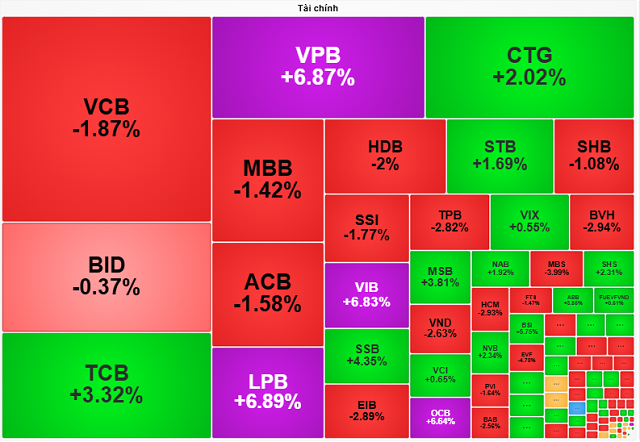

The banking stock group continued to be the main support, maintaining the recovery momentum of the VN-Index, closing the session on August 20, 2025, at 1,664.36 points, up 0.61%. The sector saw 4 stocks hitting the daily limit-up, 12 advancing, and 10 declining.

Stocks VPB, VIB, OCB, and LPB became the industry’s highlight as they hit the daily limit-up with massive trading volume.

VPB stock witnessed its second consecutive limit-up session. On August 20, it surged 6.87% to 36,550 VND per share, with a trading volume of 119.4 million shares, totaling a value of VND 4,034 billion. VPB‘s market price has increased by over 95% compared to the beginning of the year, and its average liquidity is nearly 28 million units per day.

VIB also hit the daily limit-up, reaching 21,900 VND per share, with a sudden surge in liquidity to 70.4 million shares, valuing over VND 1,533 billion. Although it has only gained over 31% since the beginning of the year, VIB stock’s average liquidity is above 10 million units per day.

OCB stock hit the daily limit-up at 13,650 VND per share, with a trading volume of over 41.7 million shares, totaling nearly VND 562 billion. Foreign investors net bought nearly 2.2 million OCB shares. Compared to the beginning of the year, OCB stock price has increased by more than 36%, with an average liquidity of nearly 4.9 million units per day.

Additionally, a series of other bank stocks also recorded positive trading sessions, such as: TCB (+3.32%), CTG (+2.02%), MSB (+3.81%), and NVB (+2.34%)…

|

Bank stocks in the green on August 20, 2025

Source: VietstockFinance

|

Multiple factors support bank stocks

Mr. Phan Dũng Khánh, an economic expert, opined that the recent growth momentum of bank stocks is driven by the convergence of both macro and industry-specific factors.

Confidence in the economic growth outlook is the most crucial driver, underscoring the pivotal role of the banking sector in providing capital for the economy. Meanwhile, the industry’s overall positive financial results further reinforce investors’ expectations.

In the stock market, given their large capitalization and significant influence on the overall index, financial and banking stocks naturally attract capital whenever the market aims for sustainable growth.

The allure of these stocks is further enhanced by their unique stories. Notably, some securities companies affiliated with banks are planning to go public, taking advantage of the favorable market conditions, thus attracting capital to the ecosystem of their parent banks.

Moreover, with the orientation to develop new financial products, banks are considered to have a superior advantage in complying with regulations and capturing market share. It is anticipated that soon, licensed organizations will be able to participate in the digital asset market, but only large financial institutions like banks will be able to meet the stringent requirements.

Impetus from the International Financial Center and digital assets story

Prof. Nguyễn Hữu Huân, a senior lecturer at the University of Economics in Ho Chi Minh City, stated that bank stocks experienced a volatile yet positive trading session, and this upward momentum is attributed to the confluence of multiple supportive factors.

The news about the establishment of international financial centers, along with the trend of large banks venturing into the digital asset market, is acting as a strong catalyst for this sector. According to unofficial sources, banks that are pioneering the research and development of digital asset exchanges are attracting special attention from investors. The expectation that banks can significantly boost their profits from this new business line has led to an upward trend in their stock prices recently.

The banking industry’s financial results for the first half of the year are considered promising. Notably, private banks (with a scale second only to the “Big 4”) are demonstrating remarkable breakthroughs, with credit growth surpassing expectations and financial performance showing significant improvement compared to the previous period. This solid foundation serves as a “backstop” for the stocks’ price appreciation.

Given their large market capitalization and far-reaching influence, bank stocks always play a pivotal role in supporting the VN-Index. In the context of the market needing momentum to sustain its upward trajectory, smart money tends to flow towards these “king stocks” with strong fundamentals and compelling narratives. However, Mr. Huân also cautioned about the risk of a correction after a prolonged bullish period for this sector.

– 16:57 20/08/2025

The Market Maverick: Can We Expect a Resilient Reversal?

The VN-Index experienced significant volatility but managed to recover towards the end of the trading session, with above-average volume. The uptrend remains intact as the MACD indicator continues to hover above the signal line, indicating no signs of weakness. However, the risk of volatility persists as the index hovers at historical highs. In the event of increased selling pressure, the middle band of the Bollinger Bands will serve as a crucial support level.

Market Beat: Pulling Major Stocks, VN-Index Makes a Strong Comeback at the End of the Session.

The trading session concluded with the VN-Index climbing 10.16 points (+0.61%), reaching 1,664.36. In contrast, the HNX-Index witnessed a decline of 2.72 points (-0.95%), settling at 283.73. The market breadth tilted towards decliners, as 569 stocks closed in the red, while 238 stocks ended in the green. Within the VN30 basket, 17 stocks fell, 12 advanced, and 1 remained unchanged, resulting in a slightly bearish sentiment.

The Market Beat: Kingmaker Stocks Push VN-Index to New Heights

The VN-Index demonstrated resilience, quickly recovering from early afternoon pressures to close at a record-breaking 1,688 points. Despite the positive finish, today’s market left many investors feeling uneasy, as the old adage of “green on the outside, red on the inside” rang true.

“VN-Index: A Clear Path to Conquer the 1,700-Point Threshold?”

The VN-Index climbed for the fourth consecutive session, closely hugging the upper band of the Bollinger Bands. While trading volume has been volatile in recent sessions, indicating investor sentiment is not yet firmly established, the rally has been largely driven by large-cap stocks. Nonetheless, the MACD indicator continues to trend upward without showing any signs of weakness, suggesting the VN-Index could soon breach the 1,700-point threshold in upcoming sessions.

“Vietstock Daily 20/08/2025: Sustaining the Uptrend”

The VN-Index reached new heights, with trading volume recovering above the 20-session average. The upward trend of the index remains robust as the MACD indicator continues to widen the gap with the signal line, providing a strong buy signal. However, investors should be cautious of potential short-term volatility if the Stochastic Oscillator indicator continues to weaken.