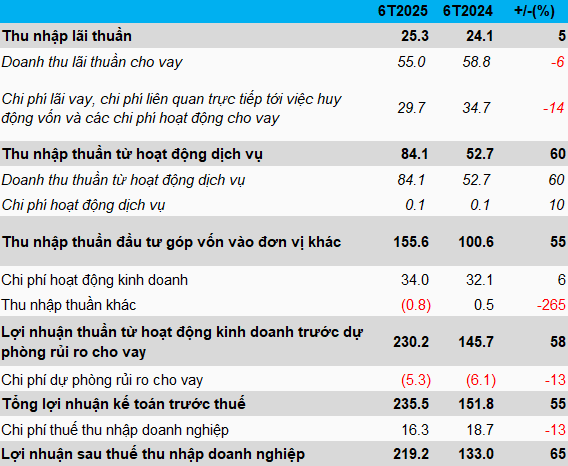

Regarding net interest income, HFIC earned over VND 25 billion in the first six months, a 5% increase compared to the same period last year. Despite a 6% decline in lending net interest revenue, a 14% reduction in interest expenses and costs directly related to fundraising positively impacted this segment’s results.

Service segment net income exceeded VND 84 billion, marking a 60% growth. Service segment revenues primarily originated from deposit interests, recording nearly VND 83 billion in the first half, a 63% surge.

The investment segment, HFIC’s primary revenue stream, witnessed a significant 55% jump in net income, reaching almost VND 156 billion. The income structure underwent a substantial shift, with the entire amount derived from dividends and shared profits during this period—double the figure from the previous year. Meanwhile, there was no recognition of income from transferring purchased shares of Ho Chi Minh City Securities Corporation (HSC, HOSE: HCM).

Given these positive results, HFIC posted a net profit of over VND 219 billion after deducting all expenses, reflecting a 65% increase compared to the first half of 2024.

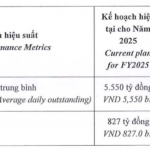

For 2025, HFIC aims for a net profit of more than VND 363 billion. Thus, the company has accomplished 60% of its annual target in the first half of 2025.

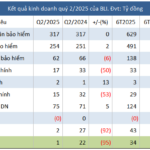

|

HFIC’s Business Results for the First Half of 2025

(Unit: Billion VND)

Source: Author’s Compilation

|

As of Q2 2025, HFIC’s total assets exceeded VND 11,973 billion, a slight increase from the beginning of the year. Investments accounted for 86% of the structure, equivalent to over VND 10,248 billion, a 5% decrease compared to the start of the year.

HFIC invested over VND 6,399 billion, including more than VND 2,619 billion in its subsidiary, over VND 1,917 billion in joint ventures and associated companies, and nearly VND 1,863 billion in other entities. However, the company has set aside nearly VND 449 billion in investment loss provisions.

The portfolio includes two investments valued at thousands of billions of VND: nearly VND 1,297 billion in Ho Chi Minh City Lottery One-Member Limited Liability Company; almost VND 1,178 billion in Ho Chi Minh City Housing Management and Business One-Member Limited Liability Company; and close to VND 1,011 billion in Ho Chi Minh City Securities Corporation (HSC), with a fair value of over VND 2,345 billion, twice its book value but a 27% drop from the beginning of the year.

The company also lent over VND 1,526 billion, a 5% decrease; had time deposits of nearly VND 2,667 billion, a 16% decline; and engaged in securities trading worth nearly VND 147 billion.

These loans comprise the recoverable value of direct loans and syndicated loans. Notably, HFIC has set aside nearly VND 42 billion in loan loss provisions.

The company holds time deposits with terms of 6–12 months in commercial banks, including nearly VND 2,641 billion at 4.4–6% per annum and $1 million (approximately VND 26 billion) at 0% interest.

Regarding the nearly VND 147 billion in trading securities, these are entirely HCM shares of HSC that the company has yet to offload, totaling over 12 million shares (including nearly 10.5 million shares remaining from the 2019 capital increase issuance and about 1.6 million shares received as dividends in Q2 2019). According to the company, it will continue to divest in the coming period.

This figure represents only the book value of this trading portfolio, while its fair value is nearly VND 258 billion, 1.8 times its book value. From another perspective, compared to the beginning of the year, the fair value of this portfolio has decreased by 27%.

|

In 2019, HSC issued additional shares to increase its charter capital at a preferential price for existing shareholders, with a total issuance of 25 million shares to HFIC, fully absorbed by the company. However, these shares were later included in the transfer plan approved by HFIC’s Board of Directors. In 2020, HFIC transferred over 14.5 million shares through order matching, with the remaining nearly 10.5 million shares classified as trading securities to be divested in the future. |

Another item with a value of thousands of billions of VND is cash and cash equivalents of nearly VND 1,374 billion, 2.1 times higher than at the beginning of the year. This comprises mainly VND-denominated time deposits with a term of three months in commercial banks, bearing interest rates of 4.2–4.6% per annum.

Additionally, the company has over VND 243 billion in receivables after provisioning, a nearly 3% decrease from the beginning of the year. This primarily comprises other receivables of nearly VND 154 billion and customer receivables of about VND 78 billion.

HFIC maintains a low debt level, with borrowings of only nearly VND 1,164 billion, a 7% decrease, accounting for less than 10% of total capital sources as of the end of Q2. The company continues to rely predominantly on owner’s equity.

– 15:09 13/08/2025

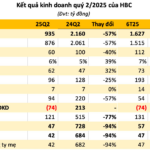

“Profits Plummet: Baolong Insurance’s Net Income Down 95% in Q2”

In Q2 of 2025, Baolong Joint Stock Insurance Company (UPCoM: BLI) reported a net profit of just VND 1 billion, a staggering 95% decrease compared to the same period last year. This significant decline can be attributed to the underperformance of both its insurance and financial operations.