A Clear Divide

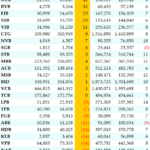

As of June 30, 2025, the CASA ratio of the banking system continued to show a clear divide. According to Wichart’s calculations from the financial reports of 27 banks, the average CASA ratio reached 21.7%, an increase of 1.8 percentage points compared to the beginning of the year. However, the overall picture was uneven, with 15 out of 27 banks recording a decrease in their CASA ratio, reflecting the varying strategies and capabilities in attracting low-cost funds.

Non-term deposits (CASA) will play a crucial role in controlling the funding costs of banks in the medium and long term.

Statistics show that MB maintained its lead in CASA with 37.74% as of Q2 2025, despite a 1.36 percentage point drop from the beginning of the year. The high CASA ratio helps MB alleviate pressure from fixed-term funding costs, but the decline indicates intensifying competition. Techcombank ranked second with 36.39%, a decrease of 1.01 percentage points, followed by Vietcombank at 35.51%, a slight drop of 0.29 percentage points compared to the end of 2024. MSB, VietinBank, TPBank, Sacombank, BIDV, and VIB trailed closely behind.

On the other hand, some other banks also experienced significant declines in their CASA ratios, such as LPBank (-2.9 percentage points), HDBank (-2.2 percentage points), PGBank (-2.1 percentage points), and MSB (-2 percentage points). In this group, 11 banks recorded CASA ratios below 10%, highlighting a clear divide in CASA performance.

Analysts believe that the CASA divide will deepen further. Leading banks typically have a vast customer base, a comprehensive ecosystem of services, and efficient cash flow management capabilities. Investing in technology, optimizing transaction experiences, and integrating financial, insurance, and investment services into a single platform are seen as key to retaining customers’ primary transaction accounts. Conversely, banks that lag in digitalization or lack proactive customer engagement strategies risk falling behind in the race for low-cost market share.

Differentiated Products – Leveraging CASA Growth

One of the banks that successfully attracted CASA in the first half of 2025 was VPBank. The bank recorded an additional 10 trillion VND in CASA, mainly attributed to its “Super Sinh Lời” product. The bank expects this figure to double in the second half, reaching approximately 20 trillion VND. Mr. Phung Duy Khuong, Vice Chairman and Director of VPBank’s Southern Region and Retail Banking Division, shared that despite similar product offerings in the market, VPBank has made significant progress in the first half of 2025.

At Techcombank, the “Auto-earning” product attracted 800,000 customers in the last quarter alone, resulting in a over 200% increase in CASA balance linked to this product.

Mr. Jens Lottner, CEO of Techcombank, believes that the emergence of similar products from competitors does not diminish their advantage but rather helps the market understand the true value of Auto-earning. The key difference is that customers only need to perform one action on the application, and their entire balance automatically earns optimized interest while still being available for regular transactions.

According to MB Securities (MBS), June 2025 witnessed a slowdown in the decline of funding rates, with only LPBank, Bac A Bank, and VPBank reducing rates by 0.1–0.2% p.a. for certain tenors. The interest rate environment still has room for reduction in Q3, as the SBV requires cost-cutting to lower lending rates. In this context, CASA continues to act as a “shield” for banks to maintain stable net interest margins (NIMs) and reduce dependence on high-cost term deposits.

Experts predict a slight recovery in CASA in the second half of 2025 due to seasonal factors, as cash flows back into the banking system. However, it is unlikely to reach the peaks of 2023–2024. SBV data shows that as of May 2025, household deposits increased by 7.61% compared to the beginning of the year, exceeding VND 7,600 trillion, while corporate deposits reached over VND 7,700 trillion, a 0.97% increase.

Dr. Chau Dinh Linh from Ho Chi Minh City University of Banking suggested segmenting customers into distinct categories and deeply understanding the unique needs of target customer groups. Based on this understanding, banks can offer tailored products, including accounts, savings, credit cards, mortgages, and unsecured loans. When using one service, customers can connect with others and access added values such as financial and insurance applications. Additionally, alongside waiving all fees on electronic banking applications, banks should actively provide incentives and promotions, such as cashback on spending, to motivate customers to maintain higher balances in their transaction accounts.

CASA is not just an indicator of low-cost funding efficiency but also a long-term competitive metric. With corporate lending remaining the primary driver and the pressure to reduce lending rates to support economic growth, banks that sustain high CASA ratios will optimize their cost structures, reinforce profit margins, and establish a solid foundation for sustainable growth.

The Elusive Nature of CASA: Unraveling the Mystery Behind its Third-Quarter Decline Amid Steady Bank Deposits

In Q3, most banks witnessed a decline in their CASA ratios. CASA accounts seem to be mere “pit stops” for funds before they are directed towards more “serious” business ventures.

The CASA Race Heats Up!

As per the financial reports of banks for the first half of 2024, there has been a shuffle in the pack when it comes to demand deposit accounts (CASA) ratios. Notably, MB has surged ahead to claim the top spot with an impressive CASA ratio of 38.83%, attributing its success to its vast customer base and robust digital transactions. Despite maintaining a substantial CASA balance of over VND 180 trillion with a ratio of 37.4%, Techcombank finds itself in the second position.

“Bizfly’s Email Automation: High-Volume, High-Speed Email Solution”

Whether you’re a small business, a startup, or a large-scale enterprise, transactional emails play a pivotal role in shaping customer experiences and boosting brand recognition.