Rang Dong Holding JSC (RDP on UPCoM) has recently announced that it received Decision No. 06/2025/QD-MTTPS dated June 25, 2025, from the Ho Chi Minh City People’s Court regarding the initiation of bankruptcy proceedings.

The decision was made after the Court reviewed the petition filed by Rang Dong Films JSC to initiate bankruptcy proceedings against Rang Dong Holding, along with relevant documents. The Court found sufficient evidence to demonstrate the company’s inability to pay its debts as defined in Clause 1, Article 4 of the 2014 Bankruptcy Law.

As a result, the Ho Chi Minh City People’s Court has decided to initiate bankruptcy proceedings against Rang Dong Holding, effective from June 25, 2025.

Illustrative image

Within 30 days from the last date of publication of this decision, creditors must submit proof of their claims to the designated insolvency practitioner/asset management enterprise. The proof of claim should include the total amount of debt that Rang Dong Holding owes, including both matured and unmatured debts, secured and unsecured debts, interest, and contractual compensation (if any).

Along with the proof of claim, creditors must provide documents and evidence supporting the claimed debts. The proof of claim must be signed by the creditor or their legal representative. Exceptions are allowed in cases of force majeure or objective obstacles as specified in Clause 4, Article 66 of the 2014 Bankruptcy Law.

Rang Dong Holding JSC was established during the period of 1960-1975 and was previously known as UFEOC (Union of French Far East Rubber Enterprises). It was later renamed UFIPLASTIC.

As one of the first plastic companies in the industry, it imported modern equipment from Japan and Taiwan to produce PVC artificial leather, PU foam, tablecloths, PVC film, PVC- and PU-coated fabrics, and waterproof canvas.

On May 2, 2005, the company was equitized and officially operated under the name Rang Dong Plastic Joint Stock Company.

In 2023, Rang Dong Holding reported a net loss of VND 146.7 billion despite revenue of over VND 2,593.7 billion. In the first half of 2024, the company incurred an additional loss of nearly VND 64.6 billion. In July 2024, Rang Dong Holding temporarily suspended operations at its branches in Hanoi and Ho Chi Minh City without disclosing specific reasons.

As of June 2024, Rang Dong Holding’s total assets decreased to nearly VND 1,996 billion, including only VND 62 billion in cash (a 36% decrease compared to the beginning of the year).

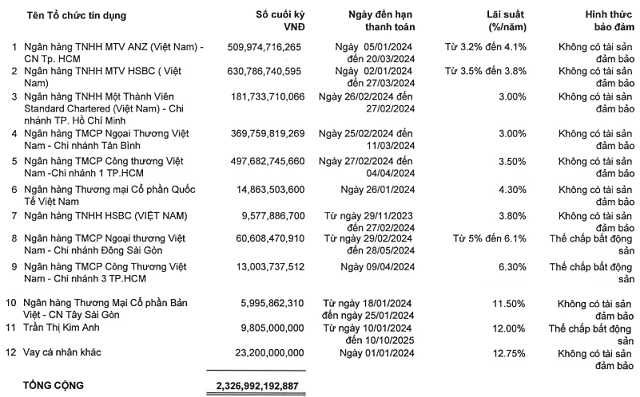

In terms of capital sources, the company’s total liabilities as of the end of the second quarter of 2024 were nearly VND 1,716.6 billion, 6.1 times its equity. These liabilities mainly consisted of bank loans from various financial institutions.

Currently, RDP, the stock symbol for Rang Dong Holding, is under warning status due to the company’s failure to hold its 2025 Annual General Meeting of Shareholders within the maximum period after the end of the financial year as prescribed.

Additionally, the stock is subject to a trading suspension as the company is mandated to delist due to serious violations of information disclosure obligations.

The Tech Titan’s Triumph: Qualcomm Continues Its Conquest with a Strategic Alliance, Unveiling a Cutting-Edge Design Center

The center established by Qualcomm and the domestic telecom group will adopt a co-development model for original design manufacturing (ODM) based on Qualcomm’s core technologies.

“Vice-Prime Minister Ho Duc Phoc Leads a Meeting with Ministries on Crucial Matters Concerning the Securities Law”

Vice Prime Minister Ho Duc Phoc gave specific instructions regarding the following matters: Maximum foreign ownership ratio; commercial banks acting as clearing members in the underlying securities market, central counterparty (CCP) clearing mechanisms; financial institutions guaranteeing bonds; and trading accounts.