Vinhomes’ Market Performance and Business Updates

Vietnam’s stock market experienced a volatile trading session, with the VN-Index swinging nearly 40 points but eventually closing over 10 points higher. One of the key contributors to this performance was Vinhomes (VHM), the real estate giant backed by billionaire Pham Nhat Vuong.

On August 20, VHM’s share price surged by more than 5%, reaching a new peak of 99,000 VND per share—a 2.5 times increase since the beginning of the year. Consequently, Vinhomes’ market capitalization also hit a record high of nearly VND 407 trillion (~USD 15.5 billion). This marks the first time the company’s market value has surpassed the VND 400 trillion threshold.

In related news, on August 15, Vinhomes issued two batches of bonds worth a total of VND 15,000 billion with a fixed interest rate of 11% per annum. These are non-convertible bonds that do not include warrants and are asset-backed.

The first batch, with the code VHM12501, consists of 80,000 bonds, each with a par value of VND 100 million, resulting in an issuance value of VND 8,000 billion. They have a tenor of 42 months. The second batch, coded VHM12502, comprises 70,000 bonds, also with a par value of VND 100 million each, amounting to an issuance value of VND 7,000 billion. These bonds have a tenor of 39 months.

Turning to Vinhomes’ business performance, the company recorded a consolidated net revenue of VND 34,720 billion for the first half of 2025. Additionally, its consolidated net revenue, including revenue from joint venture contracts and bulk sales recorded in financial income, reached VND 44,964 billion, while its consolidated after-tax profit stood at VND 11,000 billion.

As of June 30, 2025, Vinhomes’ total assets amounted to VND 658,042 billion, with equity reaching VND 230,611 billion, reflecting a 17% and 4% increase since the beginning of the year, respectively. Cash and cash equivalents witnessed a significant surge, climbing by 69% to VND 48,672 billion. Inventory as of the end of June also increased by nearly 47% compared to the start of the year, totaling VND 80,136 billion.

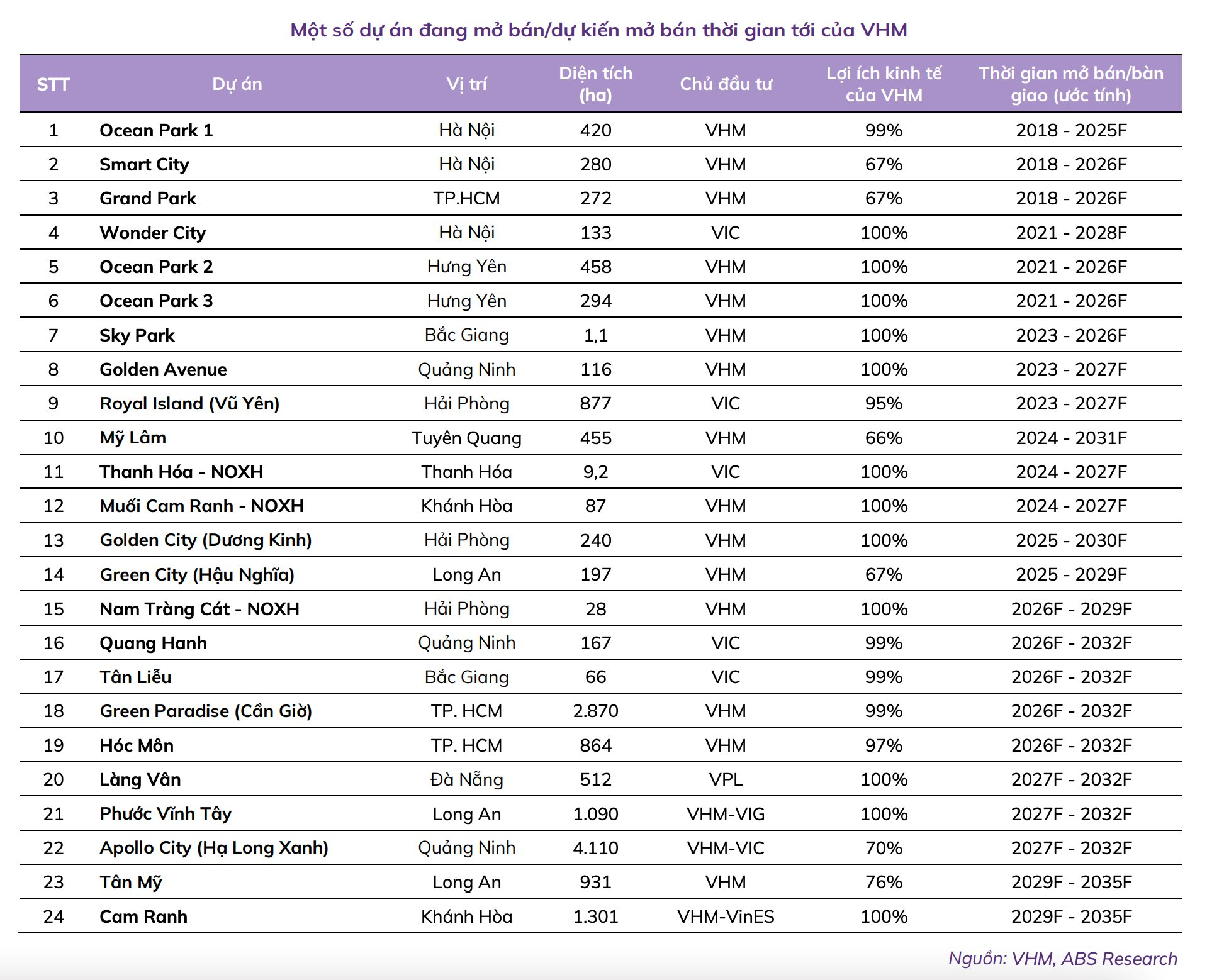

According to a recent analysis by ABS, Vinhomes is expected to maintain positive sales momentum in the second half of 2025, driven by key projects such as Royal Island, Wonder City, Ocean Park 2, and Ocean Park 3, along with newly launched projects: Golden City in Hai Phong and Green City in Long An. As of the second quarter of 2025, Vinhomes’ unrecorded sales value stood at VND 138,200 billion, providing significant support to the company’s full-year profits.

In parallel, the robust development of infrastructure is anticipated to boost real estate sales. Vingroup has been actively proposing and executing significant infrastructure projects, including the Tu Lien Bridge in Hanoi, the Gia Nghia-Chon Thanh Expressway in Binh Phuoc, the high-speed railway connecting Hanoi and Quang Ninh, and the metro line from Ho Chi Minh City to Can Gio.

“The Billion-Dollar Pyn Elite Fund: Why 2025 Could be a Landmark Year for Stock Markets”

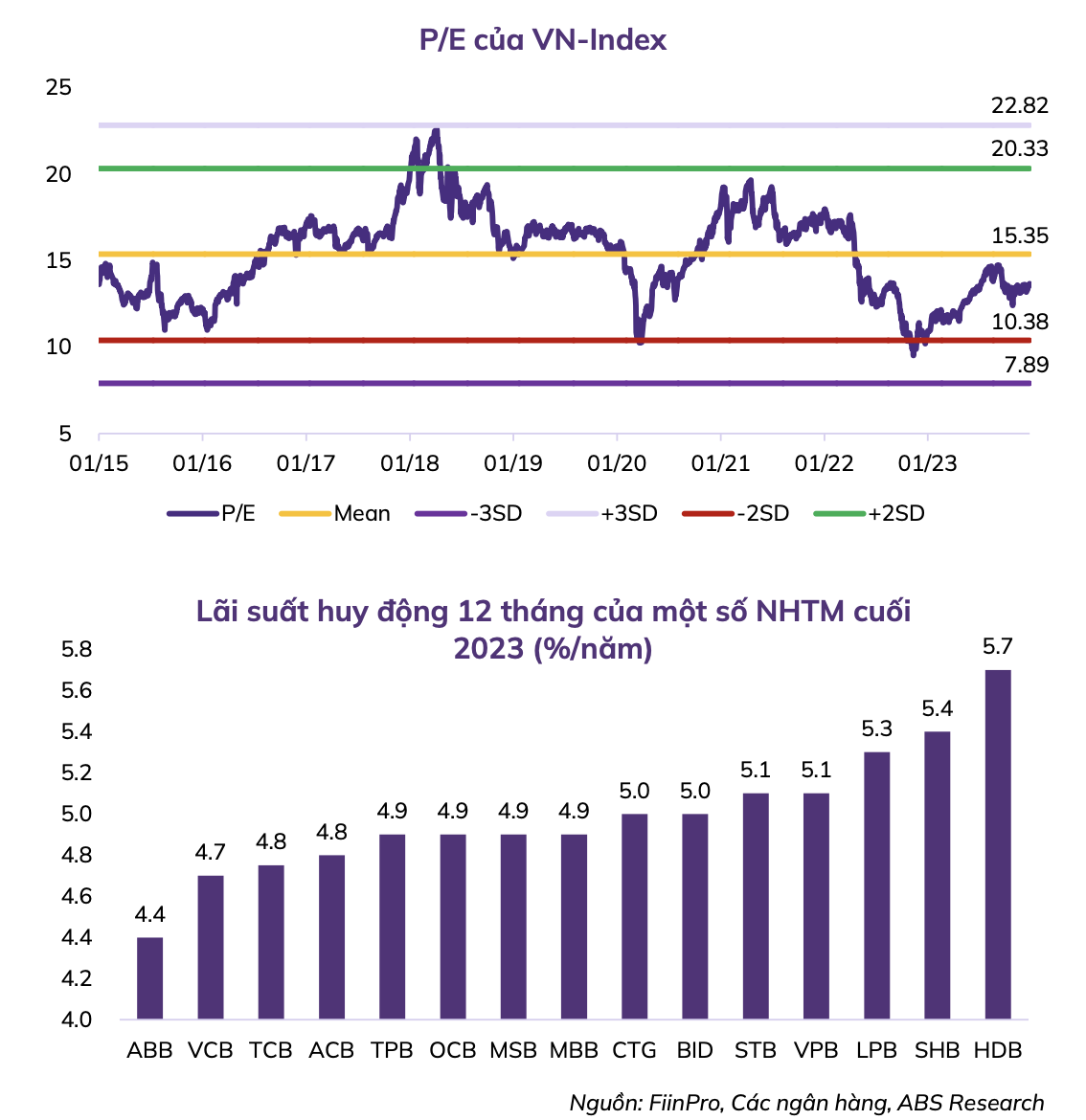

According to the Pyn Elite Fund, this could be a “Big Year” for stock market performance, based on the current fundamentals. The fund manager also highlights seven compelling reasons why a “Big Year” is feasible at this juncture.