According to market reports, modern trade currently accounts for approximately 12% of total retail sales in Vietnam, significantly lower than neighboring countries such as Thailand and Indonesia (30-50%), indicating ample room for growth. However, retail businesses also face intensifying competition, rising operating costs, particularly rental and personnel expenses, and logistics challenges in ensuring fresh produce, stable supply, and cost control in areas away from city centers.

In this context, WinCommerce (WCM), a member of the Masan Group, continues to expand its network and improve operational efficiency. Through its WinMart/WinMart+/WiN supermarket and store system, the company aims to provide quality goods at reasonable prices while enhancing the shopping experience in rural areas.

Double-digit revenue growth

According to the July 2025 report, WCM achieved net revenue of VND 3,486 billion, a 23% increase compared to the same period in 2024, surpassing the base growth target of 8-12% set for the year. For the first seven months, revenue reached VND 21,400 billion, up 14.8% year-on-year. The LFL growth of stable-operating stores increased by 7.6% year-on-year, indicating improved operational efficiency.

In July, WCM opened 36 new stores, bringing the total number of new stores opened so far this year to 354, completing over 50% of the annual plan (400-700 stores). About 75% of these are WinMart+ stores in rural areas. The Central region contributed 175 stores, nearly 50% of the total new openings, reflecting the region-focused expansion strategy.

Through the widespread WinMart+ stores in rural areas, consumers can access fresh produce, essential goods, and quality products at reasonable prices in a civilized and modern shopping space. This is helping to shift local consumption habits from traditional markets to more modern, convenient, and transparent shopping experiences. By bringing ‘supermarkets to small alleys,’ WinCommerce is narrowing the consumption gap between urban and rural areas and promoting civilized shopping habits to every Vietnamese household.

Expansion strategy linked to effectiveness

According to WCM, all new stores opened in 2025 have recorded positive profits, demonstrating tight financial efficiency control. Notably, WinMart+ stores in the Central region have emerged as a new growth driver, attributed to a product portfolio that meets consumer needs and the advantage of pioneering high-traffic locations.

Speaking at the Techcombank Investment Summit 2025 on July 9, Mr. Danny Le, CEO of the Masan Group, emphasized that modern retail channels in Vietnam account for only 12% of the total market, while in neighboring countries like Thailand and Indonesia, the figure stands at 30-50%. To accelerate retail modernization, building an integrated supply chain from production to consumption and developing a customer data platform are key factors.

WCM benefits from the Masan ecosystem, including production (Masan Consumer, Masan MEATLife, WinEco), logistics (SUPRA), consumer finance (Techcombank), and omnichannel distribution. The company also leverages customer data through the WiN membership program, aiming to reach 30-50 million consumers to personalize experiences and increase customer lifetime value.

While the modern retail market in Vietnam offers significant potential, the rapid expansion pace also demands that businesses maintain service quality, manage cost risks, and optimize supply chains. Additionally, the entry of domestic and international competitors and macroeconomic fluctuations will continue to influence the development strategies of retailers, including WCM.

Nevertheless, WinCommerce’s sustained double-digit revenue growth and network expansion with positive financial performance for several consecutive months indicate the company’s effective market opportunity capture. This can be considered a positive factor contributing to the company’s competitive edge and ability to sustain its development strategy in the next phase.

– 06:53 21/08/2025

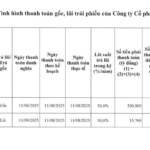

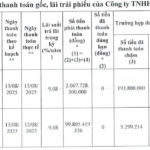

“CMC Repays Over 300 Billion VND in Principal and Interest on Bonds”

CMC has just made a significant payment of over VND 300 billion in principal and nearly VND 16 billion in interest on the CVTB2125003 bond lot.

The Dragon’s $2.8 Million Venture: FlexOffice Expansion in the Philippines

The once export-focused TLB Shareholding Group Corporation (HOSE: TLG) is taking a bold step forward by establishing a separate legal entity to introduce their FlexOffice brand as a domestic enterprise in the Philippines. This move underscores the company’s confidence in having established a strong foothold in the Philippine market, with their ballpoint pens already recognized and well-regarded by consumers in the region.

The Ultimate Cash Cow: Unveiling the Financial Giant with a Stellar Performance that Rivals the Best

In Q2, the company reported a revenue of nearly VND 40 trillion, a 15% increase year-over-year, marking an all-time high since its inception.