|

Vietnamese Banking Association Proposes to Increase Consumer Lending Limits. (Photo: Vietnam+)

|

The Vietnam Banking Association has submitted a document to the State Bank of Vietnam regarding

proposals to address challenges and complexities in implementing regulations related to consumer credit.

This document highlights three key issues: total consumer credit outstanding for a single customer at a

financial company; the ratio of direct disbursements to customers; and the minimum consumer credit debt ratio in

total credit debt.

Regarding the “total consumer credit outstanding for a single customer at a financial company,” the Vietnam

Banking Association argues that the current regulations limiting consumer credit to VND 100 million are no longer

aligned with reality and hinder the competitiveness of financial companies compared to commercial banks. As a

result, financial companies are constrained to offering small and short-term loan products, limiting their ability to

innovate with larger or longer-term loan packages that meet the diverse needs of the market.

The Vietnam Banking Association proposes to the State Bank of Vietnam to consider increasing the consumer

lending limit to VND 300-400 million. This proposed limit aligns with the threshold for large-value transactions

that require anti-money laundering reporting, personal and household loans without collateral under the agricultural

and rural development credit policy, and small-value credit card lending.

Adjusting the consumer lending limit will expand the scale of consumer credit outstanding, meeting the needs of

both financial companies and borrowers. It will also contribute to economic growth, provide a basis for financial

companies to reduce interest rates and non-performing loans, and enable them to offer larger loans to qualified

borrowers, reducing operating costs per loan.

For the “ratio of direct disbursements to customers,” the Association recommends that the State Bank of Vietnam

consider increasing the limit for total consumer credit outstanding with direct disbursements from 30% to 40%,

raising it from VND 20 million to a higher amount. This adjustment will better meet the legitimate and legal funding

needs of individuals for their daily lives and consumption, curbing the growth of “black credit” activities.

Additionally, the Association suggests amending the legal regulations to clarify that disbursements through payment

accounts/e-wallets are considered non-cash payments, thereby exempting them from direct disbursement requirements.

On the “minimum consumer credit debt ratio in total credit debt,” Article 15, Clause 4 of the State Bank’s

Circular No. 35/2024/TT-NHNN stipulates: “Consumer credit finance companies must maintain a minimum of 70%

of total credit debt in consumer credit debt.” The Vietnam Banking Association believes that, at this stage, referring

to and inheriting the minimum consumer credit debt ratio of 70% stipulated in Decree No. 39/2014/ND-CP is no

longer appropriate.

Moreover, in terms of market factors, financial companies currently operate under the Law on Credit Institutions

and are directly managed and supervised by the State Bank. However, in an increasingly competitive environment,

these companies not only compete with commercial banks and traditional credit institutions but also face intense

competition from non-credit institutions, such as peer-to-peer lending platforms (P2P Lending). This competition

puts significant pressure on financial companies to maintain their market share.

On the other hand, the government’s issuance of Decree No. 94/2025/ND-CP, officially allowing the pilot of P2P

Lending platforms, is a positive step in regulation. However, it also underscores the urgent need for financial

companies, which operate within a strict legal framework, to have greater autonomy in their business operations and

a more flexible mechanism to compete fairly and equitably.

|

SeABank Impresses with a Significant Surge in Pre-tax Profit of VND 2,884 Billion. (Photo: Vietnam+)

|

Given these realities, the Vietnam Banking Association proposes that the State Bank of Vietnam facilitate

enhanced autonomy for financial companies while ensuring system safety through close monitoring of indicators such

as the capital adequacy ratio (CAR), the ratio of short-term capital used for medium and long-term loans, credit limits,

liquidity ratio, and bad debt ratio.

Accordingly, it is suggested to adjust the minimum consumer credit debt ratio from 70% to 50% and/or consider

supervising and managing consumer credit companies through a set of safety indicators, including the capital adequacy

ratio, liquidity ratio, bad debt ratio, and other credit limits.

The Vietnam Banking Association believes that transitioning to a risk-based and performance-oriented supervisory

framework will enable financial companies to adapt proactively to the new competitive landscape, ensuring compliance

with legal requirements while enhancing their competitiveness and positively contributing to the development of the

consumer finance market in Vietnam.

Thúy Hà

– 17:12 11/08/2025

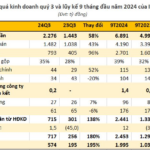

The Industrial Real Estate Titan: A Stellar Third Quarter with a Near 200% Surge in Profits, Achieving Yearly Targets in Just Nine Months

For the first nine months of the year, Idico recorded a remarkable performance with net revenue reaching VND 6,891 billion and pre-tax profit of VND 2,453 billion, reflecting a significant increase of 38% and 89%, respectively, compared to the same period in 2023.