“VPBank Securities Prepares for Potential IPO in Q4 2025”

VPBank Securities is reportedly planning an initial public offering (IPO) in the fourth quarter of 2025, according to sources. The company, a subsidiary of VPBank, has not yet disclosed the specifics of the shareholder meeting agenda, but one of the key items is expected to be the approval of the IPO plan.

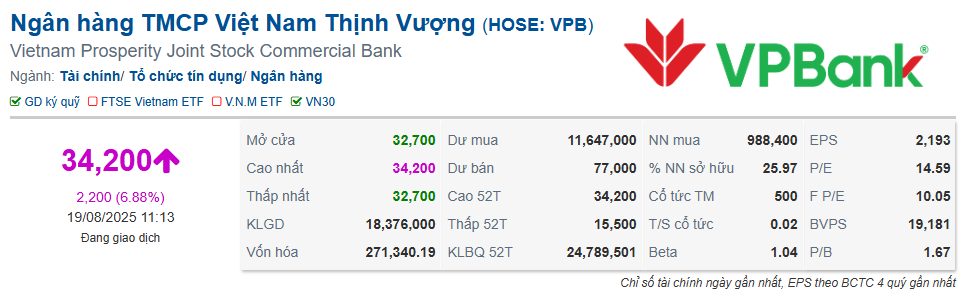

On August 19, Reuters reported that VPBank, listed on the Ho Chi Minh Stock Exchange (HOSE) under the ticker VPB, intends to proceed with the VPBank Securities IPO in November. The international news agency also mentioned that the parent bank plans to offer a 10% stake in VPBank Securities to investors.

This news sent VPB shares soaring to the daily limit of VND 34,200 per share on the stock exchange during the trading session on August 19.

Source: VietstockFinance

|

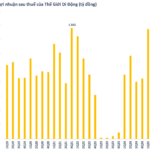

Focusing on VPBank Securities’ performance, the company recently announced its second-quarter financial results for 2025, reporting a post-tax profit of VND 441 billion, a significant 73% increase compared to the same period last year. This impressive growth was driven by strong results in proprietary trading, financial advisory, and lending activities.

The positive momentum in the second quarter carried over to the first half of 2025, with VPBank Securities achieving a pre-tax profit of nearly VND 900 billion, representing an 80% year-on-year increase and meeting 45% of its full-year target. The company’s post-tax profit for the same period stood at nearly VND 722 billion, reflecting an 80% growth rate.

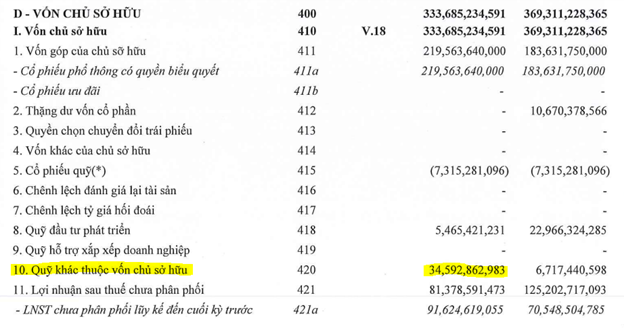

As of the second quarter of 2025, VPBank Securities had a charter capital of VND 15,000 billion, equivalent to approximately 570 million USD. If the IPO pushes through, VPBank Securities could be poised for a blockbuster debut on the Vietnamese stock market. This potential offering comes on the heels of another securities firm, TCBS, which recently set its IPO timeline for the period between the third quarter of 2025 and the first quarter of 2026. TCBS aims to raise capital by offering shares at VND 46,800 per share, valuing the firm at approximately 4.1 billion USD post-IPO.

In a recent statement, Ngo Hoang Long, Director of the VPBank Securities Research Center, pointed out the challenges faced by companies going public today compared to those listed in the 2000-2010 period. He referenced STB, a bank whose shares once traded close to par value, and how its annual general meeting was a testament to shareholder loyalty. Newer companies, Long noted, cannot rely on such sentiment and must instead invest significantly in investor relations to achieve a strong market position. He also commended TCBS for its IPO preparation process, stating that it offered a fresh perspective.

Huy Khai

– 11:31 19/08/2025

The Private IPO Platform and Open-source Custody Certificates: Unlocking Capital for Businesses?

In a booming economic landscape, with the VN-Index surpassing 1,600 points and the government targeting double-digit GDP growth, new avenues for capital raising are emerging for Vietnamese businesses. A standout development is the introduction of dedicated IPO platforms operated by securities firms, along with the advent of international depositary receipts, which are expected to serve as game-changers. These innovative tools offer businesses a more flexible and streamlined approach to accessing capital, bypassing traditional complex processes.

The Stock Market Soars: How to Invest Without “Chasing Returns”?

The task of predicting the short-term peak of the VN-Index is challenging, but investors can take a strategic approach by focusing on sector and stock selection to avoid riding the peak when the market overheats.