Record Exports, Escalating Capital Pressures

According to the General Department of Vietnam Customs, the country’s export turnover of goods in the first seven months of 2025 reached $262.46 billion, a 14.8% increase compared to the same period last year. Notably, July’s exports hit $42.3 billion, the highest monthly figure to date. This positive signal reflects the strong recovery and renewed growth of key export industries such as electronics, textiles, and seafood.

While market opportunities abound, working capital pressures have intensified. Many businesses need immediate funding to purchase raw materials and cover transportation costs, while payments from foreign partners often arrive months later. “We’ve never had such a consistent and high volume of orders. If we don’t turn over capital quickly enough, we could lose out on major deals or even clients,” shared Mr. Hoan, owner of a catfish business in Dong Thap province.

Mr. Hoan’s sentiment is shared by many other export-oriented businesses, who find themselves in a situation of “celebrating with a worried mind” as orders increase and market opportunities expand, but capital constraints weigh heavily. In this context, the ability to quickly and flexibly rotate capital becomes a critical advantage, enabling export businesses to timely fulfill orders, expand production, and achieve sustainable growth.

Businesses need timely and flexible capital to maintain production and seize market opportunities

NCB’s Flexible Document Discounting Solution

Understanding these challenges, National Citizen Bank (NCB) has introduced a “Document Discounting for Export” product with distinct advantages, applicable to the two most common payment methods: collection and letter of credit (L/C). This solution flexibly meets the needs of businesses.

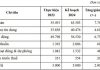

For collection payments, NCB offers recourse discounting, providing immediate funding to businesses based on the document set right after shipment. The attractive discount rate can go up to 90% of the document value for documents against payment (D/P) and 85% for documents against acceptance (D/A). Businesses will receive funding immediately after shipment to boost production or promptly respond to new orders, instead of waiting for payment from foreign partners. The discount tenure is flexible, with a maximum of 60 days for D/P and 180 days for D/A, offering significant financial autonomy to businesses.

NCB offers discount rates of up to 90% of the document value for collection payments

Regarding L/C payments, NCB applies a discount rate of up to 98% of the document value, the most competitive rate in the current banking system. Businesses can avail of a maximum discount period of 30 days for L/C at sight and up to 360 days for usance L/C. The bank accepts discounting in both VND and foreign currencies, enabling businesses to quickly access capital, proactively manage their cash flow, and better seize international market opportunities.

NCB’s document discounting solution not only provides instant funding but also boasts a swift approval process, simplified procedures, and dedicated customer service. Moreover, with its extensive experience in export financing, the bank offers in-depth consulting solutions to help businesses optimize their value chain and manage international credit risks.

NCB looks forward to continuously supporting and empowering export enterprises, promoting international trade, enhancing the prestige of Vietnamese goods, and creating opportunities to thrive in the global economic landscape.

For more information about NCB’s exclusive business products, please visit the website https://www.ncb-bank.vn/, contact NCB branches/transaction offices nationwide, or call the hotline (028) 38 216 216 – 1800 6166.

“Sprint to the Finish: Maintaining Export Momentum in the Final Months of 2025”

Amidst a challenging global economic landscape, Vietnam’s merchandise exports shone brightly in the first seven months of 2025, reaching an impressive estimated turnover of US$261.8 billion. This remarkable performance translates to a 14.6% increase compared to the same period in 2024, surpassing the annual target. As we celebrate this achievement, it is imperative to strategize and forge a path towards sustaining this export growth momentum in the remaining months of the year.

“Accelerating Strategies: The Prime Minister’s Push for Economic Growth in 2025”

“Vietnam’s esteemed Prime Minister Pham Minh Chinh has issued a critical directive, Government Dispatch No. 133/CD-TTg, on August 12, 2025. This directive emphasizes the urgent need to accelerate specific tasks and solutions to achieve the nation’s economic growth targets for the year 2025.”