Idico JSC (Stock code: IDC, HNX-listed) has recently released a report on the results of its 2024 dividend payout in the form of stock issuance to the company’s shareholders.

As of the conclusion of the issuance on August 15, 2025, Idico successfully distributed nearly 49.5 million shares to 11,245 shareholders, with no fractional shares remaining.

The entitlement ratio was set at 100:15, meaning that for every 100 shares owned, shareholders received 15 new shares. The company anticipates completing the share transfer to shareholders in September 2025.

The total issuance value, based on par value, amounted to nearly VND 495 billion. This capital was sourced from undistributed post-tax profits, as per the company’s audited separate financial statements for the year 2024.

Illustrative image

Following this issuance, Idico’s total outstanding shares increased from nearly 330 million to nearly 379.5 million, resulting in a corresponding rise in charter capital from nearly VND 3,300 billion to nearly VND 3,795 billion.

In a separate development, Idico recently announced the acceptance of the resignation of Mr. Phan Van Chinh, the company’s Vice President, effective September 1, 2025. Mr. Chinh had previously submitted his resignation from this position for personal reasons.

With regards to IDC stock transactions, on July 31, 2025, the foreign fund group Dragon Capital sold nearly 3 million IDC shares through three member funds.

Specifically, Hanoi Investments Holdings Limited sold 746,700 shares, Norges Bank sold 900,000 shares, and Vietnam Enterprise Investments Limited sold 1.35 million shares.

Post-transaction, Dragon Capital’s ownership in IDC shares decreased from nearly 17.6 million to approximately 14.6 million, resulting in a decline in their ownership ratio from 5.3187% to 4.4106% in Idico.

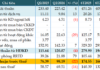

Turning to Idico’s business performance, according to the company’s consolidated financial statements for Q2 2025, Idico recorded net revenue of nearly VND 1,763.2 billion, reflecting a 17.9% decrease compared to the same period last year. After deducting taxes and fees, Idico reported a net profit of nearly VND 416 billion, a 28.8% drop.

For the first half of 2025, Idico’s net revenue amounted to nearly VND 3,556.7 billion, a 22.9% decline compared to the first six months of 2024. The company’s net profit after tax was over VND 832.9 billion, representing a 39.7% decrease.

As of June 30, 2025, Idico’s total assets increased by 4.3% from the beginning of the year, reaching over VND 19,606.4 billion. Short-term financial investments accounted for VND 4,019.3 billion, a 77.5% increase, and comprised 10.5% of total assets, while long-term work-in-progress stood at nearly VND 5,532.2 billion, making up 28.2% of total assets.

On the liabilities side of the balance sheet, total liabilities were over VND 12,150.9 billion, a 4.8% increase from the beginning of the year. Long-term unearned revenue accounted for nearly VND 5,468.3 billion, or 45% of total liabilities, while short-term and long-term borrowings totaled VND 3,432.7 billion, constituting 28.3% of total liabilities.

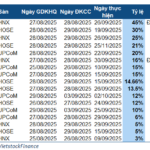

The Ultimate Dividend Stock for the Week of August 25-29: PV GAS Shines Bright with a Massive $200 Million Payout Ahead of the Long Weekend

“This week, leading up to the National Day holiday on September 2nd, a total of 17 companies will be finalizing their cash dividend distributions. The highest rate among these businesses stands at an impressive 45%, equating to VND 4,500 per share owned. A substantial return for shareholders as we head into the holiday period.”

The Rare Mineral Hunt: Vietnamese Enterprises Gear Up to Dish Out 4,500 VND Dividends.

Since its listing on the HNX in 2009, Ha Giang Minerals and Mechanics has consistently delivered cash dividends with unwavering regularity.

Unlocking Profits: Navigating the VN-Index’s Surge Past the 1,600-Point Milestone

“During the week of August 11–15, 2025, selling pressure from investment funds intensified as the VN-Index rallied for four consecutive sessions, breaching the psychological threshold of 1,600 points and approaching the 1,660 zone. However, the index faced corrective pressures during the week’s final trading session.”