The Billion-Dollar Club on Vietnam’s Stock Exchange

In the current landscape of Vietnam’s stock market, the growing presence of billion-dollar enterprises is becoming emblematic of a maturing and deeply integrated economy. These companies are not only impressive in terms of market capitalization but are also leading the way in revenue, profits, and influence within their respective industries. Together, they form an exclusive “club” of prominent names.

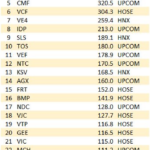

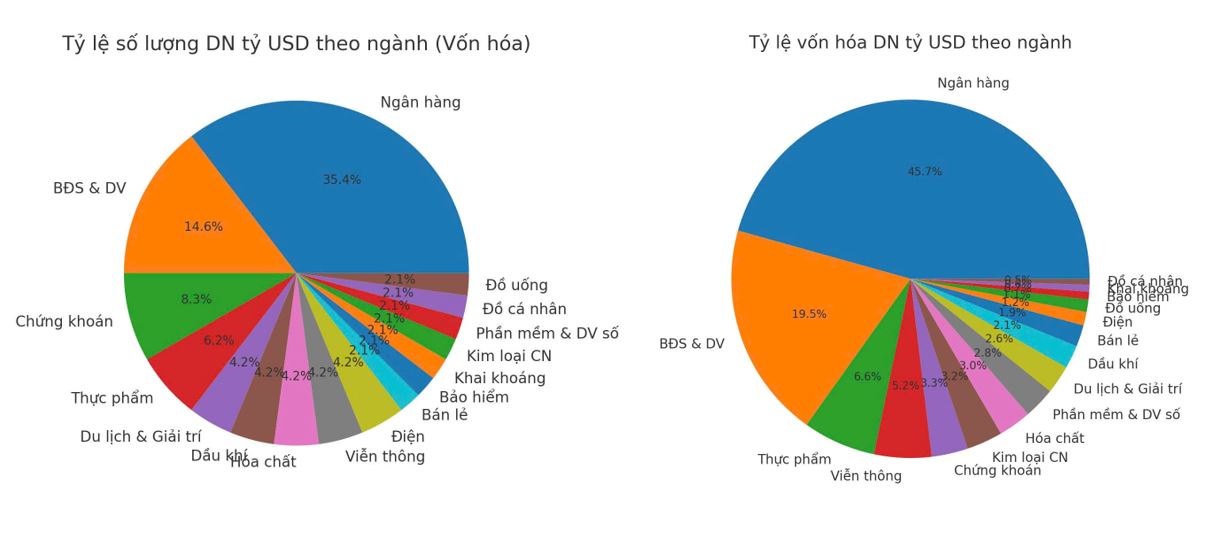

As of August 8, 2025, the country recorded 62 enterprises with a market capitalization of over one billion dollars, 37 enterprises with revenues exceeding one billion dollars, and four enterprises with after-tax profits of over one billion dollars. Looking at capitalization, the banking sector dominates with 18 members, a cumulative capitalization of 103.24 billion dollars, equivalent to over a third of the club’s total size. Some notable representatives in this sector include VCB, BID, and TCB. Following closely is the real estate and services investment group with nine enterprises and a total capitalization of nearly 54 billion dollars. Vingroup, including VIC, VHM, and VRE, are some of the prominent names in this group. Other sectors such as technology, consumer retail, securities, industry, transportation, and more are also represented, albeit on a smaller scale.

The common thread among these enterprises is their large market share, sustainable competitive advantage, effective utilization of domestic consumption trends, and sustained growth over consecutive years. They achieve their billion-dollar status not just through scale but also through their ability to create value and continuously innovate their business strategies.

When analyzed by sector, Banking and Real Estate are the two leading groups in terms of the number of billion-dollar enterprises on Vietnam’s stock exchange. The advantage of these sectors lies in their large asset size, pivotal role in the economy, and strong capital attraction capabilities. Meanwhile, the consumer-retail group, although smaller in number, boasts prominent names such as Vinamilk (VNM), Masan (MSN), and MWG.

Source: FireAnt, HSC Compilation

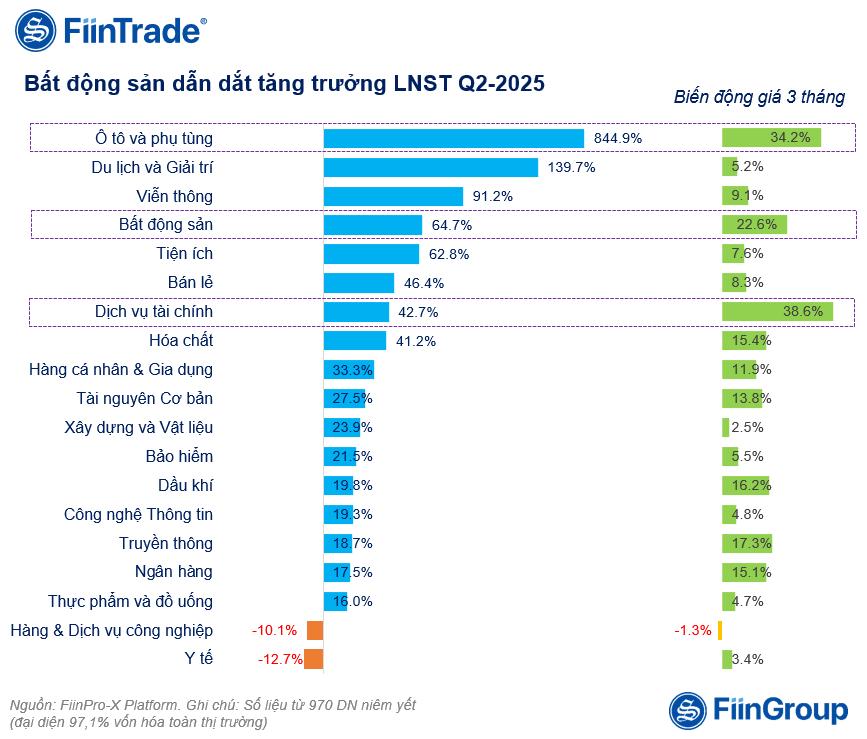

In 2025, Vietnam’s economy aims for robust growth. As of Q2 2025, GDP growth reached 7.6%, and forecasts for the entire year are above 8%. The momentum comes from significant trends such as increased public investment, recovering domestic consumption, loose monetary policies, comprehensive digital transformation, and robust administrative reforms. In this context, the benefiting sectors have also recorded very positive business results for Q2 2025, with after-tax profit growth in Telecommunications (+91.2% yoy), Real Estate (+64.7% yoy), Energy and Utilities (+62.8% yoy), all above 60%, and Retail (+46.4% yoy), Financial Services (Securities) (+42.7%), and Chemicals (41.2%) growing by over 40%.

Source: FiinPro-X Platform, data from 970 listed companies, representing 97.1% of the total market capitalization

HSC maintains a positive outlook on the prospects of Vietnam’s stock market and forecasts consolidated net profit growth of approximately 15.0%. Banking (+12.9%), Retail (+11.9%), Technology (+14.9%), Industry (+23.7%), Energy & Utilities (+28.5%), and Building Materials (+37.4%) are among the top-performing sectors. This foundation positions enterprises in these sectors to move closer to the billion-dollar milestone in terms of capitalization and revenue.

Digiworld’s (DGW) Billion-Dollar Dream

Founded in 1997, Digiworld initially focused on technology product distribution. Over nearly three decades of development, the company has diversified into home appliances, healthcare, FMCG, and industrial equipment. DGW has become a pioneer in Vietnam in the MES (Market Expansion Services) model, integrating market research, logistics, and after-sales services to enhance partner value and effectively expand market share.

By 2024, the company had established a distribution system with 18,200 sales points nationwide, offering a diverse range of products from technology and consumer goods to pharmaceuticals and nutraceuticals. Revenue in 2024 surpassed the 22,000 billion VND threshold, approaching the billion-dollar mark in scale. DGW’s capitalization currently hovers around 10,000 billion VND, with ample room for growth, especially as demand for technology and healthcare consumption continues to expand.

DGW boldly aspires to become a “multi-billion-dollar enterprise” in the future, not just in capitalization but also in revenue and profit size. In the ten years since its listing, Digiworld has increased shareholder value eightfold, with revenue growing sixfold, profits increasing fivefold, and capitalization expanding sevenfold. Notably, DGW has never incurred a quarterly loss, and its average ROE stands at an impressive 21%, despite the company’s ups and downs. Moreover, DGW is proud to be a business that has not needed to raise additional capital since its listing while consistently paying cash dividends, totaling nearly 700 billion VND to shareholders.

To realize the “multi-billion-dollar” vision, DGW has announced a long-term strategy for the next five years, up to 2030, aiming to expand its distribution ecosystem by adding at least two new industries, increasing the scale of its 45 existing brands, and executing two M&A deals. With a target of maintaining annual revenue growth between 15% and 25% and keeping ROE at a minimum of 15%, DGW is well on its way to achieving its goal of becoming a “Billion-Dollar Revenue Enterprise” in the near future.

To share more about its journey towards the billion-dollar milestone, Digiworld has collaborated with HSC to organize the C2C Workshop: DIGIWORLD – CREATING THE MARKET, which will take place at 3:30 PM on Wednesday, August 13, 2025. Special guests at the event will include Mr. Doan Hong Viet, Chairman of Digiworld’s Board of Directors, and HSC’s Analyst.

Investors can register for the workshop at: https://event.hsc.com.vn/c2c_DGW2025/

Open an investment account with HSC in just 3 minutes: https://register.hsc.com.vn

“Bank Stocks Soar to New Heights in July”

In July, bank stocks took center stage, playing a pivotal role in propelling the VN-Index to new historical highs.