Bkav Corporation, a leading antivirus software company in Vietnam, has announced the resolution of a bondholders’ meeting. Bkav Pro is seeking partners to transfer ownership of its assets currently held as collateral. These assets include 6.1 million shares of Bkav Pro owned by its parent company, Bkav Corporation, and 4.9 million shares owned by its Chairman, Nguyen Tu Quang.

Prior to this, in late July, Bkav Pro received approval from bondholders to revalue the collateral of bond code BKPCB2124001 to determine a plan for handling the secured assets.

Bkav Pro has been given a 30-day deadline to find a buyer for the assets. The condition set is that the proceeds must be sufficient to repay all remaining debt obligations to the bondholders. If the sale is not successful within the given timeframe, another bondholders’ meeting will be organized to agree on the next course of action.

Image caption: Bkav Pro seeks partners for asset transfer

The bond code BKPCB2124001, issued by Bkav Pro in May 2021, raised VND 170 billion. The first year applied a fixed interest rate of 10.5% p.a.; subsequent years were calculated based on the 12-month average rate of four banks (Vietcombank, VietinBank, Agribank, and BIDV) plus an additional 4.5% and not less than 10.5% p.a.

The initial collateral comprised over 5.44 million Bkav Pro shares owned by Bkav Corporation (valued at VND 178,125 per share, equivalent to nearly VND 970 billion) and 4.99 million shares owned by Mr. Nguyen Tu Quang.

According to Bkav Pro, the proceeds from the bond issuance were intended for the development of AI View cameras, investment in digital transformation, and partially for Bphone smartphones to make the product more affordable and expand the customer base.

In mid-2024, bondholders agreed to extend the maturity by one year, moving the due date to May 26, 2025, with a new interest rate of 11% per annum. At this time, the collateral included over 6.1 million shares of Bkav Pro owned by its parent company, Bkav, and the capital contribution of Mr. Nguyen Tu Quang in Vietnam Digital Transformation Platform Company Limited (DXP).

Bondholders have the right to request Bkav Pro, Bkav, and DXP to provide reports on revenue, expenses, and plans for accumulating cash flow, ensuring a minimum of VND 1.5 billion per month into Bkav Pro’s securities account at VNDirect.

In early 2025, VNDirect, as the representative of the bondholders, reported that Bkav Pro had violated the agreement by failing to accumulate the required VND 1.5 billion in January. On February 14, VNDirect sent a letter requesting the company to pay the shortfall within 15 days.

In terms of business performance, in 2024, Bkav Pro reported an after-tax profit of VND 40.8 billion, an increase of 2.4 times compared to 2023.

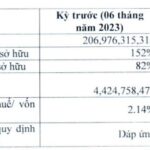

As of the end of 2024, owner’s equity stood at VND 261.4 billion, up 18.5% from the beginning of the year. Total liabilities were VND 349 billion, an increase of 10.3%, mainly comprised of bond debt.

The Profit Plunge Persists: BKAV Pro’s Dismal Performance Continues with a Meager 2.7 Billion VND Six-Month Profit

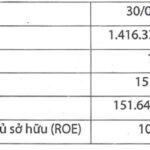

As per the financial report submitted to the Hanoi Stock Exchange (HNX), BKAV Corporation, a leading Vietnamese cybersecurity firm, reported a modest profit of VND 2.7 billion for the first half of 2024. The company, helmed by entrepreneur Nguyen Tu Quang, is known for its flagship product, BKAV Pro, a robust antivirus software solution.

The City Court’s Important Announcement Regarding the Bond Purchase in the Truong My Lan Case

The Ho Chi Minh City People’s Court encourages all concerned investors to submit their compensation claims before the deadline of August 30, 2024. After this date, any outstanding claims will be addressed through separate civil cases, if necessary.