continuing their net selling streak with a net sell value of VND 803 billion across the entire market. Here’s a breakdown:

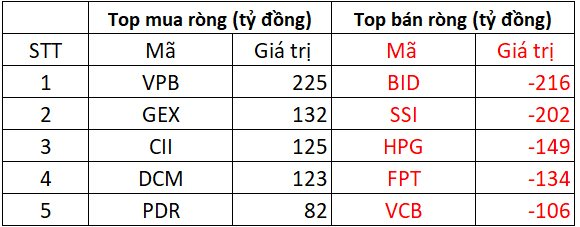

Foreigners net sold nearly VND 834 billion on HoSE

On the buying side, VPB shares were the most net bought by foreign investors on the HoSE, with a net buy value of approximately VND 225 billion. GEX, CII, and DCM shares also made it to the top net bought list, each with a net buy value of over VND 100 billion. PDR shares were net bought for VND 82 billion in today’s session.

On the selling side, BID and SSI shares witnessed the strongest net selling, with respective net sell values of VND 216 billion and VND 202 billion. Additionally, HPG, FPT, and VCB shares also faced significant net selling, with net sell values ranging from VND 106 billion to VND 149 billion.

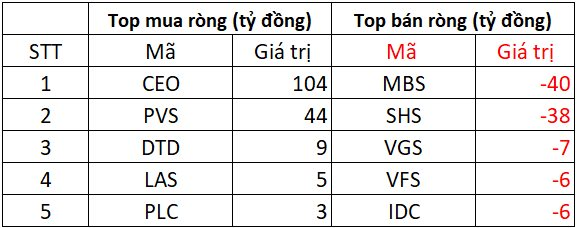

Foreigners net bought approximately VND 60 billion on HNX

On the HNX, CEO shares were the most net bought, with a net buy value of VND 104 billion, followed by PVS shares with a net buy value of VND 44 billion. DTD, LAS, and PLC shares also witnessed net buying in the range of VND 3-9 billion each.

Conversely, MBS and SHS shares faced the highest net selling on the HNX, with respective net sell values of VND 40 billion and VND 38 billion. VGS, VFS, and IDC shares also experienced net selling in the range of VND 6-7 billion each.

Foreigners net sold over VND 28 billion on UPCOM

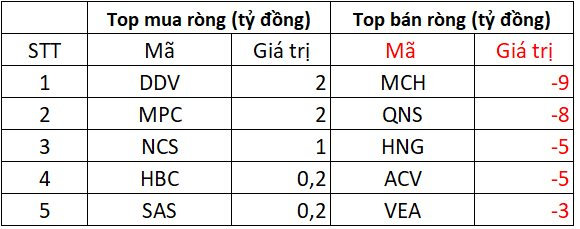

On the UPCOM exchange, DDV, MPC, and NCS shares witnessed net buying in the range of VND 1-2 billion each. HBC and SAS shares also experienced minor net buying in today’s session.

On the opposite end, MCH and QNS shares faced significant net selling, with respective net sell values of VND 8-9 billion. HNG, ACV, and VEA shares also witnessed net selling, with net sell values ranging from VND 3-5 billion each.

“Hoang Quan Real Estate Plans to Issue 50 Million Shares to Swap Debt”

“Hoang Quan Real Estate plans to issue 50 million shares at VND 10,000 per share to swap VND 500 billion of debt. The list of creditors includes Chairman Truong Anh Tuan and Hai Phat Invest. This strategic move aims to strengthen the company’s financial position and consolidate its presence in the competitive real estate market.”

The Great Foreign Sell-Off: A Week of Unprecedented Outflows and a Single Stock’s $500 Million Dump

“Foreign sell-off continues with a strong net sell-off, with the highlight of trading on the matching channel. “