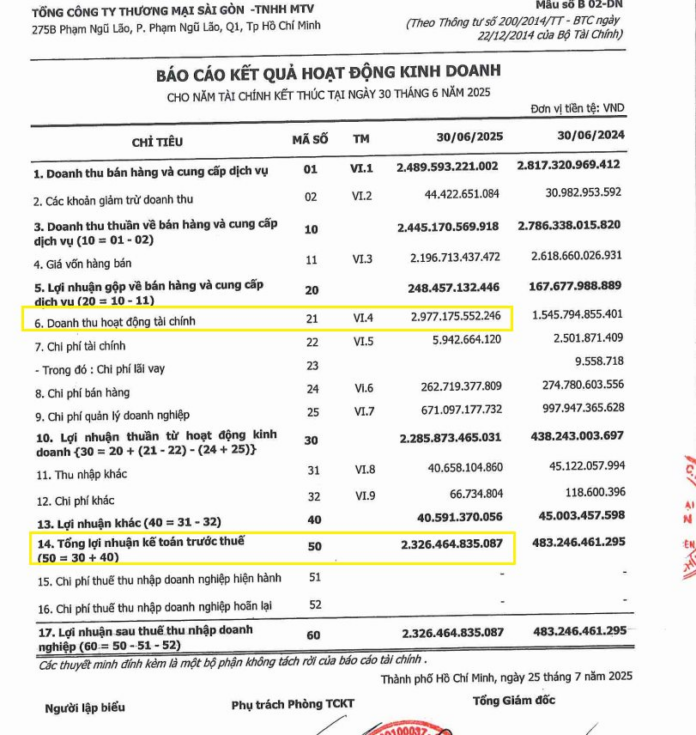

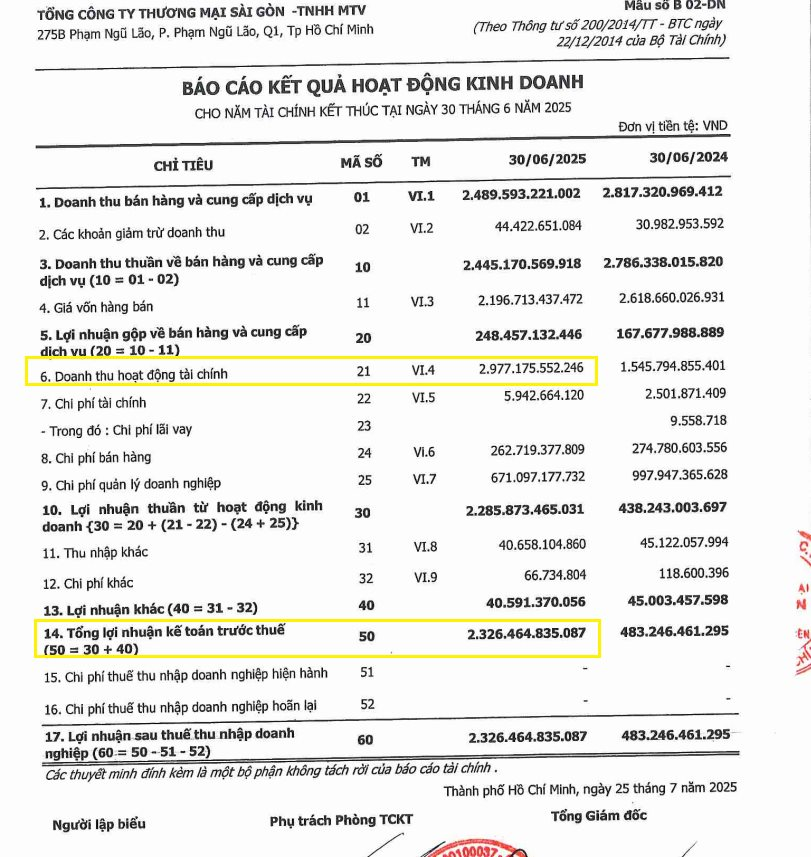

Saigon Trading Group (Satra) has released its financial report for the first half of 2025, boasting impressive results. The company achieved a remarkable five-fold increase in profit from business operations, amounting to 2,286 billion VND compared to 438 billion VND in the same period last year.

This substantial profit includes a contribution of 248.5 billion VND from gross profit on sales and services, but the majority of the profit stems from financial activity income, totaling 2,977 billion VND.

As a result, Satra’s tax profit for the first six months of 2025 reached 2,326 billion VND, a staggering 4.8 times higher than the previous year’s figure.

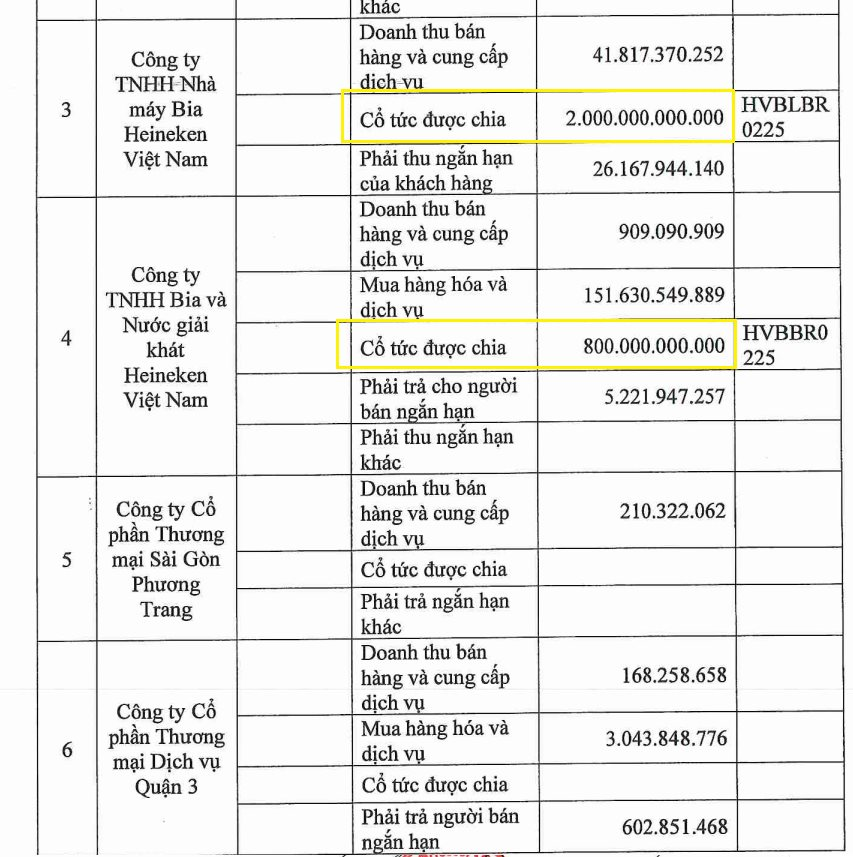

The lion’s share of Satra’s financial income derives from dividends, with Heineken, the renowned Dutch brewery, being the largest contributor during this period.

According to Satra’s report, Heineken paid out dividends totaling 2,800 billion VND, comprising 2,000 billion VND from Heineken Vietnam Brewery Limited Company and 800 billion VND from Heineken Vietnam Brewery Limited Company.

Heineken Vietnam Brewery is a joint venture between Satra, holding 40%, and Heineken Asia Pacific, with a 60% stake.

For 2025, Satra has set ambitious targets, aiming for 10,692 billion VND in revenue, 2,700 billion VND in pre-tax profit, 2,650 billion VND in after-tax profit, and 2,570 billion VND in taxes and contributions to the state budget. With the impressive first-half results, the company has already achieved 86.2% of its pre-tax profit goal.

In 2022, Heineken’s global CEO announced that the company’s investment in Vietnam had reached 1 billion USD, and they planned to invest an additional 500 million USD in the next ten years.

One of Heineken’s notable recent investments in Vietnam is the expansion of its Vung Tau plant to a capacity of 1.6 billion liters per year, an increase of 500 million liters. Heineken received the investment license for this expansion in June 2023, with a total investment value of 12,585 billion VND (approximately 540 million USD) across all project phases.

Initially operating at 110 million liters per year since the end of 2018, the Vung Tau plant’s capacity was increased to 610 million liters per year in 2019. Another expansion in 2022 further boosted its capacity to 1.1 billion liters per year, making it the largest brewery in Southeast Asia.

“Profits Soar for Phat Dat in H1: Q1 Tower Project Transfer Details Emerge”

“Thanks to its financial revenue, Phat Dat Real Estate Development Corporation (HOSE: PDR) witnessed growth in net profit for both the second quarter and the first half of 2025.”

‘Harvesting’ Dividends from Subsidiaries, Minh Phu – the ‘Shrimp King’ Reports a Windfall Third-Quarter Profit

Minh Phu reports a remarkable post-tax profit of over 198 billion VND for Q3 2024, a significant improvement from the 13.3 billion VND loss incurred in the same quarter last year. This impressive growth is largely attributed to the dividends received from its subsidiary companies, showcasing the strength and diversity of their business portfolio.