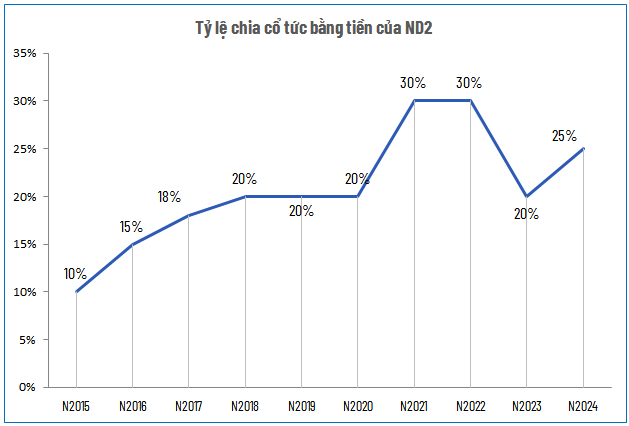

With nearly 50 million shares in circulation, ND2 expects to spend around VND 125 billion on this dividend payout.

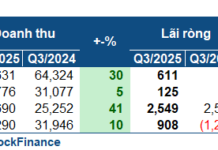

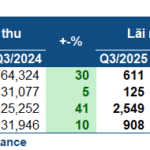

Source: VietstockFinance

|

According to statistics, over the past decade, the lowest dividend payout by ND2 was 10% (in the first year of implementation), while the highest was 30% maintained for two consecutive years in 2021 and 2022. The 25% payout ratio in 2024 was the second-highest. This change in the payout ratio is in line with the annual fluctuations in profits.

| ND2’s Financial Performance Over the Years |

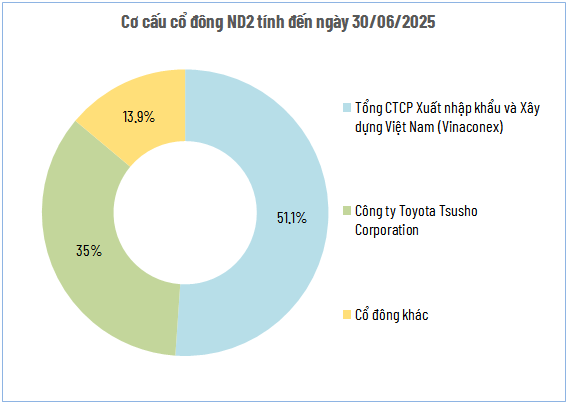

Currently, Vinaconex, listed on the HOSE under the ticker VCG, holds more than 51% of ND2‘s capital and is expected to receive nearly VND 64 billion in dividends. Toyota Tsusho Corporation, with a 35% stake, is estimated to receive approximately VND 44 billion.

Source: VietstockFinance

|

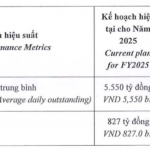

For the year 2025, ND2 targets electricity sales volume of 402.5 million kWh and revenue of nearly VND 369 billion, equivalent to the previous year, while net profit is expected to be over VND 155 billion (a slight decrease of 4%). The company plans to maintain a dividend payout ratio of 25%, as in 2024.

Source: VietstockFinance

|

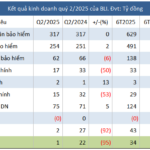

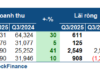

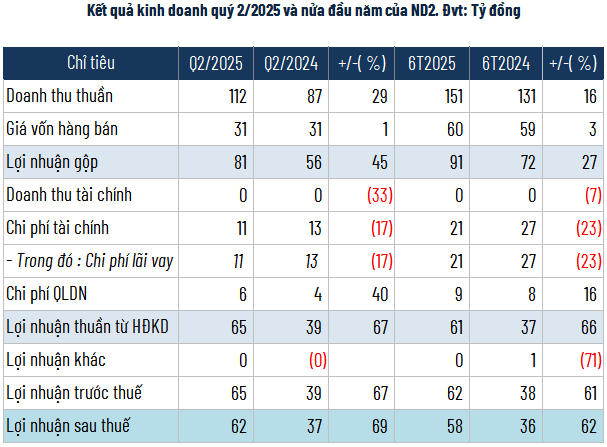

The financial results for the second quarter of 2025 showed that net revenue reached VND 112 billion, and net profit was VND 62 billion, increasing by 29% and 69%, respectively, compared to the same period last year. ND2 attributed the increase in revenue and profit to higher electricity output due to higher rainfall this quarter, which resulted in an additional 29 million kWh of electricity generation compared to the second quarter of 2024.

In the first six months of the year, net revenue reached VND 151 billion (up 16%), cost of goods sold increased by only 3%, and interest expenses decreased by 23%, resulting in a 62% increase in net profit to VND 58 billion, achieving 38% of the yearly plan.

– 08:18 15/08/2025

What’s Going On: A Surprising Move by a Securities Company to Trim Margin Debt and Annual Revenue Plans Amid VN-Index Peak

“The decision was made in the wake of less-than-favorable financial results for the first half of the year.”

The Attention-Grabbing Move of the Company Associated with Duc Hoang Anh

“The thriving Hung Thinh Loi Gia Lai Company, with a majority stake held by Hoang Anh Gia Lai Joint Stock Company, has just launched an enticing investment opportunity. The company has issued 10,000 bonds, coded HTL12501, offering a fixed interest rate of 10.5% per annum. These bonds have a maturity date of August 8, 2028, presenting a stable and attractive investment prospect for discerning investors.”