Motivating CASA Retention: The Rise of Hybrid Savings and Checking Accounts

Funds in a checking account, often referred to as CASA (Current Account Savings Account), offer an interest rate of around 0.01-0.5%/year, which is essentially negligible. Compared to fixed deposits, CASA is an extremely cost-effective source of funding for banks, helping them reduce funding costs and protect net interest margins, especially when they cannot increase lending rates to stimulate borrowing for business operations, consumption, and economic growth.

However, retaining these funds is no easy feat as customers are often reluctant to keep their money idle in a checking account without significant returns.

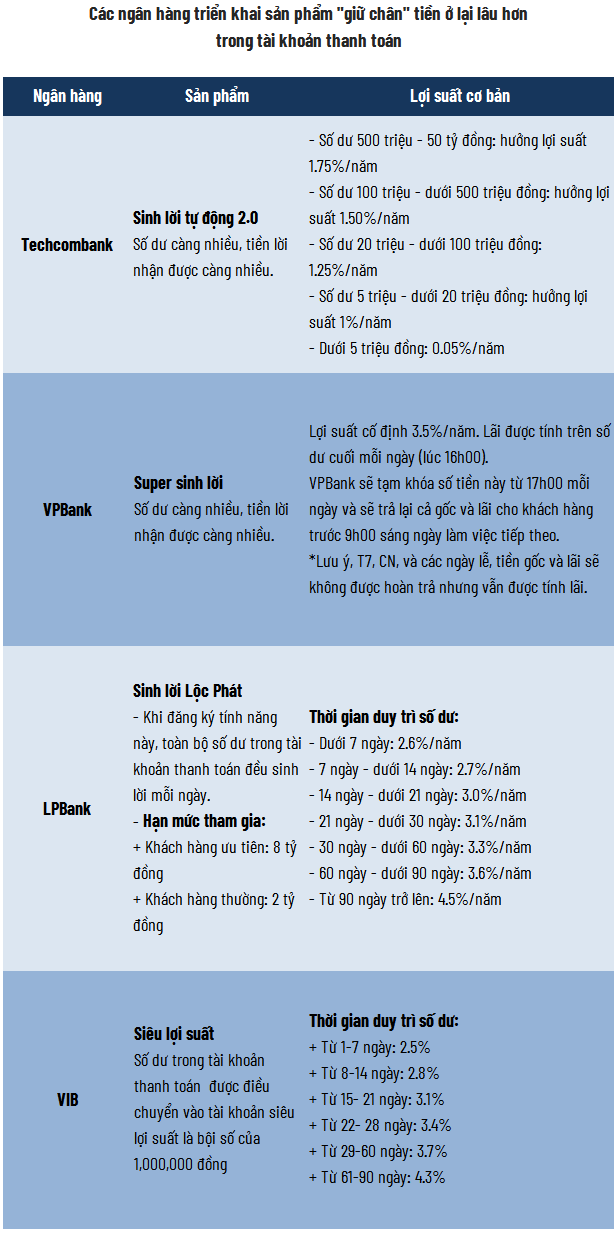

Source: Author’s Compilation

|

To address this challenge, some banks have introduced smart account products that offer both spending flexibility and automatic earnings. These hybrid accounts, blending checking and savings features, aim to encourage customers to maintain higher balances in their checking accounts.

While the maximum yield of these products ranges only between 4-4.3%/year, which is lower than the prevailing long-term deposit rates, it still outperforms traditional short-term savings and non-term deposits. As a result, banks can maintain reasonable net interest margins, while customers have an added incentive to keep their funds in their accounts when they don’t have specific investment plans.

In addition to cost advantages, when customers maintain higher checking account balances, banks have the opportunity to increase their non-interest income by cross-selling investment and insurance products, rather than solely relying on traditional credit services.

Techcombank Leads the Way

Techcombank took the initiative with its “Auto Earnings 1.0” product, launched in early 2024, and subsequently upgraded to “Auto Earnings 2.0” in January 2025. As of the first quarter of 2025, the Auto Earnings balance reached approximately VND 38,000 billion, a 22.7% increase from the beginning of the year and a remarkable 280% surge compared to the same period last year, with approximately 3 million customers signed up.

|

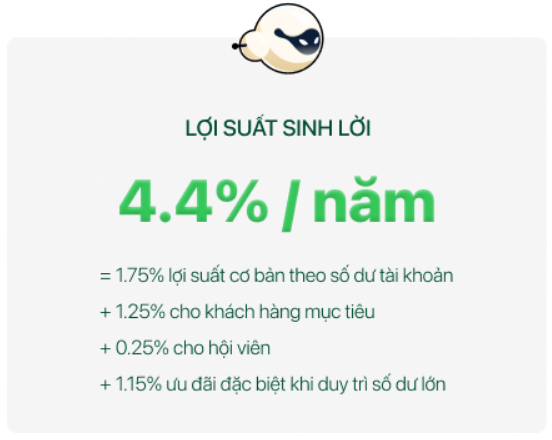

Techcombank’s Auto Earnings interest rate calculation

Source: Techcombank

|

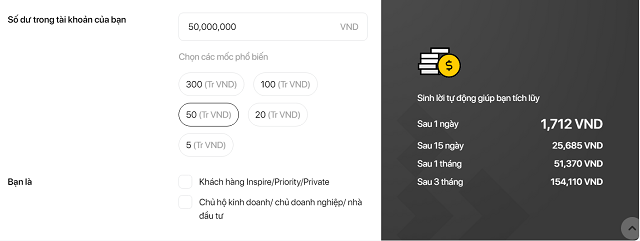

The product operates through a mechanism where the checking account earns a basic interest rate of 0.05%/year, while the registered maintained balance is transferred to a “profit-making compartment” with an interest rate of up to 4.4%/year. For example, with VND 50 million transferred to this compartment for one month, customers can receive approximately VND 51,370 in interest, equivalent to an interest rate of 1.23%/year, which is 25 times higher than leaving the money in a regular checking account.

|

Simulation of Techcombank customers’ profits when activating auto earnings with a balance in their checking account

Source: Techcombank

|

According to SSI Research, Techcombank’s CASA ratio in the first quarter of 2025 decreased to 35%, down from 37.4% in the previous quarter, due to seasonal factors during the Lunar New Year holiday and some funds being transferred to the “profit-making compartment.” However, customer loyalty to Techcombank’s checking accounts remains high at 93%, thanks to its strong digital banking foundation, free transactions, and excellent user experience, enabling the bank to effectively manage funding costs and gradually recover its NIM in the second half of 2025.

EVS Research also believes that, despite the pressure on NIM in the remaining quarters, Techcombank will better control the decline compared to other banks and maintain a high ratio, mainly due to its effective management of funding costs through its advantage in CASA and the positive performance of its auto earnings product.

The Race Expands: VPBank, LPBank, and VIB Join the Fray

Following Techcombank’s lead, several other banks have also entered the race to optimize their low-cost funding sources.

VPBank introduced “Super Earnings” in mid-March 2025, offering a fixed yield of 3.5%/year on the total balance. When customers activate this feature, the system automatically transfers the balance to the “profit-making compartment” at 4:00 PM and returns the principal and interest before 9:00 AM on the next business day, ensuring spending flexibility.

LPBank launched “Sinh loi Loc Phat” for checking accounts, where the entire balance earns interest daily. The funds are transferred to the profit-making compartment, offering a maximum yield of 4.5%/year if maintained continuously for 90 days or more.

VIB introduced the “Super Yield” product with a similar mechanism, requiring a standard threshold of VND 10 million or VND 100 million. Any amount exceeding this threshold is automatically allocated to a profit-making account, earning an interest rate of up to 4.3%/year if maintained for 61-90 days. The balance transferred to the profit-making compartment is a multiple of VND 1 million.

Beyond Interest Rates: The Race for Technological Supremacy

Behind these intelligent earnings products lies a modern digital banking platform that enables instant transaction processing. Separating the checking account into a “profit-making compartment,” establishing automatic processes for fund allocation, and daily interest calculation and accrual require significant investments in core technology, data management, and user experience.

Therefore, the CASA race going forward will not merely be about interest rate competition but also a contest of technological infrastructure, personal financial services ecosystem, and flexibility in digital experiences.

– 08:00 24/08/2025

Celebrating 80 Years of Revolution: Techcombank Honors the August Revolution and National Day

As we proudly approach the 80th anniversary of the August Revolution and National Day of Vietnam (1945–2025), Techcombank is honored to support and celebrate the nation’s proud spirit, looking forward to a brilliant future together. We are thrilled to present a series of grand cultural and artistic events: ‘V Concert – Radiant Vietnam’, ‘V Fest – Radiant Youth’, an exhibition titled ’80 Years of Independence, Freedom and Happiness’, and a stunning 3D mapping show, ‘Hanoi Shining’. Join us as we commemorate this milestone and showcase the very best of Vietnam’s vibrant culture and arts.

Unlocking VPB’s Stock Potential: The CASA Advantage

In the first half of 2025, VPBank witnessed an impressive growth in its CASA, reaching a scale of nearly VND 100,000 billion, thanks to a series of breakthrough initiatives. This remarkable achievement has played a pivotal role in sustaining the bank’s robust profit growth. As a testament to its success, the bank’s stock, VPB, has consistently reached new heights, attracting significant foreign investment.

Optimizing Land Laws: State-Determined Land Prices in the Primary Market

The government’s land valuation can provide a clearer framework for land acquisition, financial obligations, and curbing speculation, especially amidst the current lack of transparency in market data.