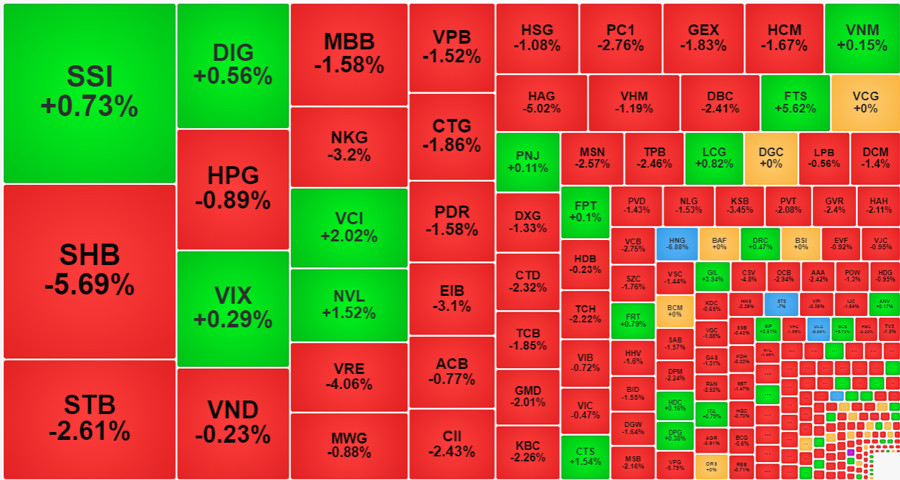

The Vietnamese stock market has just gone through a rather strong correction. Investors’ profit-taking sentiment pushed a series of stocks down sharply, even hitting the floor. The VN-Index closed at 1,645.47 points on August 22, a decrease of 42.53 points or 2.52%. Liquidity remained high, with the matching value on HoSE exceeding VND 60,600 billion.

Foreign transaction remained a downside, with a strong net sell of VND 1,521 billion in the whole market. Specifically:

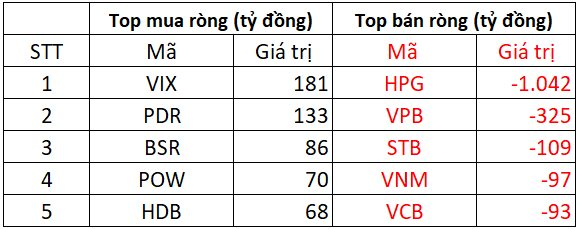

On HoSE, foreign investors net sold about VND 1,347 billion

In the buying side, VIX and PDR stocks were net bought the strongest in the market with values of VND 181 billion and VND 133 billion, respectively. Foreigners also net bought from VND 68 billion to VND 86 billion in BSR, POW, and HDB stocks in this session.

In contrast, HPG stock was net sold by foreign investors with a value of VND 1,042 billion; VPB was also net sold VND 325 billion. Following were STB (-VND 109 billion), VNM (-VND 97 billion), and VCB (-VND 93 billion).

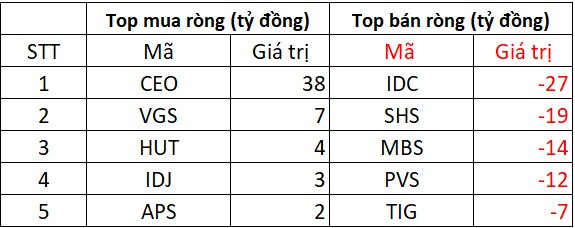

On HNX, foreign investors net sold about VND 45 billion

In terms of net buying, CEO stock was the strongest with a value of VND 38 billion, followed by VGS with a net buying value of VND 7 billion. In addition, HUT, IDJ, and APS were also net bought in the range of VND 2-4 billion each.

On the opposite side, IDC, SHS, MBS, and PVS were among the top net sold stocks on HNX, with values ranging from VND 12 billion to VND 27 billion; similarly, TIG was also net sold about VND 7 billion.

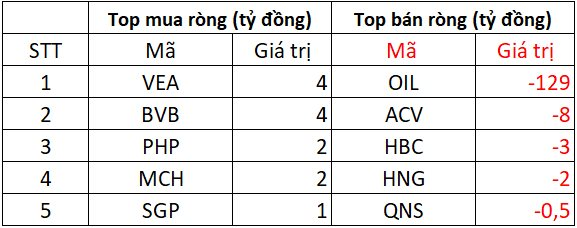

On UPCOM, foreign investors net sold nearly VND 129 billion

In terms of net buying, VEA and BVB were the two stocks with the strongest net buying value of VND 4 billion each. Following were PHP, MCH, and SGP, which were net bought in the range of VND 1-2 billion each.

In contrast, OIL stock was net sold with a value of VND 129 billion, followed by ACV, HBC, and HNG, which were net sold in the range of VND 2-8 billion. In addition, QNS was also slightly net sold in the hundred million VND range.

“Buy on a Market Peak: A Safer Bet Than Buying on a Dip, Say VPBankS Experts”

The experts suggest that, at present, with a P/E of just 15, the market would need to surge by a further 20% to reach its peak, assuming profits remain static.

Dabaco Takes Over Another Livestock Company in Thanh Hoa

“Dabaco is set to acquire a 98% stake in Lam Son Nhu Xuan CNC Agriculture Joint Stock Company, a Thanh Hoa-based enterprise. This acquisition involves the transfer of 9.8 million shares, representing a significant step for Dabaco as it expands its presence in the dynamic and thriving agricultural sector of Vietnam.”

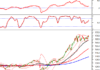

Vietstock Daily Recap: Potential for Persistent Volatility

The VN-Index rose after a tug-of-war session, but the trading volume fell below the 20-session average, indicating investors’ cautious sentiment. With the Stochastic Oscillator continuing its downward trajectory and signaling a sell-off in the overbought territory, alongside persistent net foreign selling, the market remains vulnerable to short-term volatility.