Gold Prices Surge: Experts Weigh In on the Rise and Potential Risks

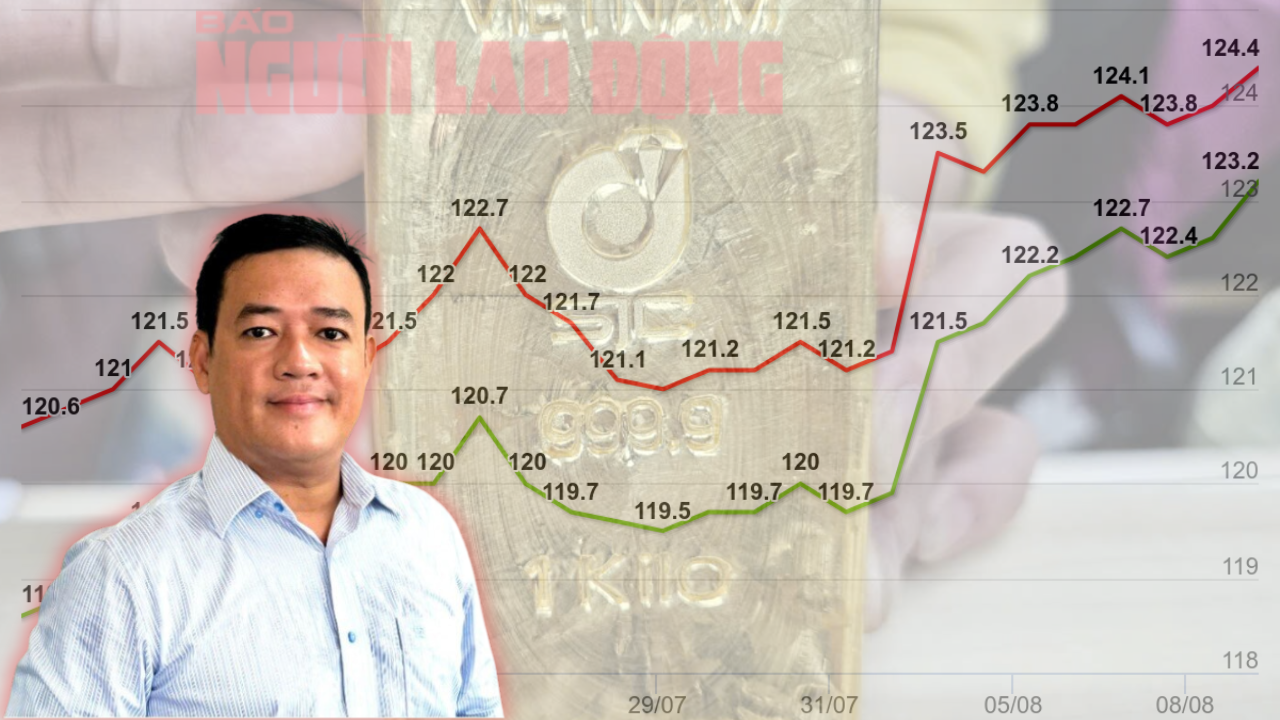

On August 9th, the price of SJC gold bars surged to new highs, with buying and selling rates listed by companies at 123.2 million VND/tael and 124.4 million VND/tael, respectively—a significant increase of 500,000 VND/tael from the previous day. In just one week, gold bar prices have rapidly climbed by 3 million VND/tael, surpassing the previous record of 124 million VND/tael set back in April 2025. Many investors are optimistic that gold prices will continue to rise as global prices have yet to peak and domestic gold supply remains scarce.

However, in an interview with Nguoi Lao Dong newspaper, gold expert Tran Duy Phuong offered a different perspective, cautioning that gold investments carry risks in the current market.

Gold expert Tran Duy Phuong comments on the recent gold bar price movements

SJC Gold Bars Outpace Global Gold Prices

Reporter: What factors have driven the continuous rise in domestic gold prices, breaking previous records and surpassing the 124 million VND/tael mark?

– Gold Expert Tran Duy Phuong: SJC gold bar prices have surpassed 124 million VND/tael, while global gold prices remain below the $3,400/ounce mark, far from the April peak of $3,500/ounce. This indicates that domestic gold prices are rising faster than global prices.

The surge in gold bar prices is primarily due to supply dynamics. Not only is the supply scarce, but there is also a strong preference for the SJC brand among consumers, further driving up prices. Additionally, SJC gold bars are currently priced approximately 4 million VND higher than plain gold rings of the same purity (99.99%).

The State Bank of Vietnam has not yet introduced any specific policies or new mechanisms to address this issue and boost gold supply.

If the regulatory authorities implement measures to increase gold supply in the market through concrete policies, we could see a cooling down of gold prices. Currently, SJC gold bar prices are a substantial 16 million VND/tael higher than global prices.

Why You Should Avoid Buying SJC Gold Bars at This Time

In reality, the gold market is not very large. If the market receives an additional supply of gold bars, could SJC gold bar prices plummet?

– The demand for SJC gold bars among the public and investors is quite high, despite the relatively small market size. Because of this small scale, when there is high demand for SJC gold bars and supply falls short, prices surge.

Conversely, there is a risk that if the State Bank of Vietnam introduces new gold policies to narrow the gap with global prices, SJC gold bar prices will drop sharply. Other types of gold, such as jewelry and plain gold rings, tend to move more in line with global price fluctuations.

At present, it is not advisable to purchase SJC gold bars. The government and the State Bank of Vietnam are taking decisive steps towards implementing policies aimed at reducing the disparity between domestic and global gold prices. Once these policies are finalized, SJC gold bar prices are expected to decline.

Moreover, global gold prices are approaching relatively high levels, suggesting a potential downward trend. Investors considering gold purchases may opt for gold rings to mitigate the risk associated with the global price differential.

The Price of Gold Treads Water as SPDR Gold Trust Dumps Holdings

“After several consecutive buying sessions, SPDR Gold Trust has just witnessed a significant bout of selling.”