According to the Vietnam Association of Seafood Exporters and Producers, apart from frozen fillets, which are the traditional key export products of Vietnamese catfish, value-added catfish (a type of catfish that undergoes further processing to enhance its value) is gradually proving its potential and strong consumption power. According to statistics from Vietnam Customs, as of July 15, 2025, exports of value-added catfish reached $28 million, up 47% over the same period last year.

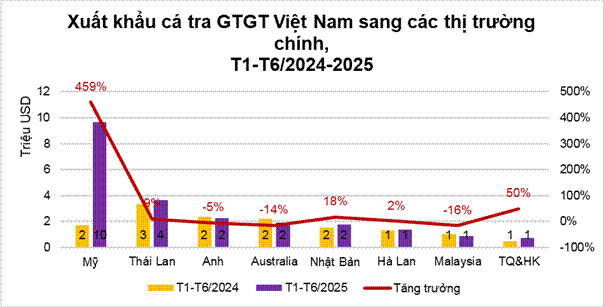

Topping the list of markets with the highest consumption and strongest growth in imports of Vietnam’s value-added catfish products is the US, with nearly $10 million in imports in the first six months of this year, up 459% over the same period last year (equivalent to 5.5 times). The US accounts for 38% of the total value of Vietnam’s value-added catfish exports to markets. In Q2/2025 alone, the US increased by 332% in imports of this product, with a value of over $5 million.

Following the US, Thailand is the second largest importer of Vietnam’s value-added catfish, with a value of $2 million in Q2/2025, up 45%, and $4 million in the first six months of this year, up 9% over the same period last year, accounting for 14% of the total value of Vietnam’s value-added catfish exports.

The UK, Australia, Japan, the Netherlands, Malaysia, and others consecutively rank after the US and Thailand in the list of single markets with the highest consumption of Vietnam’s catfish products under HS code 16. Specifically: exports of value-added catfish in the first half of 2025 to the UK reached $2.2 million, down 5%, accounting for 9% of the total value; exports to Australia reached $1.8 million, down 14%, accounting for 7% of the total value; exports to Japan reached $1.7 million, accounting for 7% of the total value; exports to the Netherlands reached $1.3 million, accounting for 5% of the total value; and exports to Malaysia reached $865,000, accounting for 3% of the total value of Vietnam’s value-added catfish exports.

Additionally, although the export value is still quite modest, the growth rate of catfish exports under HS code 16 to some markets such as Sweden, Cambodia, China, and Canada was quite impressive in the first half of this year, at 324%, 232%, 185%, and 164%, respectively.

The export value of Vietnam’s value-added catfish accounts for only 2.5% of the total export value of Vietnam’s catfish to markets, but it still maintains a growth momentum and shows strong potential for development. The Association expects that, in the context of a complex economy, especially the impacts of the White House’s tariff policies, exports of value-added catfish will continue to yield positive results, making an important contribution to the industry’s journey to achieving a billion dollars in exports this year.

The Great Seafood Trade: How the US and China are Diving into Vietnam’s Aquatic Delights

The Vietnamese seafood industry is experiencing a boom, with the Vietnam Association of Seafood Exporters and Producers (VASEP) reporting an impressive surge in exports. In July, the industry hit a high note, raking in over $885 million in exports, reflecting a 14% increase compared to the previous year. This marks the highest monthly export turnover since the beginning of the year, fueled by rising demand from key markets like the US, China, and Hong Kong.