I. MARKET ANALYSIS OF STOCKS ON AUGUST 26, 2025

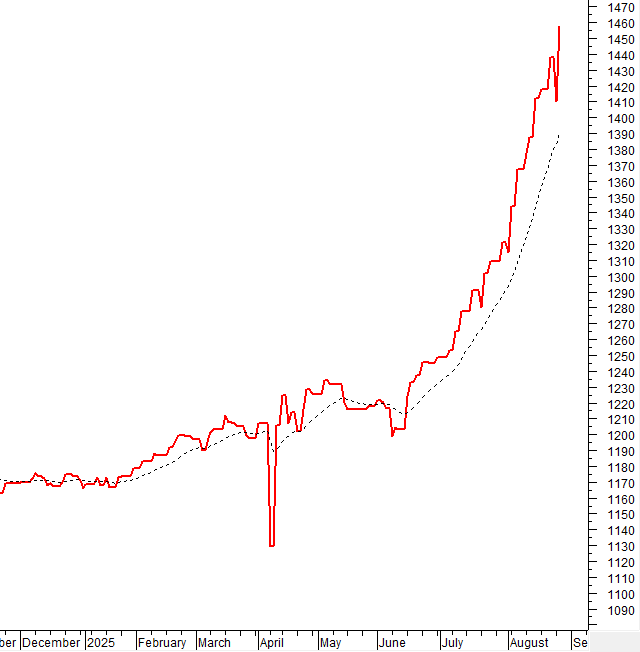

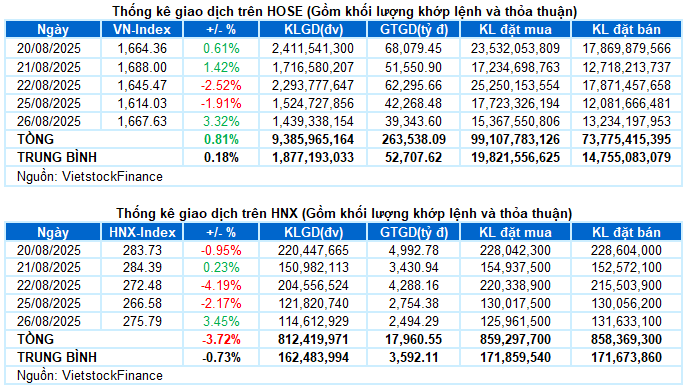

– The main indices rebounded during the trading session on August 26. Specifically, VN-Index surged by 3.32%, reaching 1,667.63 points; HNX-Index also increased significantly by 3.45% from the previous session, reaching 275.79 points.

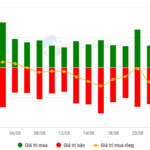

– However, the market liquidity lacked consensus. The matched volume on the HOSE decreased by 15.2%, reaching over 1.2 billion units. HNX recorded nearly 112 million units, a 5% decrease compared to the previous session.

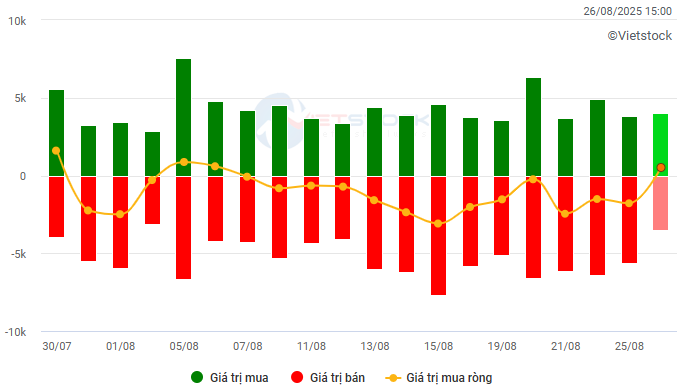

– Foreign investors returned to net buying with a value of more than 702 billion VND on the HOSE but continued to net sell more than 51 billion VND on the HNX.

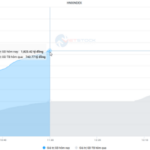

Trading value of foreign investors on HOSE, HNX, and UPCOM. Unit: Billion VND

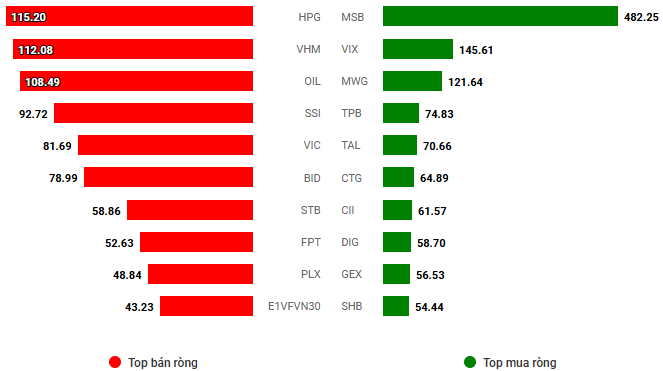

Net trading value by stock code. Unit: Billion VND

– The market rebounded strongly after two deep correction sessions. After more than an hour of fluctuating around the reference level, the green color gradually regained its advantage as the selling pressure eased significantly. In the afternoon session, the strong comeback of many large caps helped the market become more vibrant. The positive effect spread across all sectors, pushing the index up until the end of the session. The VN-Index closed at 1,667.63 points, up 3.32% from the previous session.

– In terms of impact, VHM was the leader today, contributing 6.8 points to the VN-Index. Following were VIC, TCB, and CTG, which added a total of nearly 10 points. Meanwhile, the total impact of the 10 most negative stocks took less than half a point from the overall index.

– VN30-Index made a spectacular comeback, surging 66 points to close at 1,849.05 points. Notably, all 30 stocks in the basket agreed on an upward momentum, with more than half of the codes breaking through the 3% threshold. In particular, MWG, SSI, VHM, and SHB simultaneously rose to the maximum limit.

Considering the sectors, the green color dominated all stock groups. The real estate industry was the market leader with an outstanding increase of 4.5%. Besides the remarkable performance of the VinGroup trio, cash flow also found its way to many notable stocks such as PDR (+5.17%), KBC (+3.36%), BCM (+6.15%), KDH (+5.5%), NVL (+4.67%), DXG (+4.16%), NLG (+4.91%), TCH (+5.16%), and DIG, which hit the ceiling price.

The financial group was not outdone, with purple colors appearing in many stocks such as SSI, SHB, VIX, MSB, VND, EVF, ORS, and CTS. In addition, numerous other names also traded dynamically with outstanding increases, such as VPB (+2.39%), TCB (+4.79%), TPB (+4.23%), MBB (+5.15%), EIB (+6.12%), HCM (+6.35%), and SHS (+9.58%).

Furthermore, the energy, materials, and discretionary consumer sectors also rose by over 2% as buying interest focused on BSR (+5.78%), PVS (+2.12%), PVD (+3.13%); HPG (+4.82%), GVR (+2.82%), DGC (+2.06%), NKG (+3.59%), DCM (+5.85%); FRT (+2.72%), GIL (+5.42%), DGW (+5.19%), and MWG, which hit the ceiling price.

The VN-Index remained above the Middle line of the Bollinger Bands and rebounded impressively with a gain of nearly 54 points. However, trading volume needs to improve soon for the index to return to a more sustainable upward trajectory. If, in the coming sessions, the index surpasses the old peak of 1,680-1,693 points, new highs will continue to be set.

II. TREND AND PRICE MOVEMENT ANALYSIS

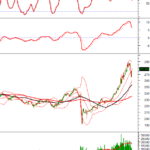

VN-Index – Maintained Above the Middle Line of Bollinger Bands

VN-Index remained above the Middle line of the Bollinger Bands and rebounded impressively with a gain of nearly 54 points. However, trading volume needs to improve soon for a more sustainable upward trend.

If, in the coming sessions, the index surpasses the old peak of 1,680-1,693 points, new highs will be set.

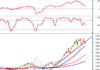

HNX-Index – Trading Volume Below the 20-session Average

HNX-Index rebounded strongly, but trading volume continued to decline below the 20-session average, indicating that investors remain cautious.

Currently, the Stochastic Oscillator and MACD indicators have not shown signs of improvement after giving sell signals, so the short-term outlook for the index may face challenges.

Analysis of Money Flow

Movement of Smart Money: The Negative Volume Index indicator of the VN-Index is above the EMA 20-day line. If this status continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Foreign Capital Flow: Foreign investors returned to net buying in the trading session on August 26, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more positive.

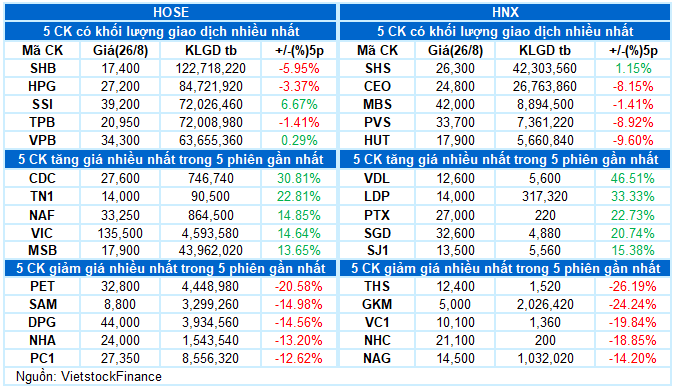

III. MARKET STATISTICS ON AUGUST 26, 2025

Economy and Market Strategy Analysis Department, Vietstock Consulting

– 17:15 26/08/2025

Market Pulse, August 27: Stumbles Under Foreign Investors’ Selling Spree

The VN-Index experienced a back-and-forth session, hovering around the 1,675-point mark throughout the afternoon. Despite significant support from the market heavyweight VCB, which surged to its daily limit, the index couldn’t sustain its gains and ended the trading day on a rather lackluster note. The selling pressure from foreign investors weighed heavily on the market, eroding much of the early gains.

Vietstock Daily: Summit Showdown

The VN-Index pared its gains towards the end of the trading session on August 27th, forming a Long Upper Shadow candle. This indicates that profit-taking pressures remain robust at the previous peak of 1,680-1,693 points. Additionally, with the Stochastic Oscillator indicator continuing to weaken after issuing a sell signal, it suggests that the index is likely to encounter further volatility in the upcoming sessions.

The New Wave of Banking: Leading Expectations and Managing Margins

The post-COVID-19 era has witnessed a record-breaking rally for bank stocks, but this impressive performance belies a more nuanced story. This surge is underpinned by a combination of factors, including heightened expectations and the influx of margin financing into the financial sector. While this has provided a much-needed boost to the market, it also presents challenges, as the margin contraction highlights a delicate balance that could impact the market’s trajectory.