Special AI and Crypto Advisor, David Sacks, chats with President Donald J. Trump as he signs executive orders in the Oval Office at the White House on January 23, 2025, in Washington, DC.

|

In a post on X, White House Special Crypto and AI Advisor, and Silicon Valley venture capitalist, David Sacks, revealed that the bitcoin reserve would be built entirely from bitcoins confiscated by the government in criminal and civil cases, ensuring taxpayers aren’t burdened financially.

Estimates suggest the federal government currently holds around 200,000 Bitcoins – a massive sum worth billions of dollars on today’s market.

Notably, Trump’s order also mandates a comprehensive inventory of all digital assets held by the US government. It prohibits the sale of Bitcoin from the reserve, firmly establishing Bitcoin’s position as a long-term store of value for the nation.

Additionally, the order establishes a US Digital Asset Reserve, managed by the Department of the Treasury, to hold other confiscated cryptocurrencies.

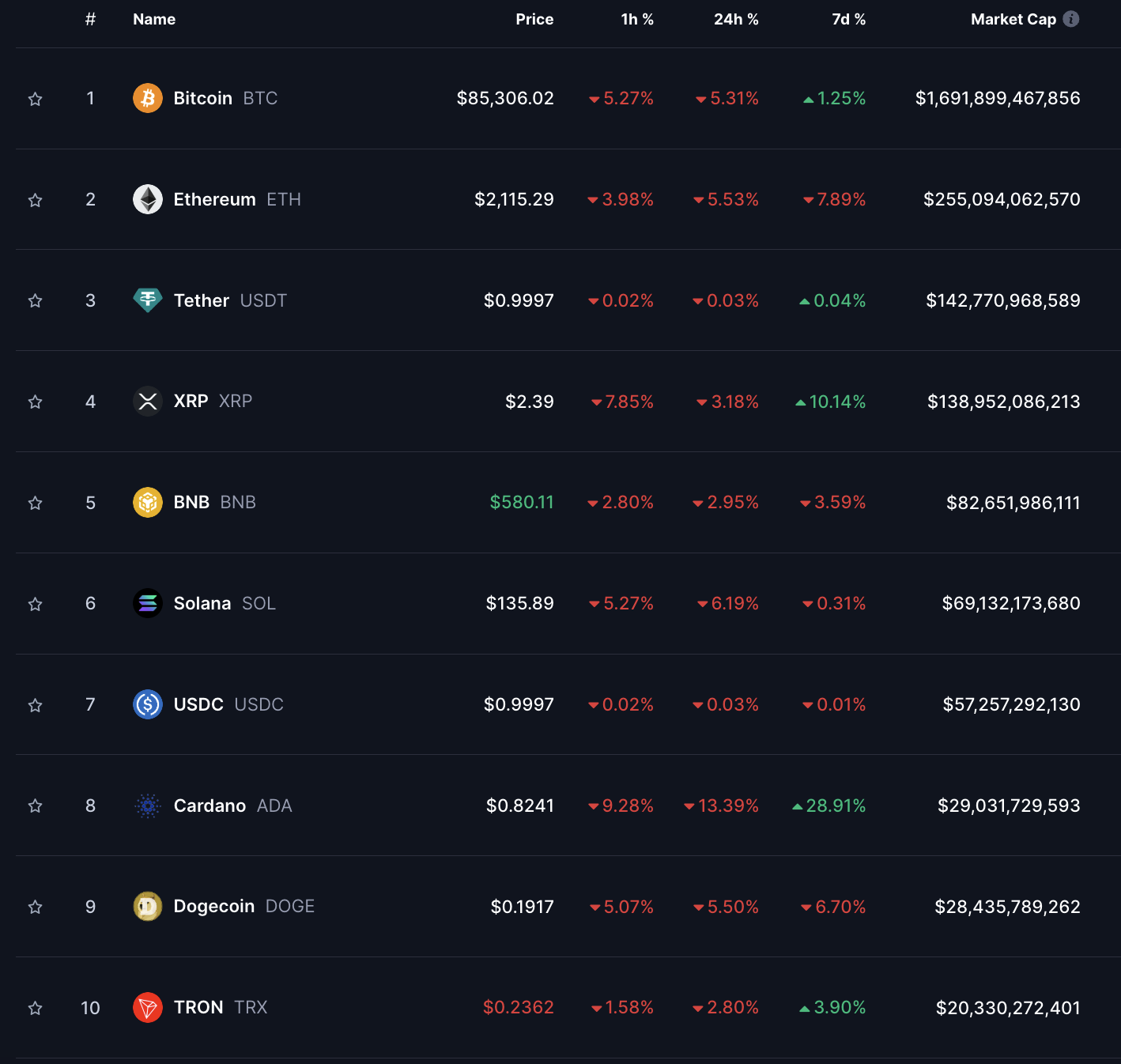

Following this news, Bitcoin prices continued to dip, falling towards 85,000 USD. Similarly, other top 10 cryptocurrencies saw red.

Source: CoinMarketCap

|

Sacks hailed the decision as a milestone in making the US the “crypto capital of the world”. He previously noted that the nation had lost out on over 17 billion dollars in potential value by selling confiscated Bitcoin too early.

Secretary of the Treasury, Scott Bessent, and Secretary of Commerce, Howard Lutnick, are now focused on strategies to buy Bitcoin without increasing the national debt.

The Crypto Superpower: Trump’s Vision for America’s Digital Future

With his new policy moves, President Donald Trump is making a bold bet on cryptocurrencies. Aiming to establish American dominance in this arena, he is reshaping Washington’s approach to digital assets.

Unleashing Digital Assets: MB and Korean Partners Gear Up for Vietnam’s First-Ever Platform

“As per the agreement, Dunamu steps in as a pivotal strategic partner for MB. This partnership entails sharing cutting-edge technology and robust infrastructure, along with expert consultation on legal compliance, investor protection, and talent development. With Dunamu’s expertise, MB is poised to elevate its operations and fortify its position in the market.”

The Financial Hub: It’s Not About the Number of Skyscrapers or Acres of Land

“Vietnamese enterprises believe that the first and most crucial factor is an open-door policy. Economic experts emphasize that while tax incentives are necessary, they are not sufficient for fostering true competition. Instead, the key lies in creating a revolutionary business environment, one that fosters flexibility and encourages the development of novel financial and technological models.”