Since its debut in August 2025, F88’s stock has seen consecutive ceiling-hitting sessions, once reaching a high of 1.175 million VND before trading around the current level of 1 million VND.

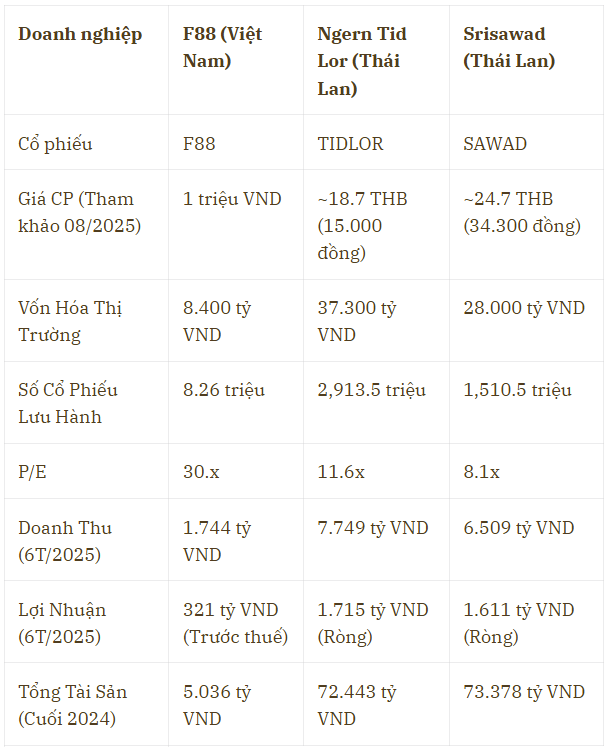

As for the two similar pawn shop chains in Thailand, TIDLOR’s stock price is around 15,000 VND (18.7 THB), while SAWAD trades at 34,300 VND (~24.7 THB). The main reason behind F88’s high market price is the current limited number of shares, with a total of just over 8 million units, making the stock highly concentrated. Based on the current market price, if a stock split is executed, F88’s price will adjust to approximately 70,000 VND.

In reality, F88’s market capitalization and asset scale still lag significantly behind the two Thai giants. Specifically, Ngern Tid Lor’s market cap is approximately 37,300 billion VND, 4.4 times that of F88, while Srisawad’s is around 28,000 billion VND, 3.3 times F88’s. The gap is even more pronounced when it comes to asset scale, with the total assets of the two Thai companies being more than 14 times that of F88.

However, the recent growth trajectory is what’s truly noteworthy. Financial results for the first half of 2025 indicate that F88 is experiencing explosive growth, with a 213% surge in pre-tax profit compared to the same period last year. Tid Lor continues to exemplify sustainability, posting a 14.3% increase in net profit and maintaining a low non-performing loan ratio of 1.78%. In contrast, Srisawad shows signs of struggling, with a 6.2% decline in net profit and a relatively higher non-performing loan ratio of ~3.73%.

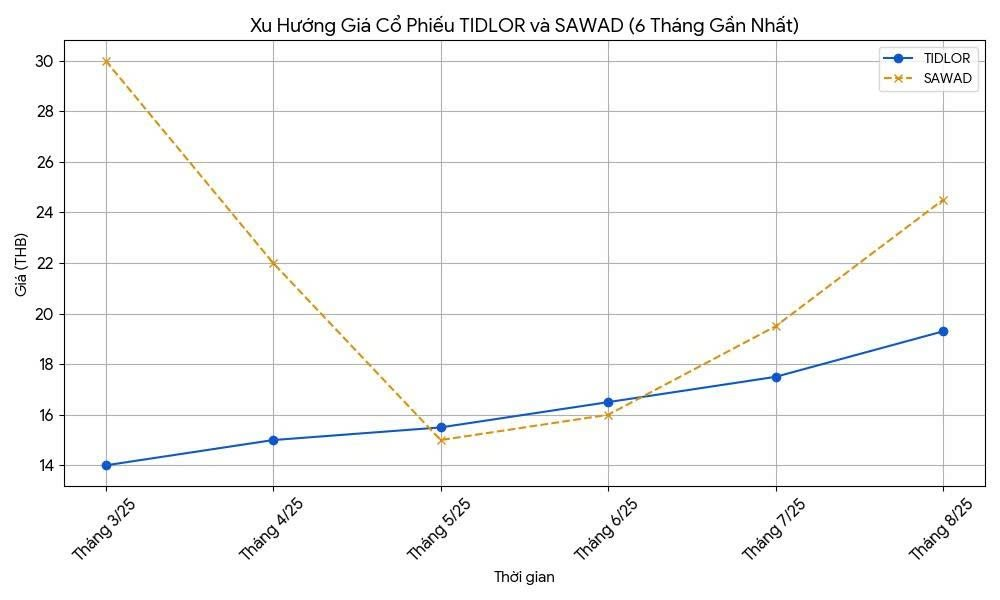

The stock price movements over the past six months reflect these characteristics.

To better understand these two Thai businesses, let’s delve into their intriguing development histories.

Srisawad embodies the classic tale of self-made success, starting as a family-owned pawnshop in 1979 and expanding rapidly through organic growth, particularly in rural areas.

In contrast, Ngern Tid Lor, which shares a similar origin story, underwent a remarkable transformation through a series of M&A deals, involving Ayudhya Bank and later the world-renowned investment fund CVC Capital Partners, culminating in a billion-dollar IPO in 2021.

Both companies have a presence in Vietnam, but their approaches differ significantly. Srisawad chose direct competition, entering the Vietnamese market in 2016 with the brand Srisawad Vietnam and over 100 branches, with outstanding loans of approximately 600 billion VND in 2024.

Meanwhile, Ngern Tid Lor made a strategic move: Piyasak Ukritnukun, CEO of Ngern Tid Lor, joined F88’s board of directors as an independent member.

Ngern Tid Lor’s CEO Joins F88’s Board Before UPCoM Listing

The reason behind the interest of Thai investors and companies in Vietnam’s microfinance sector lies in its market potential. According to a report by FiinGroup, Vietnam’s consumer lending by credit institutions in 2023 accounted for only 28.5% of GDP, a modest figure compared to regional peers like Thailand (44.5%) and Malaysia (65.2%). In contrast, the revenue of registered pawnshops across Vietnam reached approximately 8 billion USD in 2024.

The alternative finance market in Vietnam is growing rapidly, with a compound annual growth rate (CAGR) of over 38% during 2021-2023. The primary customer segment comprises low and middle-income groups, representing 47% of the working-age population—a vast market that traditional banks have yet to fully serve.

Within this context, F88 has emerged as the undisputed leader, turning this into a “blue ocean” that F88 is navigating and that Thai companies covet.

The Evolution of Alternative Financial Services Globally and in Vietnam: Unlocking New Opportunities

Despite the efforts of banks to extend their personal loan services, not everyone qualifies for these loans. This gap in the market has allowed alternative lending services, particularly those offering loans against vehicle or asset ownership, to thrive and flourish worldwide.

Stock F88 Debuts on August 8 with a Limit-Up, Trading at 888,800 VND, Securing the Highest Par Value in the Vietnamese Stock Market

With a tentative ceiling price of VND 888,800 in today’s session, the share price is expected to adjust to approximately VND 68,000 post-split at a ratio of 1:12.