The latest financial reports from 28 banks (Agribank and 27 listed banks) reveal that net profits from service activities in the first half of 2025 remained stagnant compared to the same period in 2024, reaching VND 31,860 billion.

Techcombank, BIDV, MB, VietinBank, VPBank, Agribank, HDBank, TPBank, LPBank, and Vietcombank were the top ten banks with the highest net profits from services in the first six months of this year.

Techcombank maintained its leading position with VND 3,935 billion, followed by BIDV with VND 3,426 billion, MB with VND 3,151 billion, and VietinBank with VND 3,045 billion. These four banks form a distinct leading group, each with service profits exceeding VND 3,000 billion. VPBank and Agribank are close behind, while HDBank, TPBank, and LPBank retain their positions in the top ten.

| Net Profit from Services in the First Half of 2025 (VND billion) | |

|---|---|

| Techcombank | 3935 |

| BIDV | 3426 |

| MB | 3151 |

| VietinBank | 3045 |

| VPBank | 2512 |

| Agribank | 2457 |

| HDBank | 2065 |

| TPBank | 1899 |

| LPBank | 1680 |

| Vietcombank | 1667 |

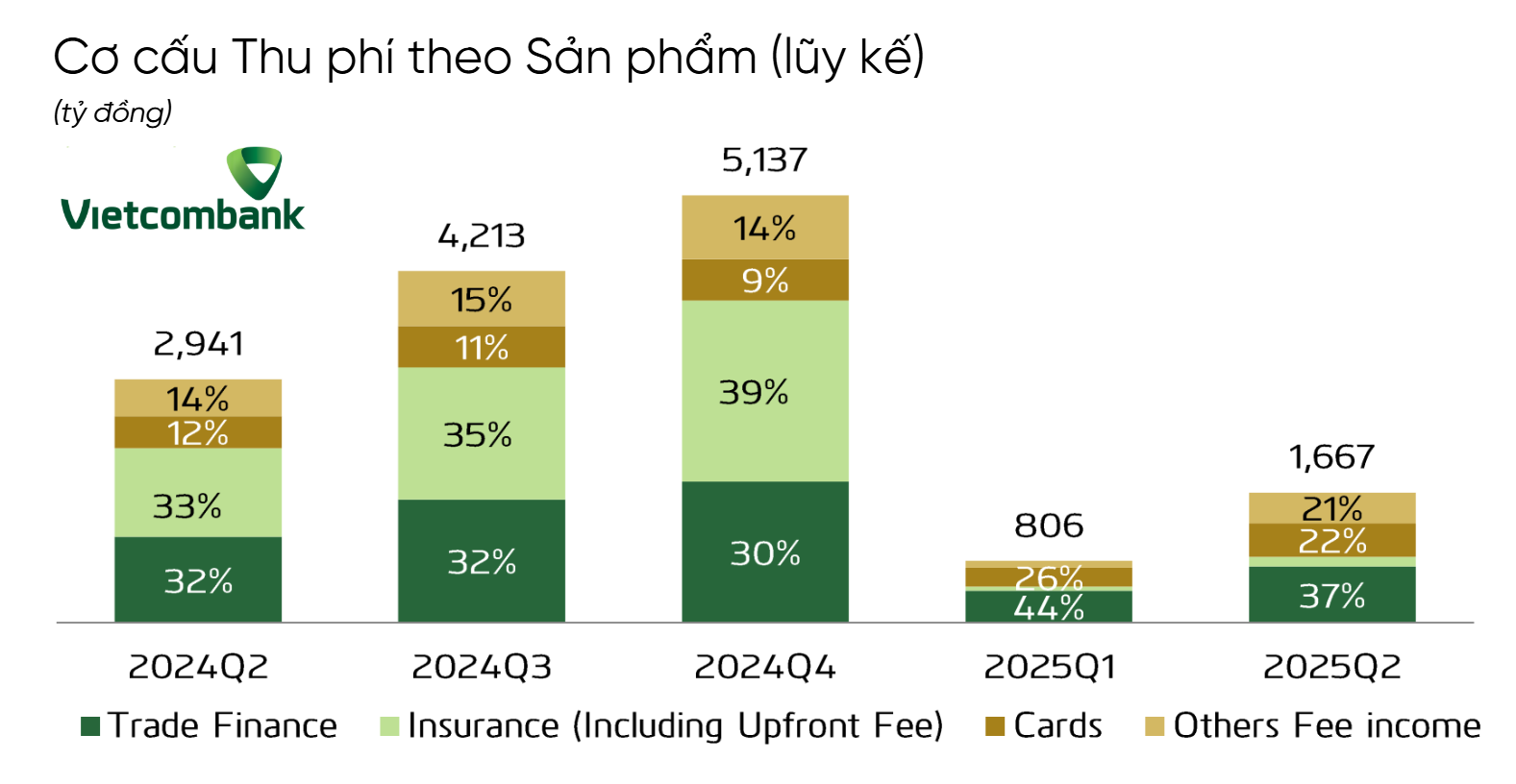

Vietcombank, once a dominant force in the services sector (4-5 years ago), now ranks tenth with VND 1,667 billion in net profit in the first half of 2025, a 43% decrease compared to the previous year. The primary reason for this decline is the end of upfront fee recognition from its exclusive bancassurance agreement with FWD, signed in 2020, which had contributed significantly to the bank’s service profits during 2020-2021. With this special revenue stream drying up and the insurance market still facing challenges, Vietcombank’s fee income took a significant hit.

A breakdown of Vietcombank’s fee income by product for the first half of the year shows that TF (Trade Finance) fees accounted for 37%, card fees for 22%, and other service product fees (ebank, securities services fees, account management fees, office rental fees, etc.) for 21%. While TF and card fees showed a slight increase compared to the previous year, bancassurance and domestic payment fees declined.

Vietcombank’s position in the top ten for service profits came as a surprise, given its peak performance in 2020 and 2021, when it led the industry with VND 6,607 billion and VND 7,407 billion, respectively, outpacing its competitors. During that time, Vietcombank’s service profits were nearly double that of Techcombank and almost one and a half times that of BIDV. This advantage was attributed to the bank’s strong market share in payments, cards, digital banking services, pre-paid insurance fees, and a massive customer base of individuals and enterprises.

However, a significant turning point changed the landscape. In early 2022, Vietcombank implemented a policy to waive all transfer fees and maintenance fees for its digital banking service, VCB Digibank. This decision was made to promote cashless payments and enhance customer satisfaction in a highly competitive market. While the fee waiver policy helped to strengthen the bank’s image and retain loyal customers, it also led to a significant decline in revenue.

Among the top ten, Vietcombank was not the only bank to experience a decrease in net profits from services in the first half of 2025. Techcombank, BIDV, VietinBank, and VPBank also saw declines, mainly due to intense competition in the payments sector.

HDBank, on the other hand, stood out with a remarkable 255% year-over-year increase in service profits, rising from VND 581 billion to VND 2,065 billion. This impressive growth propelled the bank from the middle of the pack to seventh place in the rankings. MB also achieved a significant growth rate of 37%, pushing its net service profit above VND 3,100 billion and securing its position in the top three. Agribank and TPBank maintained stable growth rates of 14%, solidifying their places in the top ten.

“The Banking Sector’s Proposal 06: Driving Economic and Social Development and Empowering Businesses.”

The implementation of Scheme 06 by the banking sector (2022-2025) has yielded impressive results and made significant strides in fostering economic and social development and supporting businesses. This initiative has played a pivotal role in driving innovation and technology adoption, ushering in a new era of progress and transformation.

The Cashless Revolution: How Vietnam’s Expanding Ecosystem Enables a Seamless Digital Payment Experience, From Groceries to Luxury Shopping.

With a swift embrace of a cashless ecosystem and a robust push towards digital payments, this trend has seamlessly woven itself into the very fabric of Vietnamese daily life.

Prudential Vietnam and HSBC Vietnam: Forging a Dynamic Bancassurance Alliance

Prudential Vietnam and HSBC Vietnam are proud to announce a strategic bancassurance partnership, combining their expertise to offer tailored financial solutions for the country’s burgeoning affluent market. This collaboration marks a significant step forward in providing comprehensive and innovative financial services to Vietnam’s high-net-worth individuals and families.