Illustration image

|

“Punch” from weak demand

According to data from the General Department of Customs, in 2023, the export value of timber and wood products is estimated to reach 13.47 billion USD, a decrease of nearly 16% (equivalent to a decrease of 2.55 billion USD) compared to the previous year. However, in 2023, Vietnam’s timber products ranked among the top 5 in the world for the first time. In which, the United States is still the largest market for Vietnam’s timber and wood products, with 7.31 billion USD, a sharp decrease of 15.6% (equivalent to a decrease of 1.35 billion USD), accounting for 54% of the total export value of this group of goods for the whole country.

Undergoing a difficult 2023 due to the weakening of major export markets such as the US, EU, along with the high cost of materials, significantly affecting the overall business results of the timber industry.

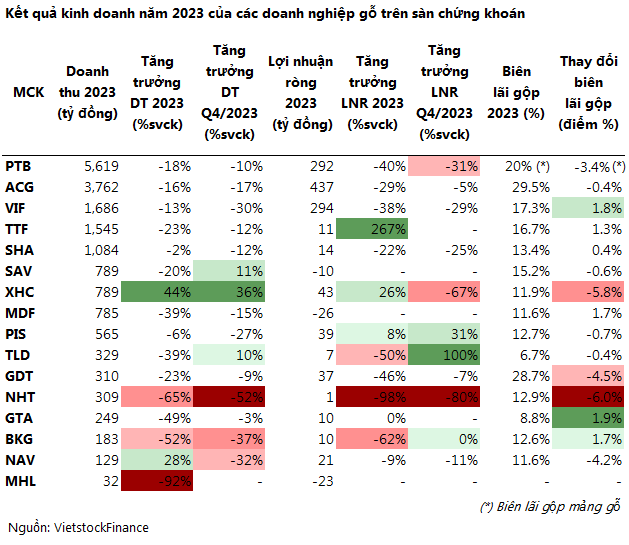

Data from VietstockFinance shows that out of the 16 timber and wood products companies listed on the stock exchange that announced their business results in 2023, 9 companies experienced a decrease in profit, 4 companies experienced an increase in profit, and 3 companies experienced a loss. The total revenue and net profit reached nearly 18.2 trillion VND and nearly 1.2 trillion VND, respectively, a decrease of 21% and 41% compared to the previous year.

In terms of absolute numbers, there are 5 companies with revenues exceeding 1 trillion VND. Specifically, the “giant” of the wood industry – Phu Tai (HOSE: PTB) achieved the highest level in the group with over 5.6 trillion VND, but still 18% lower than the previous year.

Also experiencing double-digit revenue decline are Go An Cuong (HOSE: ACG), Vietnam Forestry Corporation (Vinafor, HNX: VIF), Truong Thanh Wood Technology Group (HOSE: TTF), with revenues of nearly 3.8 trillion VND, 1.7 trillion VND, and over 1.5 trillion VND, respectively. Son Ha Sai Gon (HOSE: SHA) also achieved revenue of over 1 trillion VND, a slight decrease of 2%.

The bright spot in the industry: Xuan Hoa Vietnam (UPCoM: XHC) and Nam Viet (Navifico, HOSE: NAV) are the top two companies in terms of revenue growth, reaching 789 billion VND (an increase of 44%) and 129 billion VND (an increase of 28%).

Net profit drops sharply

In 2023, the average gross profit margin of the wood industry reached 19.5%, a decrease of 0.5% compared to the previous year, due to the increase in raw material costs and logistics costs. Specifically, the gross profit margin of San xuat Va Thuong mai Nam Hoa (HOSE: NHT) decreased by 6%, to 12.9%; or PTB wood with a gross profit margin decrease of 3.4%, to 20%.

Minh Huu Lien (HNX: MHL) is a rare loss-making company in the industry due to doing business below cost in 2023. As for Vinafor, Thuan An Wood Processing Company (HOSE: GTA), and BKG Vietnam Investment (HOSE: BKG), they are positive signs in terms of gross profit margin growth.

The net profit of 8 out of 16 companies has plummeted by two digits in 2023. NHT dropped 98% compared to the same period, from 66 billion VND to only 500 million VND; BKG’s net profit decreased by 62%, reaching only 10 billion VND.

However, the most negative ones in the group are MDF VRG – Quang Tri (UPCoM: MDF), which has made its first loss in its 17 years of operation (since 2006); Savimex (HOSE: SAV) returned to loss after 8 years (since 2015); MHL incurred losses while still having profits the previous year.

This result wiped out the entire accumulated undistributed post-tax profit of MDF and MHL. At the end of 2023, MDF had accumulated losses of more than 23 billion VND, while MHL had accumulated losses of nearly 20 billion VND.

Meanwhile, TTF’s net profit growth is approximately 4 times that of the previous year, reaching 11 billion VND, mainly due to profits from joint venture partnerships and cost reduction.

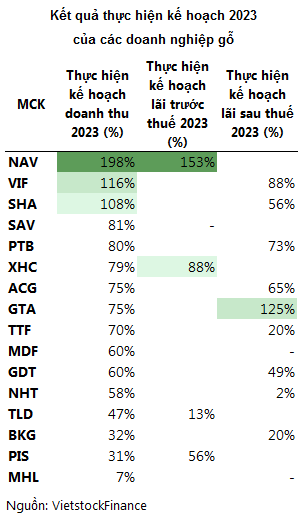

However, the profit champion belongs to ACG, reaching 437 billion VND, accounting for 38% of the entire group’s profit, although it decreased by 29% compared to the previous year. The company also failed to achieve the set profit target of 668 billion VND for 2023.

Only Navifico and Thuan An wood processing company (HOSE: GTA) announced that they exceeded the profit target for 2023. With unsatisfactory results, 9 out of 16 companies have not been able to achieve 3/4 of the journey to the finish line.

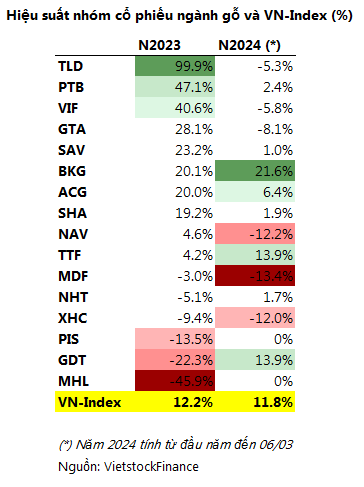

In 2023, stock prices of wood and wood product companies have diverged. Half of the listed companies have an average increase higher than the 12% increase of the VN-Index, with TLD (+100%), PTB (+47%), and VIF (+41%) being the most positive signs; while MHL is the most disappointing (-46%).

From the beginning of the year to March 6, 2024, the wood industry group of stocks has traded below the average increase of 11.8% of the VN-Index. The biggest decrease is MDF (-13.4%); NAV (-12.2%); MDF (-12%).

In the market, wood industry stocks have not received much attention from investors. Except for TTF with an average liquidity of a few million shares per day, other stocks only have liquidity ranging from a few thousand to tens of thousand units.

After the rain, comes the sun?

According to preliminary statistics from the General Department of Customs, in the first half of February (from February 1st to 15th), wood and wood product exports reached 353.97 million USD; the cumulative value from the beginning of the year to February 15th reached 1.82 billion USD, an increase of 0.61 billion USD compared to the same period.

In January 2024 alone, wood and wood product exports surged, reaching 1.47 billion USD, up 9.7% compared to the previous month and up 83.1% compared to the same period last year.

Along with the bright prospects in the US and European markets, Vietnam’s wood industry is looking forward to achieving the target of 16 billion USD in export turnover in 2024.

Companies are also making efforts to expand into new markets, diversify sales channels to meet the annual targets. According to Mr. Do Xuan Lap – Chairman of the Vietnam Timber and Forest Products Association (Viforest), although the market has shown signs of recovery, 2024 still harbors some risks for the industry.

“In 2024, the wood industry is still in a position of instability. The most important solution in 2024 is to create a sustainable development image for the wood industry in Vietnam, based on the basic factors of using certified wood and reducing emissions in products” – Mr. Do Xuan Lap emphasized.

Still, there are concerns

Despite the optimistic signals at the beginning of the year, export companies are now facing new concerns such as tension in the South China Sea causing shipping costs to soar.

However, up to this point, freight rates for goods to be shipped to the EU and the US have shown signs of cooling down, as they enter the third consecutive week of decline. This brings hope to many wood export companies.

In addition, wood export companies are also facing bad debts and difficulties in collecting debts when partners encounter financial difficulties. For example, the more than 30-year-old furniture company Noble House (US) has filed for bankruptcy, which has affected at least 2 companies listed on the stock exchange, which are Cam Ha Joint Stock Company (UPCoM: CHC) and Phu Tai Joint Stock Company.

In which, Noble House is the main customer, contributing an average of about 50% of Cam Ha’s total revenue. Regarding Phu Tai, as of the end of 2023, the short-term receivables with Noble House reached about 61 billion VND, a significant increase from the 8 billion VND at the beginning of the year.

According to the forecast of SSI Research, Phu Tai will have to find new customers to compensate for the revenue of over 100 billion VND per year, setting aside provisions from 30% to 40% of the value, equivalent to about 20-25 billion VND in 2024.

Earlier, in a letter to shareholders dated October 10, 2023, Phu Tai stated that Noble House is still contacting to place orders to maintain regular business operations and make payments according to court decisions. Orders from customers exporting to the US market are still stable and tend to increase in the coming time.