Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (HOSE: CII) has just released a report on the results of its public offering of convertible bonds.

According to the report, as of the offering’s conclusion on August 18, 2025, CII successfully distributed 20 million convertible bonds, which can be converted into common shares, to 155 individual and institutional investors. The expected bond delivery date is between September and October 2025.

With an offering price of VND 100,000 per bond, CII raised a total of VND 2,000 billion from this issuance. After deducting expenses, the company’s net proceeds amounted to over VND 1,998.7 billion, which will be utilized for the company’s debt restructuring.

Illustrative image

As per the consolidated financial statements for the second quarter of 2025, CII’s total liabilities stood at nearly VND 27,373.8 billion. Following the aforementioned bond offering (as of August 18, 2025), CII’s total debt increased to over VND 28,194.2 billion, resulting in a debt-to-equity ratio increase from 2.42 to 2.49 times.

In a separate development, CII recently provided explanations to the State Securities Commission of Vietnam and the Ho Chi Minh City Stock Exchange (HoSE) regarding the consecutive five-session rise in its stock price.

CII received Official Dispatch No. 1212/SGDHCM-GS dated August 13, 2025, from HoSE, requesting information related to the stock price surge during the five consecutive trading sessions from August 7 to August 13, 2025.

In response, CII clarified that the stock price movement during that period was an objective market phenomenon driven by supply and demand dynamics in the securities market.

The company affirmed that its production and business operations remain normal, adhering to the established plan, with no significant changes or abnormal fluctuations that could substantially impact its financial position or business operations.

Additionally, CII pledged to fulfill its information disclosure obligations as stipulated by the law and HoSE’s regulations.

Prior to this, on August 6, 2025, CII distributed over 76.7 million bonus shares to 42,311 shareholders, while 2,461 fractional shares were canceled.

The entitlement ratio was 100:14, meaning that for every 100 shares owned on the record date, shareholders received 14 new shares, which are freely transferable. The expected share transfer date is in August 2025.

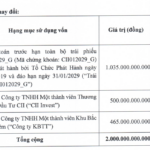

The total value of the issuance, based on par value, exceeded VND 767.4 billion, financed from the company’s capital surplus, investment fund, and undistributed post-tax profits as per the audited financial statements for the fiscal year ending December 31, 2024.

Following this issuance, CII’s outstanding shares increased from nearly 548.2 million to over 624.9 million, resulting in a corresponding increase in charter capital from nearly VND 5,481 billion to over VND 6,249 billion.

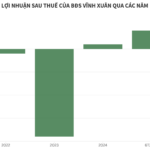

“Highway Investor Reports $156 Million Profit in H1 2025”

The Hanoi Highway, a prominent BOT enterprise within the CII ecosystem, witnessed a slight uptick in profits, surpassing 156 billion VND in the first half of 2025.