Pomina Joint Stock Company (stock code: POM) has just sent a written explanation to the Hanoi Stock Exchange regarding the reason for the late submission of its audited financial statements for 2023 and 2024, and the measures to rectify the restriction on trading its shares on the UPCoM.

Pandemic and International Conflicts

In 2021, the COVID-19 pandemic erupted during the construction of Pomina’s Blast Furnace Project, part of its steel billet production plant in Phu My 1 Industrial Park, Ba Ria-Vung Tau Province (now Ho Chi Minh City). This led to delays in installation, testing, and preparation for operation, incurring additional costs and significantly increasing the project’s investment compared to the initial estimate.

In 2022, before the economy could recover from the pandemic, the conflict between Russia and Ukraine emerged, affecting the global economy, along with China’s zero-COVID policy. These events had a detrimental effect on Pomina’s operations.

The entire Vietnamese economy suffered a crisis. Input material prices soared while billet and finished steel prices dropped, and the real estate market froze.

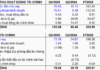

The government intervened by requesting banks to restructure loans and reduce interest rates for businesses. Additionally, tight capital controls, rising borrowing rates, inflation, and tight monetary policies forced Pomina to cut production and erode profits, resulting in negative working capital (short-term liabilities exceeding current assets).

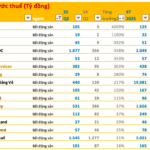

According to estimates, the total investment cost for the blast furnace project was VND 2,833 billion, but in reality, it increased to VND 5,880 billion due to the necessity of adding essential items to maximize advantages. This was also the result of the report by AFC Vietnam Audit Company Limited.

Collapse of Deals with Nansei and THACO

In July 2023, Pomina held its Annual General Meeting, where the issuance of private placement shares worth VND 701.7 billion from August 2023 to December 2024 was approved, along with a foreign ownership limit of less than 65%.

Subsequently, Pomina signed a consulting contract on October 11, 2023, with the Vietnam Industrial and Commercial Bank Securities Company – Ho Chi Minh City Branch, to advise on the issuance of over 70 million shares and offer private placement shares to strategic investors.

In parallel, Pomina negotiated with Nansei Co., Ltd. Senior executives from both sides discussed and agreed to sign a memorandum of cooperation in September 2023.

According to the memorandum, Pomina would transfer 51% of its shares to Nansei for a total value of USD 58.9 million.

However, the share transfer to foreign investors encountered a setback due to the State Securities Commission’s regulation that the maximum transfer ratio to foreign enterprises should not exceed 50%. This regulation could not meet the initial agreement with Pomina for a 51% share transfer, forcing Pomina to seek other cooperation opportunities with domestic investors and funds.

With regard to THACO Industries, although a professional investor, they lacked a deep understanding of the steel industry. Before signing the investment agreement, THACO wanted to grasp the operational procedures of the plant, especially the blast furnace. Moreover, THACO’s goal was not only to produce steel billets for the construction industry but also to manufacture special steel grades for the automotive industry. This required time, and the collaboration timeline had to be extended.

Consequently, the two parties were unable to proceed.

In June 2024, Pomina signed a memorandum of understanding with Vietnam Steel Corporation – VNSteel (stock code: TVN) to establish Pomina Phu My Joint Stock Company.

The plan is for Pomina Phu My to have a charter capital of VND 2,700-2,800 billion, accounting for 40% of the total capital. The remaining VND 4,000 billion (60%) will be raised through bank loans. In terms of ownership, Pomina is expected to hold 35% of the charter capital (equivalent to VND 900-1,000 billion), and VNSteel will hold 65% (equivalent to VND 1,800-1,900 billion).

Pomina will contribute the land use rights, workshops, and equipment of Pomina 1 and Pomina 3 plants, while VNSteel will contribute in cash. The two parties are currently negotiating the details and are expected to complete the establishment procedures in the first quarter of 2026.

Remediation Plan

Pomina is expediting the contract signing process and providing the auditing unit with clear evidence of rectifying the negative working capital situation. This will facilitate the assessment of the company’s ability to continue operating.

By the second quarter of 2026, Pomina will provide the auditing unit with complete documents to finalize the audited financial statements for 2023, 2024, and 2025 and organize the Annual General Meeting of Shareholders by the second quarter of 2026 at the latest.

In the stock market, on August 7, POM shares surged to the ceiling price of VND 2,600 per share, with no sellers.

National Securities Seeks to Accumulate an Additional 5 Million SAM Shares

National Securities has just registered to purchase an additional 5 million SAM shares, aiming to increase its ownership stake in SAM Holdings to 2.88%.