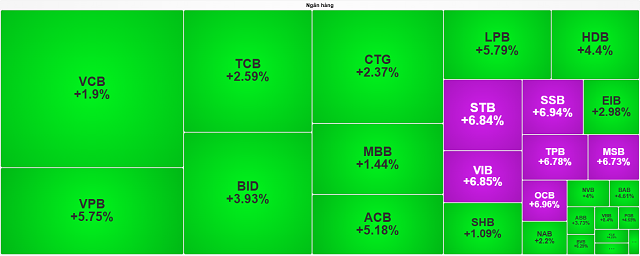

Closing session on August 21, the VN-Index rose 1.42% to 1,688 points. Notably, banking stocks continued to thrive with 6 codes hitting the ceiling price, including STB, VIB, OCB, TPB, MSB, and SSB. In addition, the remaining bank codes also gained points, such as LPB (+5.79%), VPB (+5.75%), ACB (+5.18%), BID (+3.69%), and TCB (+2.59%)…

|

Bank stocks rose on August 21

Source: VietstockFinance

|

Banking – From Policy Pillar to Strategic Support for the Market

According to Mr. Nguyen Quang Huy – CEO of Finance and Banking, Nguyen Trai University, the strong growth in banking stocks on August 21 reflects the multi-layered picture of capital flows. Investors have different perspectives on banks depending on their intrinsic quality, valuation, and individual prospects. As the VN-Index remains heavily dependent on the finance and banking sector, accurately interpreting the pulse of this group holds strategic significance.

Mr. Nguyen Quang Huy

|

The recent upward momentum has been supported by diverse factors. Firstly, the second-quarter and first-half 2025 financial results indicate a recovery in credit, improved profits driven by stable net interest income, and strong growth in service fees (payment, insurance, and cards). Many banks have maintained a high CASA ratio, resulting in low funding costs and stable profit margins. Additionally, several banks have announced cash or stock dividend plans, attracting domestic and international capital flows.

Equally important are monetary policies and industry regulations. The decision to reduce the mandatory reserve ratio by 50% for some banks from October 1 will release tens of billions of VND, directly easing funding cost pressures and creating room for credit expansion. At the same time, the amended Law on Credit Institutions, which takes effect on October 15, and the new Land Law promulgated on August 15, provide a legal framework for handling bad debts and resolving legal issues related to real estate projects. This implies a gradual reduction in banks’ asset quality risks and better control over provisioning costs.

From a capital market perspective, the launch of the KRX trading system in May marks a milestone. This is not just a technical improvement but also paves the way for new products such as T+0 trading and sell orders, thereby enhancing overall market liquidity. As liquidity increases, the banking group, which accounts for a significant weight in the index and ETF portfolios, becomes a preferred destination for capital flows, especially as Vietnam is expected to be upgraded by FTSE in the upcoming October review. This could attract significant foreign capital, with banks being the initial “hotspot.”

Macroeconomic stability forms the foundation for growth, with inflation for the first seven months at around 3.3%, within the target range, and no significant shocks in exchange rates or interest rates. Public investment is being disbursed on a large scale, creating a spillover effect on various sectors, from construction and materials to consumer industries, ultimately benefiting bank credit. Additionally, Vietnam continues to attract FDI due to its cost and labor advantages and its position in the supply chain. Import-export enterprises are also reaping the benefits of the recently concluded tax agreement with the US, promising a robust recovery in production and business activities, leading to increased demand for bank loans and services.

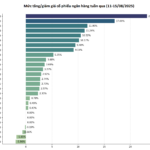

Furthermore, the current valuations of many banks suggest upside potential. The industry’s P/E and P/B ratios are generally attractive compared to historical averages and regional peers. With an estimated ROE of around 15-16% for 2025, there is room for re-rating. Notably, banks with high liquidity, a broad customer base, high CASA ratios, and diverse fee-income streams will be more highly valued, as they possess not only a cost advantage but also demonstrate sustainability throughout the cycle.

Looking ahead, Mr. Huy predicts that the banking group is likely to maintain its role as a “pillar” for the VN-Index, but with a high level of selectivity. Upcoming catalysts are abundant, including October 1 (reduction in reserve requirements), October 15 (effective date of the amended Law on Credit Institutions), the FTSE review in October, and the third-quarter financial reporting season. Each of these events could trigger capital flows, but the extent of benefit may vary across banks. This underscores the importance of discipline; instead of FOMO (fear of missing out) and chasing short-term trends, investors should focus on banks with strong capital foundations, high CASA ratios, stable profitability, reasonable valuations, and direct beneficiaries of supportive policies.

In Mr. Huy’s view, banks are not just a “short-term pillar” but a “strategic lever” for the entire market. The current uptrend is not a temporary phenomenon but is underpinned by the synergy of corporate fundamentals, monetary and legal policies, market reforms, and a stable macroeconomic environment. However, differentiation will become more pronounced, and only banks with good governance, cheap capital advantages, a developed digital ecosystem, and a healthy asset structure will sustain their appeal. This is the time to view the banking group as a strategic pillar but approach it with a selective mindset, disciplined valuation, and patience, rather than following the crowd.

– 15:36 21/08/2025

The Stock Market’s Stealthy Strategists: In-House Traders Unveil their Tactics with a $9 Million Shopping Spree on August 18th.

The proprietary securities firms continued their net buying streak on the HoSE, with a total value of 208 billion VND. The focus was on the leading technology stock, which saw a significant boost in trading volume and value. This strategic move by the proprietary firms showcases their confidence in the tech sector’s potential and strengthens their position in the market.

Stock Market Update: Mid and Small-Cap Stocks to Attract Investors’ Interest

The August 18th session concluded with a robust buying spree as investors sought to take advantage of discounted stock prices. For the upcoming August 19th trading day, we anticipate a shift in focus towards mid and small-cap stocks, presenting a strategic opportunity for savvy investors to diversify their portfolios and potentially capitalize on the momentum of these dynamic segments of the market.