At the upcoming Extraordinary General Meeting of Shareholders of JSC Production Business Import-Export Binh Thanh – Gilimex (stock code: GIL), the Board of Directors is expected to present to the General Meeting of Shareholders for approval matters related to the protection of the Company’s rights and legal interests in the lawsuit with Amazon Robotics LLC.

Specifically, authorizing the Company’s legal representative, the General Director, and other executives to work with consulting units to research and implement effective solutions to best protect the Company’s rights and legal interests in the Lawsuit at the competent court in the US.

The Company will accept the legally binding decision of the competent US court regarding the Lawsuit. The Company’s legal representative, General Director, other executives, and employees involved in the Lawsuit will not be held personally liable for any damages (if any) incurred by the Company related to the Lawsuit.

At the same time, the Company will protect the rights, honor, and reputation of these individuals and will not hold them legally accountable for matters related to the Lawsuit. The success fee for the consulting units currently defending the Company’s rights and legal interests in the Lawsuit is set at 20% of the total amount received by the Company from Amazon according to the legally binding decision of the competent US court.

The total bonus for individuals, including the Company’s legal representative, General Director, other executives, and employees involved in the Lawsuit, is set at 20% of the remaining amount after deducting the total damage and lawsuit expenses from the total amount received by the Company from Amazon according to the legally binding decision of the US court.

Gilimex stated that Amazon has been one of its major customers since 2014. During the cooperation, the Company has heavily invested in infrastructure and labor to meet Amazon’s demands as per the agreement between the two parties.

However, Amazon abruptly changed and significantly reduced its demand, violating the cooperation contract between the two parties, greatly affecting the Company’s production and business activities and causing a loss of $280 million to the Company. Therefore, in 2022, the Company initiated procedures to sue Amazon, with the jurisdiction being the competent court in the United States, and the lawsuit is currently in the process of being resolved.

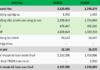

In terms of business results, since Q3 2022, when the Company’s largest customer, Amazon, cut orders, revenue decreased by over 80%, causing a 24% drop in revenue for the full year 2022, and core profit (gross profit minus financial expenses, selling expenses, and management expenses) evaporated by 97%, amounting to VND 12 billion.

In 2023, GIL’s net profit continued to decrease by 92%, and operating cash flow recorded a record negative number of VND -319 billion. The company’s over-reliance on a single major customer left it unprepared for the sudden turn of events.

GIL recorded consecutive losses in the three quarters following Amazon’s decision, totaling over VND 63 billion, before returning to profitability in Q4 2023. According to the latest financial report for Q1 2025, Gilimex recorded a revenue of VND 126 billion and a post-tax profit of over VND 2.1 billion in the first quarter, down 43% and 71%, respectively, compared to the previous year.

“Gilimex Updates Shareholders on Amazon Lawsuit Developments”

Gilimex has revealed that Amazon’s abrupt change and significant reduction in demand, which breached the cooperation contract between the two parties, has severely impacted the company’s operations and business. This has resulted in a staggering loss of $280 million for Gilimex.

“CII Annual General Meeting: A Double Feature in May”

The CIJ annual general meeting, which was initially scheduled for a previous date, will now take place on the 21st of May, 2024, at 8 am. This highly anticipated event marks the company’s second attempt to hold its annual general meeting, and all eyes are on the successful execution of this gathering.