Ms. Nguyen Thi Thanh Thuy joined the Board of Directors of VTGS since the Extraordinary General Meeting of Shareholders on July 1st, 2024 – at that time, the company was still known as Viet Tin Securities. The meeting approved the dismissal of two board members, Mr. Boyd-Bowman Charles James and Ms. Hoang Ngan Ha, and elected Ms. Nguyen Thi Thanh Thuy and Ms. Vo Huynh Ngoc to fill the vacant positions.

On the same day, the then-chairman of the board, Mr. Ronald Nguyen Anh Dat, also submitted his resignation as chairman for personal reasons. Notably, Mr. Dat was a major shareholder and the husband of Ms. Hoang Ngan Ha, who had just been dismissed from the board.

In the afternoon of July 1st, the board of directors of the company officially dismissed Mr. Ronald Nguyen Anh Dat and elected Ms. Nguyen Thi Thanh Thuy as the new chairman. Ms. Thuy also replaced Mr. Dat as the legal representative of the company.

In the minutes of the previous Extraordinary General Meeting of Shareholders, Ms. Thuy was the authorized representative of Minh Thanh Tourism Joint Stock Company – a major shareholder owning 49% of the company’s capital at that time (transferred from former chairman Ronald Nguyen Anh Dat on December 7th, 2023).

On December 26th, 2024 – by which time the company had changed its name to VTG Securities (VTGS) – Ms. Thuy was appointed as General Director, thus holding two key positions until now.

According to VTGS’ 2024 Annual Report, Ms. Thuy holds a Bachelor’s degree in Finance and has 15 years of experience in the securities industry, having worked at Viet Thanh Securities, Vietinbank Securities, and VIX Securities.

|

As for Mr. Thai Hoang Long, the new chairman of VTGS, he was elected to the board of directors at the 2025 Annual General Meeting of Shareholders held on June 26th, 2025, nominated by Minh Thanh Tourism Joint Stock Company. Prior to his appointment, Mr. Long served as a Senior Advisor.

Mr. Thai Hoang Long, born in 1970, has over 17 years of experience in finance and securities. In fact, Mr. Long is no stranger to the industry, having served as Chairman of the Board of VIX from April 15th, 2023, to September 27th, 2024. Prior to that, he was Vice President of VIX from October 19th, 2022.

Before joining VIX, he served as General Director of Nhat Viet Securities and Vice President of Vietinbank Securities.

Major Changes in Shareholding Structure, Welcoming a “Young” Shareholder

In recent developments, VTGS has announced changes in the list of shareholders holding at least 10% of its charter capital following a share offering to existing shareholders, with the emergence of a new name, TNP Capital.

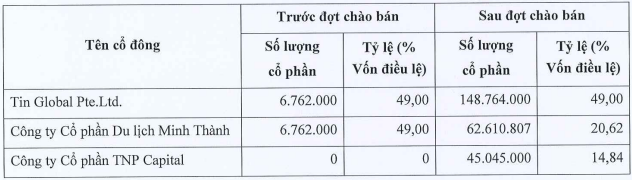

Specifically, the new list after the offering, which ended on July 16th, includes TIN Global Pte Ltd holding 49% (nearly 148.8 million shares), Minh Thanh Tourism Joint Stock Company holding 20.62% (over 62.1 million shares), and TNP Capital holding 14.84% (over 45 million shares). These three organizations hold a combined 84.46% of the capital.

Compared to the list before the offering, Minh Thanh Tourism Joint Stock Company has reduced its ownership from 49%, while TNP Capital – a newly established enterprise on February 24th, 2025, based in Ho Chi Minh City, mainly operating in the field of management consulting, with a charter capital of VND 451.5 billion – has emerged as a new shareholder.

TNP Capital is backed by 79 Nam Phong Joint Stock Company, a real estate business holding 65.34%; Hung Bao Anh Tourism Service Trading Joint Stock Company, a tourism accommodation business holding 28.13%; and the remaining 6.53% is held by its Director and legal representative, Tran Thi Thanh Huong.

|

List of VTGS shareholders holding at least 10% of charter capital before and after the offering

Source: VTGS

|

VTGS’ share offering to existing shareholders ended on July 16th, 2025, with 289.8 million shares offered, thus increasing its charter capital to VND 3,036 billion, nearly 21 times higher than before.

With an offering price of VND 10,000 per share, VTGS is estimated to have raised VND 2,898 billion. The company plans to use most of this amount to supplement capital for securities business activities, including VND 2,386 billion for margin lending, VND 400 billion for pre-sale securities lending, and VND 100 billion to purchase certificates of deposit and/or term deposits for payment reserves. The expected capital usage period is before June 30th, 2026.

The remaining amount of approximately VND 12 billion will be used to invest in upgrading the company’s information technology system (including hardware supplements, software upgrades for trading, website, web trading, and mobile app development), as well as purchasing work tools and office equipment. The expected capital usage period for this portion is before December 31st, 2027.

In terms of financial performance for the first half of 2025, VTGS recorded over VND 1.2 billion in operating revenue, 3.2 times higher than the same period last year. This was mainly contributed by interest income from held-to-maturity investments (HTM) and securities brokerage services.

However, the company operated below its cost of sales, with operating expenses of over VND 2.4 billion, 2.8 times higher than the previous year, mainly attributed to the brokerage segment. More notably, management expenses reached nearly VND 18.8 billion, resulting in a loss of over VND 20 billion for the period, falling short of the year’s target of VND 32 billion in pre-tax profit.

– 10:11, August 16th, 2025

“Digiworld Aims for Ambitious 15-25% Annual Compound Growth, Prepares to Venture Into a New Automotive Sector”

On August 13, HSC Securities Joint Stock Company, in collaboration with Digiworld Corporation, hosted an exclusive C2C (Connecting to Customers) workshop themed “Digiworld: A Journey of Market Shaping.”

“TDC Aims to Garner $30 Million from the Transfer of Lot E15 in the Hoa Loi Residential Area”

On July 21, 2025, Becamex TDC, a leading real estate company listed on the Ho Chi Minh Stock Exchange (HOSE: TDC), and Global Corp proudly announced the signing of a term sheet for the transfer of residential properties in Lot E15, located within the TDC Hoa Loi residential project in Binh Duong Ward, Ho Chi Minh City.

Revolutionizing the Industry: NRC Expands Horizons with a New Name and Venture into Pharmaceuticals

The Board of Directors of NRC Corporation (HNX: NRC) has approved the establishment of NRC Pharma LLC with a chartered capital of VND 50 billion. The new subsidiary will be headquartered in Tan Dinh Ward, Ho Chi Minh City, and NRC will contribute the entire capital to this new venture.