Fed keeps policy unchanged, signaling not ready to cut interest rates

On February 1, 2024 (Vietnam time), the Federal Reserve (Fed) signaled an end to its rate hikes, but is still not ready to cut interest rates. As predicted by the market, the Federal Open Market Committee (FOMC), the body responsible for setting Fed’s policy decisions, unanimously decided to keep interest rates unchanged for the fourth consecutive time at a range of 5.25% – 5.5%.

Prior to the highly anticipated decision from the Fed, experts believed it would have little impact on Vietnam’s economy.

PGS.TS. Dinh Trong Thinh – Economic expert

|

PGS.TS. Dinh Trong Thinh – Economic expert believes that maintaining the current interest rates by the Fed will create favorable conditions for the world in general and Vietnam in particular.

If the Fed were to lower interest rates, the USD would depreciate and create instability, while keeping interest rates unchanged would create stability.

For Vietnam, stabilizing the USD is crucial as the exchange rate policy has been linked to the fluctuations of the USD for many years. When the USD is stable, it will facilitate macroeconomic stability.

Over the past week, the USD/VND exchange rate has increased due to expectations that the Fed would not lower interest rates. Additionally, this is the end of the year and some business investors have longer vacations; they want to hoard USD to secure their assets, leading to changes in USD supply and demand, pushing the USD price up. The USD-Index also increased as the Fed maintained interest rates.

After the Lunar New Year, the USD/VND exchange rate may fluctuate by 1-2%, and it may vary by around 2-3% throughout 2024.

Mr. Nguyen Duc Do – Deputy Head, Institute of Economics & Finance – Financial Academy also believes that the Fed has reached the peak in interest rates and the question now is when the rates will be lowered. The market predicts that the Fed may lower interest rates in March or May.

If the Fed is not expected to raise interest rates anymore, the USD will have difficulty appreciating and there will not be much pressure.

In addition, the State Bank of Vietnam (SBV) will use all measures to maintain the stability of the exchange rate domestically.

Mr. Nguyen Duc Do Mr. Nguyen Duc Do

|

“What I am betting on is that the SBV will stabilize the exchange rate, and USD exchange rate fluctuations will not be significant. I believe that the USD/VND exchange rate will be kept stable without surpassing the previous peak,” expected Mr. Nguyen Duc Do.

Last week, positive signals from the US labor market and economy, along with statements from FOMC members about continuing to act based on actual data, have caused market participants to gradually reduce their expectations of an early rate cut by the FOMC, causing domestic currencies in Asia, including Vietnam, to weaken against the USD.

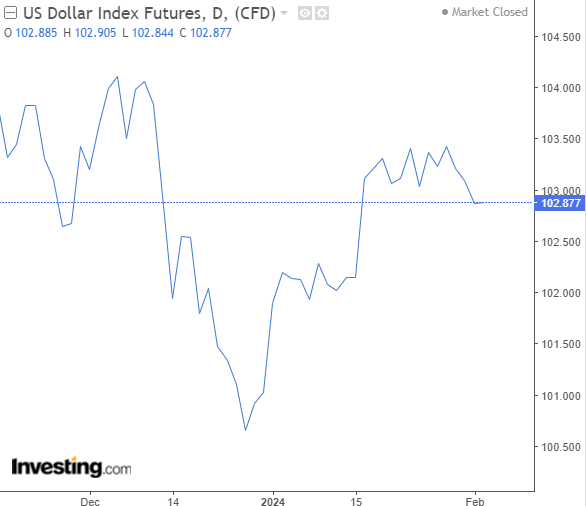

The USD-Idex decreased immediately after the Fed announced the unchanged interest rate and is currently holding at 102.87 points, a significant decrease compared to the recent peak of 103.43 points (January 29).

|

USD-Idex from the beginning of 2024 until now

Source: Investing.com

|

At banks, on February 2nd, Vietcombank listed the selling price of USD at 24,570 VND/USD, while the cash purchase price was 24,200 VND/USD and the transfer purchase price was 24,230 VND/USD. BIDV had a selling price of USD at 24,550 VND/USD, both the cash and transfer purchase prices were the same at 24,240 VND/USD.

Cat Lam